Key factors:

-

Bitcoin made a robust comeback, confirming that dip consumers had been current at decrease ranges; increased ranges might proceed to draw sellers.

-

Choose altcoins have bounced off their respective assist ranges, indicating a constructive sentiment.

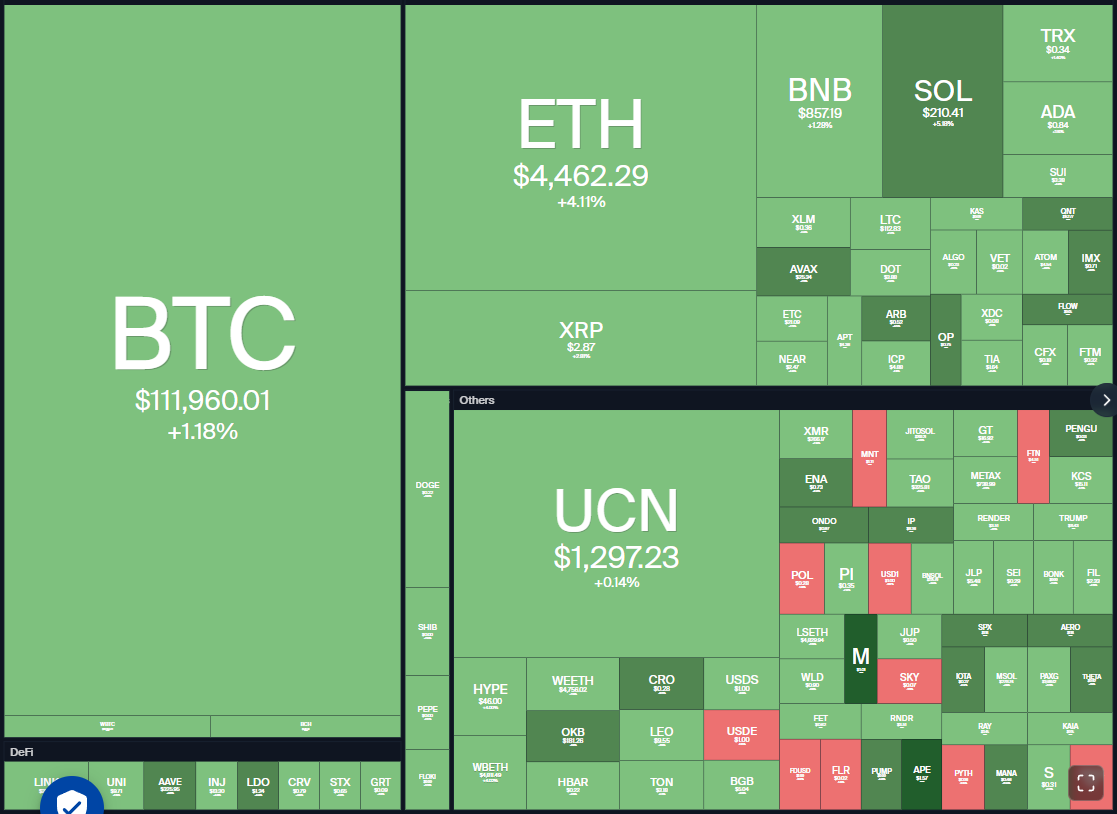

Bitcoin (BTC) rallied to $112,500 on Wednesday, indicating that the bulls are attempting to increase the restoration. The aid rally attracted shopping for in spot BTC exchange-traded funds on Tuesday, which recorded $332.7 million in web inflows, in keeping with SoSoValue information.

A constructive signal for the crypto bulls is that gold (XAU) made a brand new excessive above $3,500 (per ounce) on Tuesday. Historical past exhibits that BTC follows gold with a lag. BTC’s median rise following gold’s new all-time excessive is 30% at three months, and 225% at 12 months. If historical past repeats, BTC might rally to the $135,000 to $145,000 zone by early December.

Nevertheless, September’s weak seasonality is a threat for the bulls within the close to time period. Community economist Timothy Peterson stated in a put up on X that BTC plunges 100% of the time between Sept. 16 and Sept. 23, with a typical decline of 5%.

What are the important resistance ranges to be careful for in BTC and the main altcoins? Let’s analyze the charts of the highest 10 cryptocurrencies to search out out.

Bitcoin worth prediction

BTC rose again above the breakdown stage of $110,530 on Tuesday, indicating stable demand at decrease ranges.

There may be stiff resistance on the 20-day exponential transferring common ($112,438), but when the bulls overcome it, the BTC/USDT pair might rally to the 50-day easy transferring common ($115,640). Such a transfer means that the corrective section could also be over. The pair might then try a rally towards $124,474.

If bears wish to retain the benefit, they must fiercely defend the 20-day EMA and swiftly pull the Bitcoin worth beneath $107,255. In the event that they handle to do this, the pair might plummet to $105,000 and ultimately to the important assist at $100,000.

Ether worth prediction

ETH (ETH) closed beneath the 20-day EMA ($4,379) on Monday, however the bears couldn’t pull the worth to the $4,094 assist.

The bulls are attempting to make a comeback by sustaining the worth above the 20-day EMA. In the event that they do this, the ETH/USDT pair might rise to $4,500 and, after that, to $4,664. Sellers will attempt to defend the zone between $4,664 and $4,956 as a result of a break above it might resume the uptrend towards the subsequent goal goal of $5,662.

