Key takeaways:

-

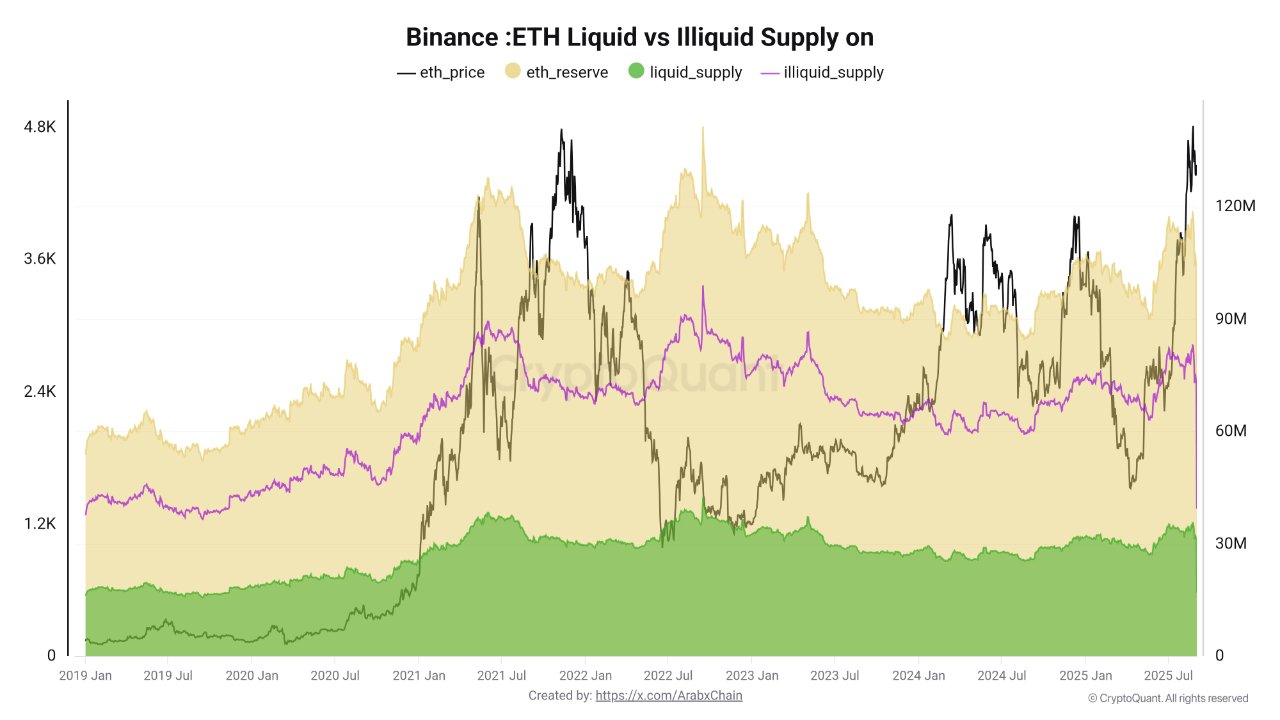

Greater than 70% of the Ether provide is staked, underpinning a longer-term bullish atmosphere.

