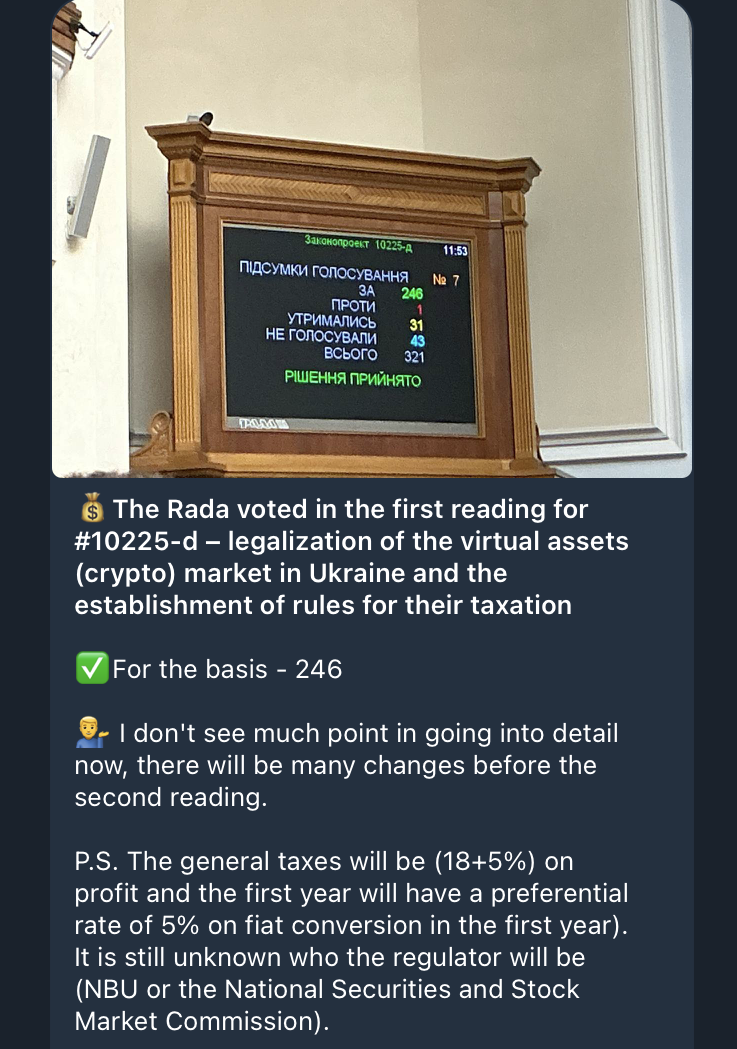

The Verkhovna Rada, Ukraine’s parliament, handed the primary studying of a invoice to legalize and tax cryptocurrency on Wednesday, in response to lawmaker Yaroslav Zhelezniak. If signed into legislation, the invoice would considerably form the digital asset economic system within the nation, which ranks among the many world’s high in crypto adoption.

In response to Zhelezniak’s announcement on a Telegram channel, the invoice handed the primary studying with 246 lawmakers voting in assist. The laws’s draft outlines an earnings tax of 18% and a army tax of 5% on digital asset earnings. The invoice additionally units a preferential 5% tax price on fiat conversions its first 12 months, in response to the announcement.

The proposed taxation price of 23% is in step with the April advice of Ukraine’s monetary regulator. The preliminary advice exempted crypto-to-crypto and stablecoins transactions, bringing Ukraine’s crypto tax system nearer to crypto-friendly nations.

“I do not see a lot level in going into element now, there can be many modifications earlier than the second studying,” Zhelezniak stated in an translated assertion. “It’s nonetheless unknown who the regulator can be (NBU or the Nationwide Securities and Inventory Market Fee).”

Ukraine’s parliament has been advancing crypto laws this 12 months as digital belongings achieve mainstream traction. In June, the Verkhovna Rada launched a invoice to determine a crypto asset reserve, and in August, Cointelegraph realized {that a} taxation invoice would obtain its first studying.

Ukraine ranks eighth globally in Chainalysis’s 2025 World Crypto Adoption Index. The nation scores notably excessive in centralized worth obtained throughout each retail and institutional classes, and in addition holds a high spot in DeFi worth obtained — a sector gaining traction in Japanese Europe.

“A window of alternative has opened for attracting crypto investments and repatriating international belongings of Ukrainian crypto lovers,” Volodymyr Nosov, CEO of European crypto alternate WhiteBIT, informed Cointelegraph. “It is a key issue for revitalizing the economic system and modernizing the market […].”

Crypto tax discussions world wide

Extra nations are weighing tax insurance policies for cryptocurrencies because the asset class positive factors international acceptance. Over the previous 12 months, Denmark, Brazil and america have every moved to handle crypto taxation.

In October 2024, Denmark’s Tax Legislation Council really useful a invoice to levy taxes on unrealized crypto positive factors. In his report, the Danish tax minister stated that the invoice’s strategy can be a less complicated technique to tax crypto. It’s nonetheless thought of a proposal.

In June 2025, Brazil moved to finish a crypto tax exemption and impose a 17.5% flat tax price on crypto positive factors amid a authorities’s push to boost cash via taxation of monetary markets.

In July, representatives within the US’s decrease legislative chamber have been set to carry a listening to on a framework for the taxation of crypto belongings within the nation.

Journal: AI Eye: ‘Slaughterbot’ drones in Ukraine, MechaHitler turns into attractive waifu