The 50-day SMA ($4,072) is the important stage to be careful for on the draw back. If this assist cracks, the Ether worth might tumble to $3,745 after which to $3,354.

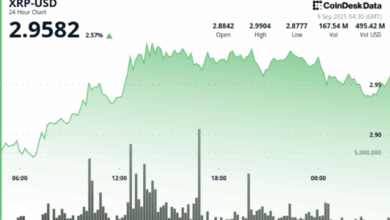

XRP worth prediction

XRP (XRP) bounced off the $2.73 stage on Monday, indicating that the bulls are aggressively defending the extent.

The aid rally is predicted to face promoting on the 20-day EMA ($2.93), which is sloping down. The XRP/USDT pair will full a bearish descending triangle sample on a break and shut beneath $2.73. That would begin a downward transfer to $2.20.

Consumers must thrust the worth above the downtrend line to negate the bearish sample. The XRP worth might then rally towards $3.40, signaling that the pair might stay caught between $2.73 and $3.66 for some time.

BNB worth prediction

Consumers are attempting to maintain BNB (BNB) above the 20-day EMA ($849), however the bears have saved up the stress.

If the 20-day EMA provides means, the BNB/USDT pair might slide to the 50-day SMA ($811). Consumers are anticipated to fiercely defend the zone between the 50-day SMA and $794.

If the worth turns up and breaks above $869, it means that the promoting stress is lowering. The bulls will then attempt to push the worth above $881, difficult the overhead resistance at $900. A break and shut above $900 alerts the beginning of the subsequent leg of the uptrend to the psychological stage of $1,000.

Solana worth prediction

Solana (SOL) turned up from the 20-day EMA ($197) on Tuesday, signaling that the constructive sentiment stays intact.

Consumers will attempt to strengthen their place by pushing the worth above the $218 resistance. If they will pull it off, the SOL/USDT pair will full a bullish ascending triangle sample. That clears the trail for a rally to $240 after which to $260.

The uptrend line is the important assist to be careful for on the draw back. Sellers must drag the worth beneath the uptrend line to invalidate the bullish setup. The Solana worth might sink to $175 and thereafter to $155.

Dogecoin worth prediction

Consumers have managed to maintain Dogecoin (DOGE) above the $0.21 assist however are struggling to push the worth above the transferring averages.

The downsloping 20-day EMA ($0.22) and the RSI close to the midpoint counsel a minor benefit to the bears. If the worth turns down and breaks beneath $0.21, the DOGE/USDT pair might stoop to $0.19 after which to $0.16.

This adverse view can be invalidated within the close to time period if the worth turns up and breaks above the 50-day SMA ($0.22). That means the Dogecoin worth might oscillate contained in the $0.21 to $0.26 vary for a number of extra days.

Cardano worth prediction

Cardano (ADA) has been falling inside a descending channel sample for a number of days, indicating shopping for on dips and promoting on rallies.

If consumers drive the worth above the 20-day EMA ($0.84), the ADA/USDT pair might attain the downtrend line. Sellers are anticipated to mount a vigorous protection on the downtrend line, but when the bulls prevail, the Cardano worth might rise to $0.96 and later to $1.02.

As a substitute, if the worth turns down from the 20-day EMA, the bears will try to tug the pair to the assist line. That could be a important stage for the bulls to defend as a result of a break beneath the channel might sink the worth to $0.68.

Associated: Basic XRP worth chart sample targets $5 as spot ETF actuality attracts nearer

Chainlink worth prediction

Chainlink (LINK) has been witnessing a troublesome battle between the bulls and the bears on the 20-day EMA ($23.45).

The flattish 20-day EMA and the RSI close to the midpoint don’t give a transparent benefit both to the bulls or the bears. If the worth turns down from the present stage, the LINK/USDT pair might discover assist on the 50-day SMA ($20.99).

Contrarily, consumers will achieve the sting within the close to time period in the event that they push and keep the Chainlink worth above $24.06. In the event that they handle to do this, the pair might march towards $26 after which $27.

Hyperliquid worth prediction

Hyperliquid (HYPE) turned up from the uptrend line on Tuesday, however the bears are more likely to promote at increased ranges.

A break and shut beneath the uptrend line invalidates the bullish ascending triangle sample. That will pull the Hyperliquid worth to $40 and subsequently to the stable assist at $35.51.

Opposite to this assumption, if the worth maintains above $45.50, it means that the bulls are shopping for on dips. The HYPE/USDT pair might then ascend to the overhead resistance at $49.88. This can be a essential stage to be careful for as a result of an in depth above $49.88 opens the gates for a rally to the sample goal of $64.25.

Sui worth prediction

Sui (SUI) closed beneath the $3.26 assist on Monday, however the bears couldn’t maintain the decrease ranges.

The bulls pushed the Sui worth again above $3.26 on Tuesday however are more likely to face stiff resistance from the bears on the 20-day EMA ($3.45). If the worth turns down sharply from the 20-day EMA, the chance of a break beneath $3.11 will increase. The SUI/USDT pair might then plummet to $2.80.

Alternatively, if consumers drive the worth above the 20-day EMA, the pair might climb to the 50-day SMA ($3.67).

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.