-

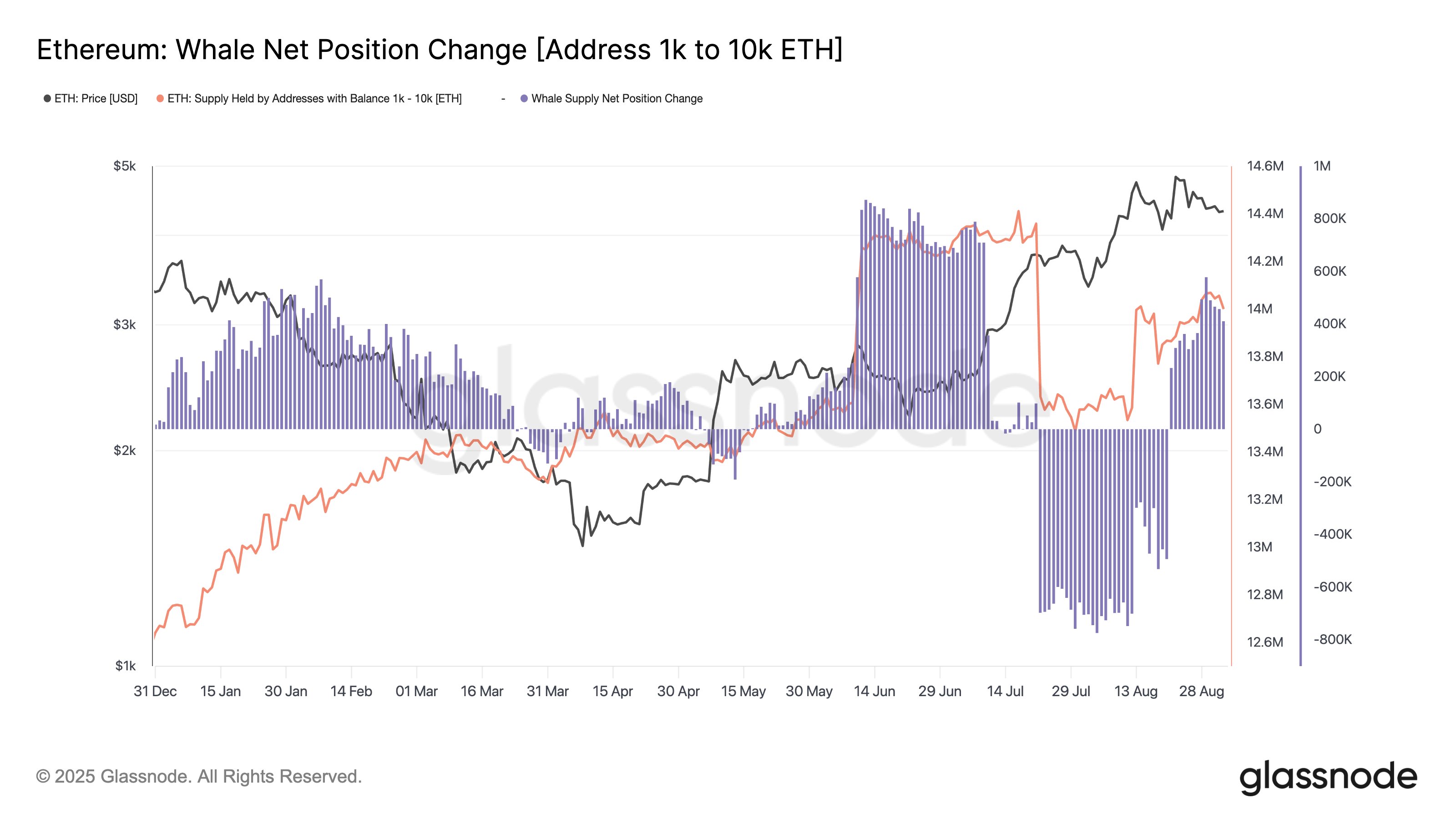

Ether whales added greater than 411,000 ETH in August.

