Key takeaways:

-

Ether rallied close to $4,500 after sweeping liquidity round $4,200.

-

Spot demand fueled the rally, whereas futures participation stayed muted.

-

A day by day shut above $4,500 is crucial to substantiate breakout momentum.

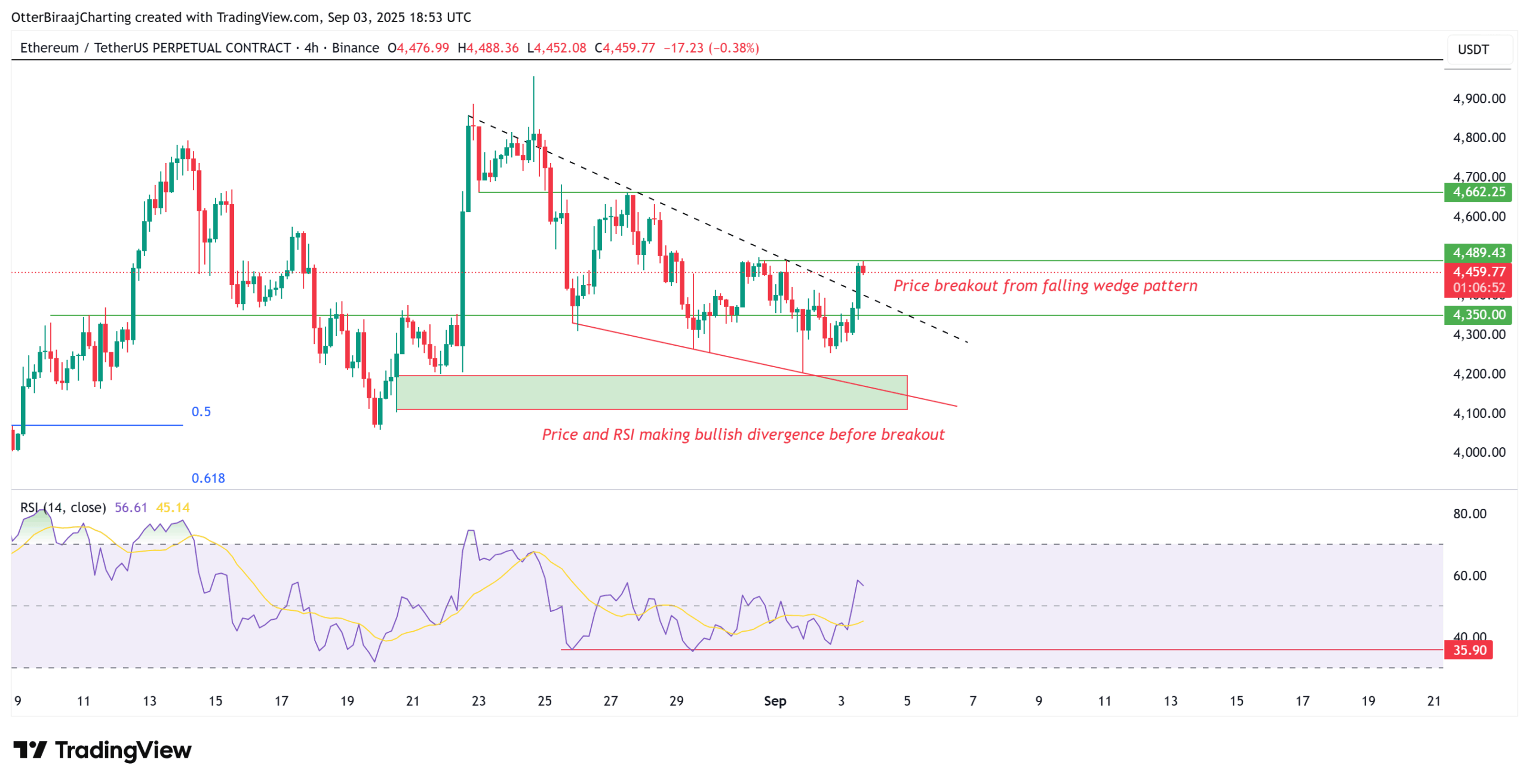

Ether (ETH) rose 3.5% on Wednesday, approaching $4,500 after sweeping liquidity close to $4,200 earlier on Monday. The transfer coincided with a bullish divergence between the worth and the relative power index (RSI) on the four-hour chart, in addition to a breakout above a two-week falling wedge formation. Each technical patterns sometimes level towards potential upside continuation.

For affirmation, ETH must safe a day by day shut above $4,500, a degree that would open the trail towards the exterior liquidity zone between $4,800 and $5,000.

Market commentator Jelle additionally acknowledged the breakout, suggesting that “value discovery awaits” for the altcoin.

Nevertheless, one analyst doesn’t view the breakout as decisive simply but. Crypto dealer Popeye famous that Ether stays inside a broader vary. In an X submit, the dealer stated,

“4H – this can be a vary till confirmed in any other case. We do have some confluence with Monday’s vary and quantity nodes. If value finds acceptance above that node, we in all probability have a legit breakout.”

