With bitcoin caught simply above $110,000 and ether (ETH) consolidating after hitting contemporary data, Solana has emerged as a standout performer within the crypto market just lately.

The token traded round $211 on Monday, up 33% from early August lows, making it among the best performers within the CoinDesk 20 Index up to now month. In opposition to bitcoin, SOL has gained 34% over the previous month, and it has strengthened 14% versus ETH since mid-August.

The rally displays a broader rotation into altcoins, analysts stated.

“The season of revenue redistribution amongst holders of cryptocurrencies continues,” Sergei Gorev, head of danger at YouHodler, stated in a market observe shared with CoinDesk. He stated liquidity has been shifting out of BTC into second-tier tokens, with “a noticeable enhance within the optimistic dynamics in capital flows to SOL.”

Such flows might be long-term as company buyers search for massive, liquid initiatives to carry, Gorev added, naming SOL alongside with XRP because the “subsequent attention-grabbing market concepts.”

Jeff Dorman, chief funding officer at Arca, tipped SOL to copy ether’s turnaround earlier this yr. He pointed to Ethereum’s resurgence after stablecoin adoption, robust ETF inflows and the relentless bid from digital asset treasuries, or DATs, helped ETH rally almost 200% since April.

“SOL seems poised to repeat the very same playbook that ETH simply executed within the coming months,” Dorman wrote in a contemporary report.

The primary U.S.-listed Solana ETF launched in July, nevertheless it was futures-based. A number of asset managers, together with VanEck and Constancy, have filed for spot merchandise with selections due later this yr, Dorman stated.

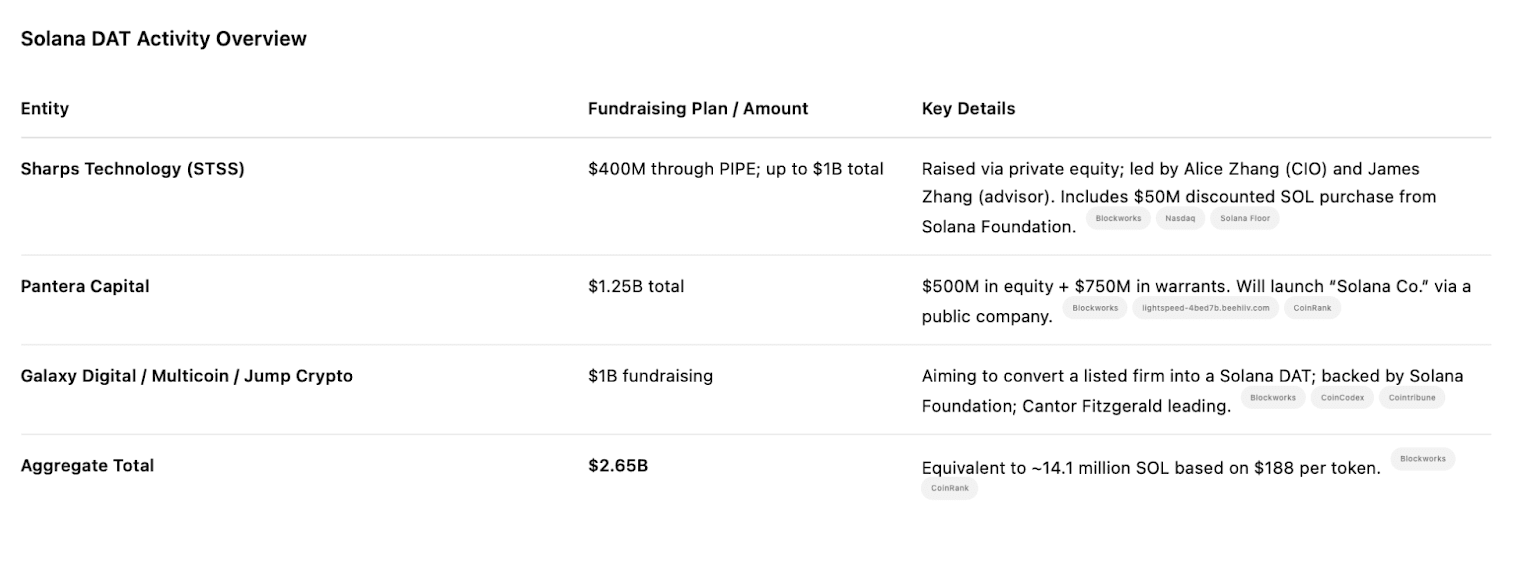

In the meantime, not less than three Solana-focused DATs are elevating funds that would channel as much as $2.65 billion into SOL over the subsequent month, he added.

At solely one-fifth of ETH’s market capitalization, SOL’s value might be much more reactive to the flows in the event that they materialize.

“SOL is likely to be the obvious lengthy proper now,” Dorman stated. “If the value of ETH rose virtually 200% on roughly $20 billion of recent demand, what do you suppose occurs to SOL on $2.5 billion or extra of recent demand?”

Current information may additionally add to the momentum. Nasdaq-listed digital asset conglomerate Galaxy Digital tokenized its shares on Solana, whereas the approval of the Alpenglow improve guarantees to enhance transaction pace and finality.

Learn extra: TRUMP, XRP, and SOL Choices Sign a Potential 12 months-Finish Altcoin Season: PowerTrade