-

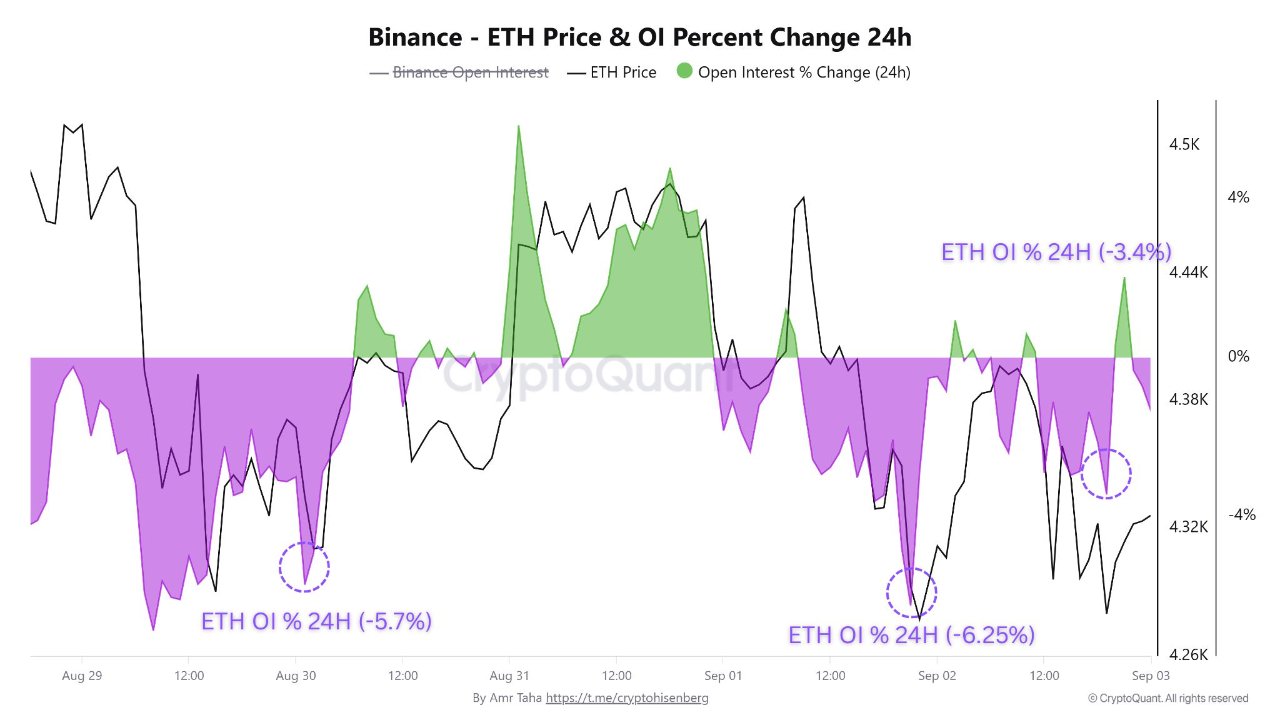

Binance ETH futures open curiosity stays above $8.4 billion regardless of the $4,300 retest.

Ether (ETH) surged to an all-time excessive of $4,950 in August, fueled by broad market momentum and spot ETH ETF inflows. Nevertheless, behind the rally, alternate and provide dynamics point out a mixture of short-term warning and long-term bullish indicators.

Information from CryptoQuant exhibits that Binance’s ETH reserves climbed sharply in August. Rising reserves normally trace at profit-taking as extra cash transfer into circulation. Liquid provide has additionally risen, suggesting some ETH holders are reentering the market.

Nonetheless, nearly all of the ETH provide stays illiquid, or locked in staking or long-term holdings, making a structural scarcity that helps the larger bullish image. The evaluation mentioned,

“The most definitely situation for September is a sideways-to-slightly-bullish transfer between 4.3k and 5k. If the 4.8k resistance is damaged and sustained, we may see 5.2k–5.5k.”

Whale flows mirror a shifting panorama. Glassnode knowledge present that mega whales holding greater than 10,000 ETH drove August’s rally with web inflows peaking above 2.2 million ETH in 30 days. That accumulation has now stalled, whereas giant whales (1,000–10,000 ETH) have returned to purchasing, including greater than 411,000 ETH over the identical interval. This rotation exhibits that demand hasn’t disappeared, even when the most important holders pause their exercise.

Associated: Spot Bitcoin ETFs surge, Ether funds bleed as buyers flee for security

ETH futures sign conviction regardless of worth dip

ETH futures knowledge provides additional context. Crypto analyst Amr Taha famous that regardless of ETH sliding under $4,300 this week, Binance open curiosity has held agency above $8.4 billion, the identical threshold seen on Aug. 30.

Usually, sharp worth drops set off liquidation-driven flush, however the resilience right here suggests merchants are staying put, both betting on a rebound or unfazed by additional draw back.

The tempo of contraction can be slowing. Open curiosity fell 6.25% earlier within the week however eased to three.4%, pointing to cooling deleveraging stress. Web taker quantity on Binance stays unfavourable, signaling sellers are in management, but the steadiness in open curiosity exhibits that patrons are absorbing a significant portion of that stress.

In the meantime, spot flows proceed to tighten provide. Withdrawals from Binance and Kraken often exceed 120,000 ETH per day, reinforcing the illiquid provide narrative and dampening future sell-side depth.

Associated: ETH staking entry queue surges to two-year excessive as establishments accumulate

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.