Key factors:

-

Bitcoin returns to $112,000 as bulls stage a key resistance retest.

-

BTC value motion preserves the “bull market assist channel” in a traditional dip to assist.

-

Gold hits new all-time highs as views on Bitcoin reward its standing as a macro hedge.

Bitcoin (BTC) tapped $112,500 after Wednesday’s Wall Road open as merchants slowly flipped bullish on BTC value motion.

BTC value punishes shorts with $112,000 rebound

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD trying to win again key assist ranges.

These included $112,000 itself, which fashioned the underside of a big patch of ask liquidity on alternate order books.

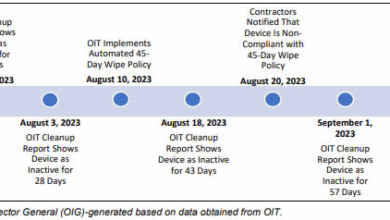

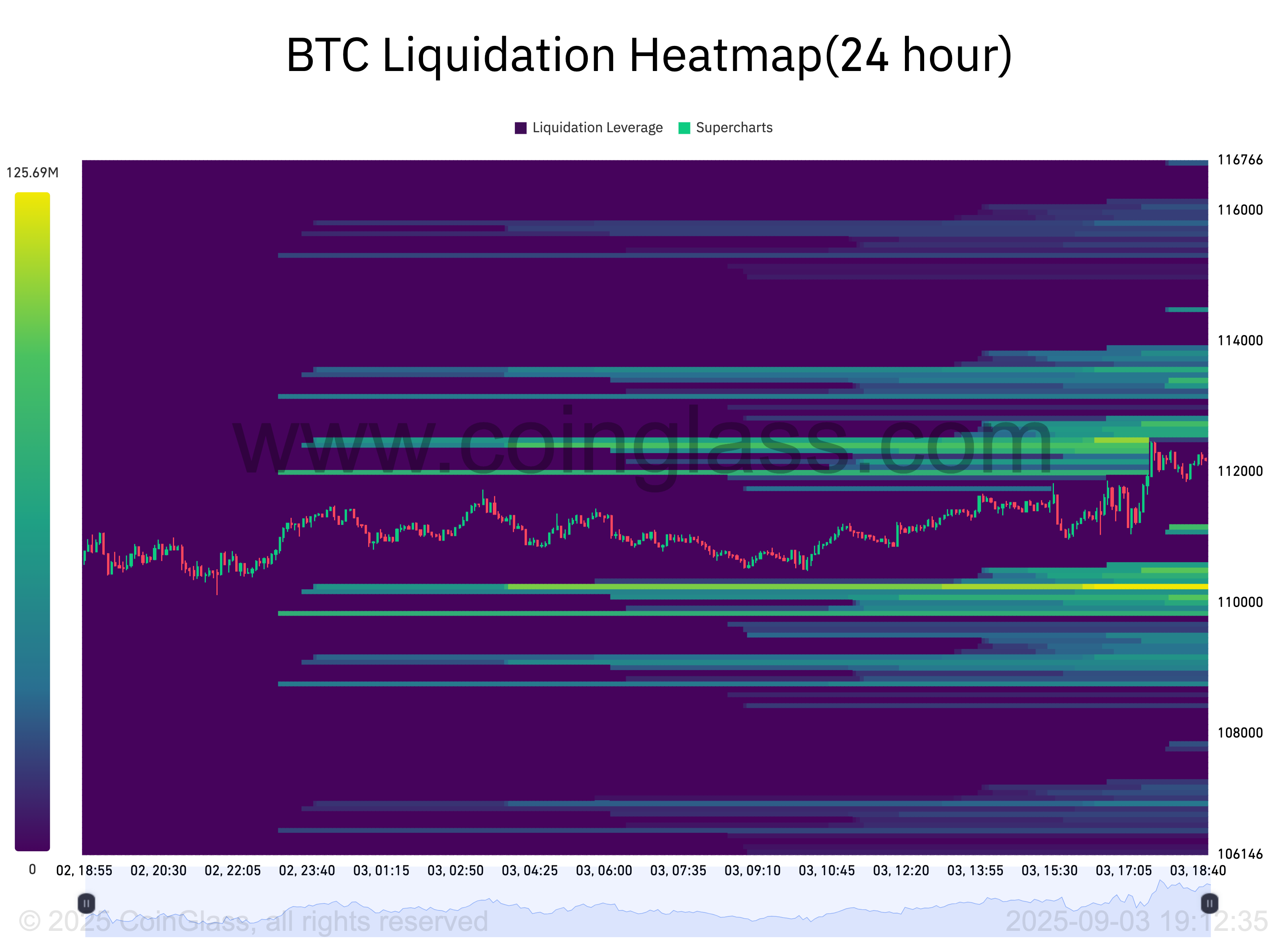

Information from CoinGlass confirmed value taking out a bit of that liquidity on the day, with the rest extending to $114,000.

