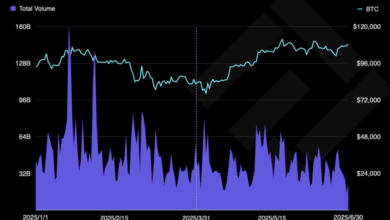

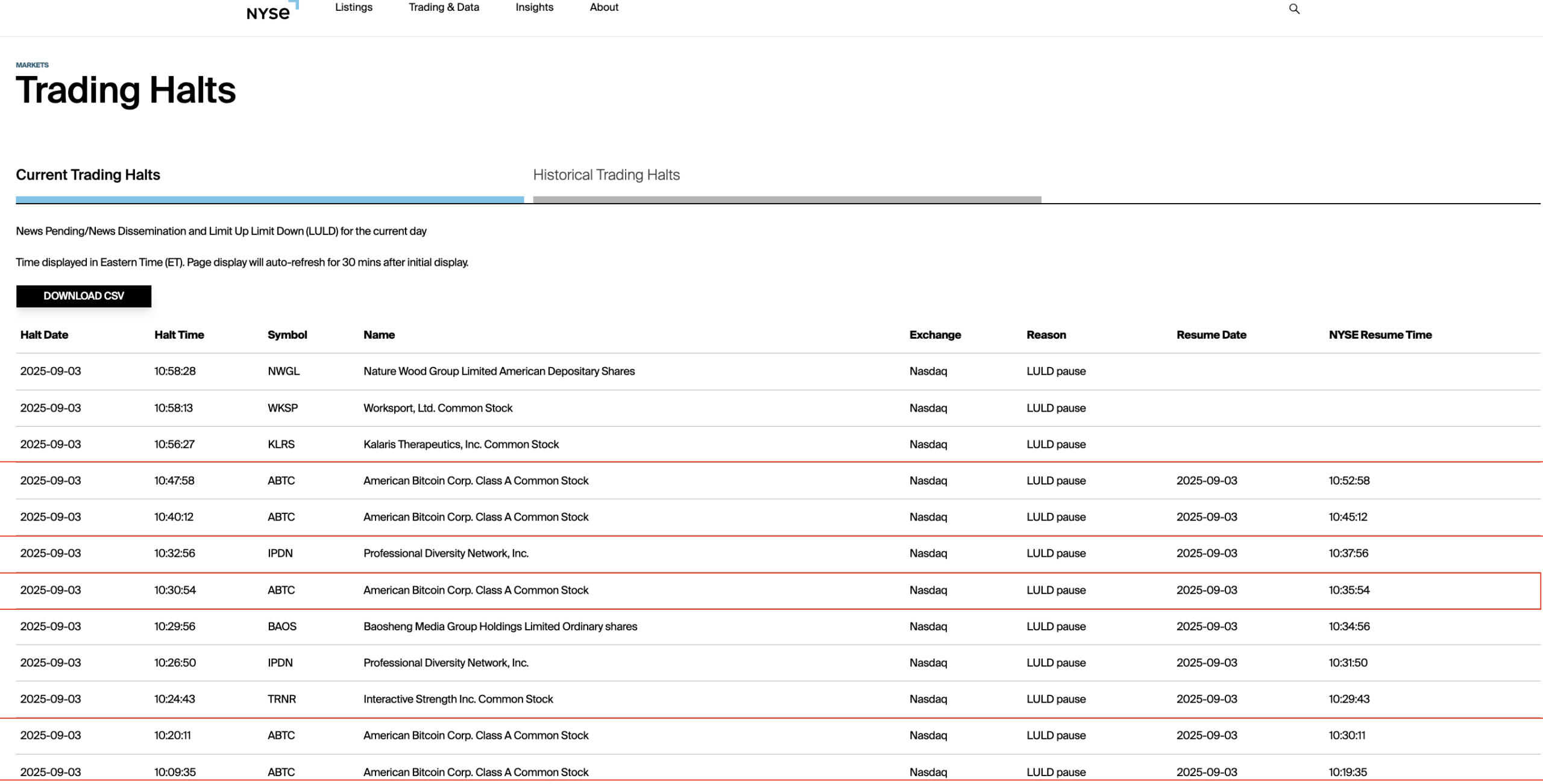

The Nasdaq inventory alternate halted buying and selling of American Bitcoin (ABTC) shares 5 occasions Wednesday as volatility spiked on the inventory’s relisting debut.

Shares of ABTC, a Bitcoin (BTC) mining firm co-founded by Eric Trump and Donald Trump, Jr., climbed by practically 85%, hitting a excessive of $14 per share throughout intraday buying and selling, following American Bitcoin’s inventory merger with Gryphon Digital Mining, one other crypto mining firm.

ABTC buying and selling was first halted at 3:09:35 UTC for 10 minutes and once more at 3:20:11 UTC, with two further halts at 3:30:54 and three:40:12.

The latest buying and selling halt occurred at 3:47:58 UTC; nevertheless, buying and selling has since resumed, in accordance with the New York Inventory Trade (NYSE), and shares of ABTC are at present swapping fingers at about $9.80.

American Bitcoin’s debut to a buying and selling frenzy displays Wall Avenue’s rising urge for food for digital asset companies and mining firms, because the crypto business matures and courts institutional funding.

Associated: Bullish inventory surges 218% in NYSE debut as crypto enters Wall Avenue limelight

Crypto companies eye merges to go public

American Bitcoin went public by way of an all-stock merger with Gryphon. The deal, disclosed in late August, gave Trump’s household firm a quicker pathway to US markets.

Crypto firms are more and more turning to mergers to succeed in American buyers, notably by way of particular function acquisition firms (SPACs) — automobiles that enable non-public firms to go public by combining with present publicly traded “clean verify” firms.

These SPACs will not be working companies and solely exist to discover a appropriate non-public firm to merge with, providing an avenue to go public with out having to undergo the prolonged and expensive preliminary public providing (IPO) course of.

In August, Parataxis, a digital asset funding agency, introduced plans to go public through a SPAC merger with SilverBox Corp IV. As soon as the deal closes, the brand new firm will probably be listed as Parataxis Holdings (PRTX).

Investor Chamath Palihapitiya filed for a SPAC referred to as “American Exceptionalism Acquisition Corp A,” a $250 million clean verify firm targeted on decentralized finance (DeFi), synthetic intelligence, and power.

Trump Media and Know-how Group, a tech firm co-founded by US president Donald Trump, introduced a $6.4 billion SPAC cope with Crypto.com to arrange a Cronos (CRO) treasury firm in August.

Journal: Will Robinhood’s tokenized shares REALLY take over the world? Professionals and cons