Etherealize, a startup creating infrastructure to assist Wall Avenue establishments undertake Ethereum, has raised $40 million in Collection A funding, co‑led by Electrical Capital and Paradigm.

The brand new capital builds on an earlier grant from Vitalik Buterin and the Ethereum Basis and can assist fund Etherealize’s push to develop zero‑information privateness methods, settlement engines, and functions for tokenized mounted‑earnings markets.

“This elevate kicks off the ‘Institutional Merge’, upgrading institutional finance to trendy, safer, globally accessible rails,” co-founder Danny Ryan, previously of the Ethereum Basis, mentioned in an announcement on Wednesday.

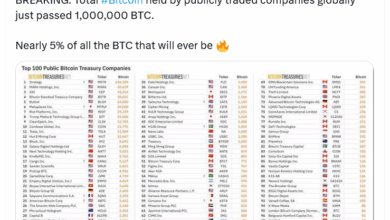

Etherealize’s efforts to border ETH as an institutional reserve asset and participation in regulatory discussions on Capitol Hill complement latest institutional developments on Ethereum.

BlackRock launched a tokenized cash market fund on Ethereum, signaling help for blockchain-based asset issuance, whereas JPMorgan’s Kinexys platform is being ramped up for actual‑world asset tokenization and on-chain USD funds.

With this funding, Etherealize goals to fast-track the event of monetary infrastructure that can make Ethereum the unseen spine of institutional markets.