Commenting, widespread dealer CrypNuevo highlighted the important thing assist battles at present in play.

“This seems to be like an try and reclaim Assist 1, which might result in a transfer again contained in the vary,” a part of an X put up defined.

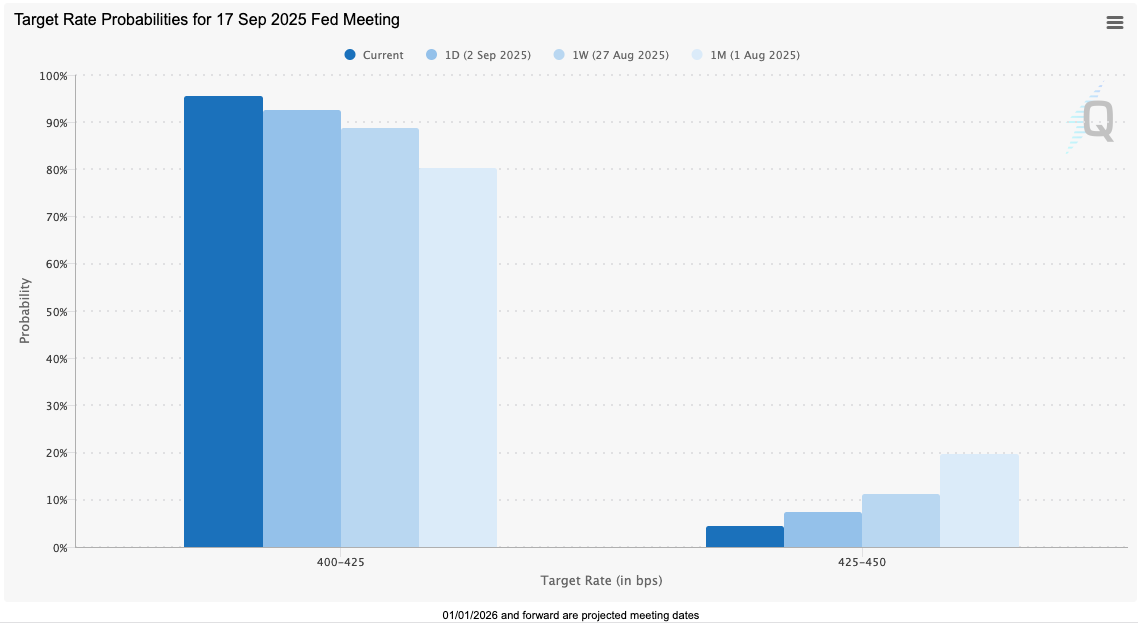

CrypNuevo famous that there have been simply two weeks left till a possible bullish risk-asset catalyst entered — an interest-rate reduce by the US Federal Reserve on Sept. 17.

The put up described this week’s native lows at $107,270 as a “false transfer,” whereas fellow dealer BitBull flagged a traditional bounce at assist.

“$BTC completely bounced again from its bull market assist band,” he advised X followers, referring to a channel fashioned by two shifting averages.

“This can be a signal that bulls are nonetheless in management.”

As Cointelegraph reported, many market members stay bearish throughout a number of timeframes, seeing a retest of $100,000 as quickly as this week.

Bitcoin bull case boosted as gold beats file highs

Concerning macro volatility, buying and selling agency QCP Capital noticed the percentages in Bitcoin’s favor going ahead.

Associated: BTC vs. ‘very bearish’ gold breakout: 5 issues to know in Bitcoin this week

“Two cuts this yr look affordable, however regulate breakevens, as new tariffs may push expectations greater,” it summarized in its newest “Asia Shade” market replace.

“With coverage uncertainty lingering, a softer US greenback is extra doubtless as long as international progress holds up. Gold and BTC stay easy hedges on this backdrop.”

Information from CME Group’s FedWatch Software confirms that market expectations of an interest-rate reduce in September at the moment are over 95%.

Gold made contemporary all-time highs on Wednesday, hitting $3,567 per ounce.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.