Ether futures and spot exercise cut up on momentum

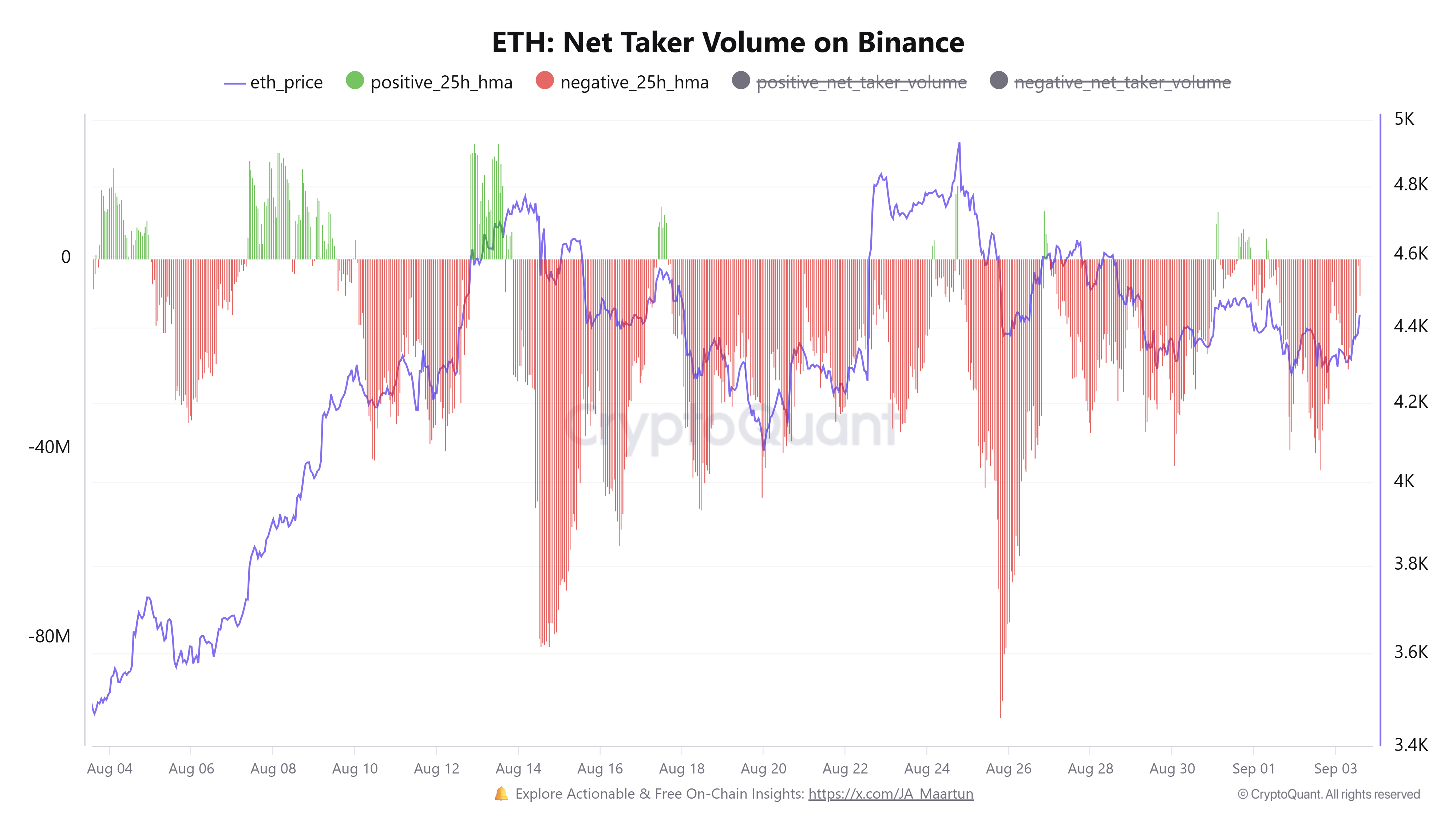

ETH futures knowledge exhibits a cut up between spot and derivatives flows. Ether futures open curiosity didn’t improve considerably in the course of the rally, signaling restricted urge for food from leveraged merchants. Against this, aggregated spot volumes elevated with value, whereas funding charges stayed near impartial, in step with its 30-day common.

This mixture suggests the transfer has been led by spot demand moderately than futures leverage. Spot-driven rallies usually point out natural shopping for curiosity, however with out futures participation, breakouts can lack sturdiness if momentum weakens.

Associated: Ether rally to $5.5K potential resulting from illiquid provide and bullish ETH futures sign

Altcoin quantity spike on Binance

Binance recorded greater than $16 billion in spot altcoin buying and selling quantity on Monday, dwarfing exercise on rival exchanges. The spike has been attributed to improved macro liquidity circumstances and Binance-specific incentives.

The rise contributed to a broader market rally, with Bitcoin (BTC) crossing $112,000 inside two days. Nevertheless, Ether flows inform a distinct story. Knowledge from CryptoQuant signifies that its internet taker quantity on Binance stays largely detrimental on Wednesday, persevering with the August development of signaling persistent sell-side strain regardless of wider altcoin enthusiasm.

This divergence signifies that whereas merchants are rotating into higher-beta altcoins, ETH won’t be the first beneficiary of speculative flows for the time being.

Thus, the important thing technical degree stays $4,500. A day by day shut above this threshold might verify breakout momentum and lengthen features, whereas failure to carry dangers reaffirms the range-bound construction, probably concentrating on vary lows below $4,100.

Associated: Value predictions 9/3: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LINK, HYPE, SUI

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.