South Korean crypto change Upbit quickly suspended buying and selling in Stellar’s XLM token on Tuesday, a precautionary transfer because the Stellar community readies for its Protocol 23 improve.

The scheduled modernization, set for Sept. 3, is predicted to reinforce scalability and speed up transaction speeds, prompting a number of exchanges to undertake stability measures through the transition.

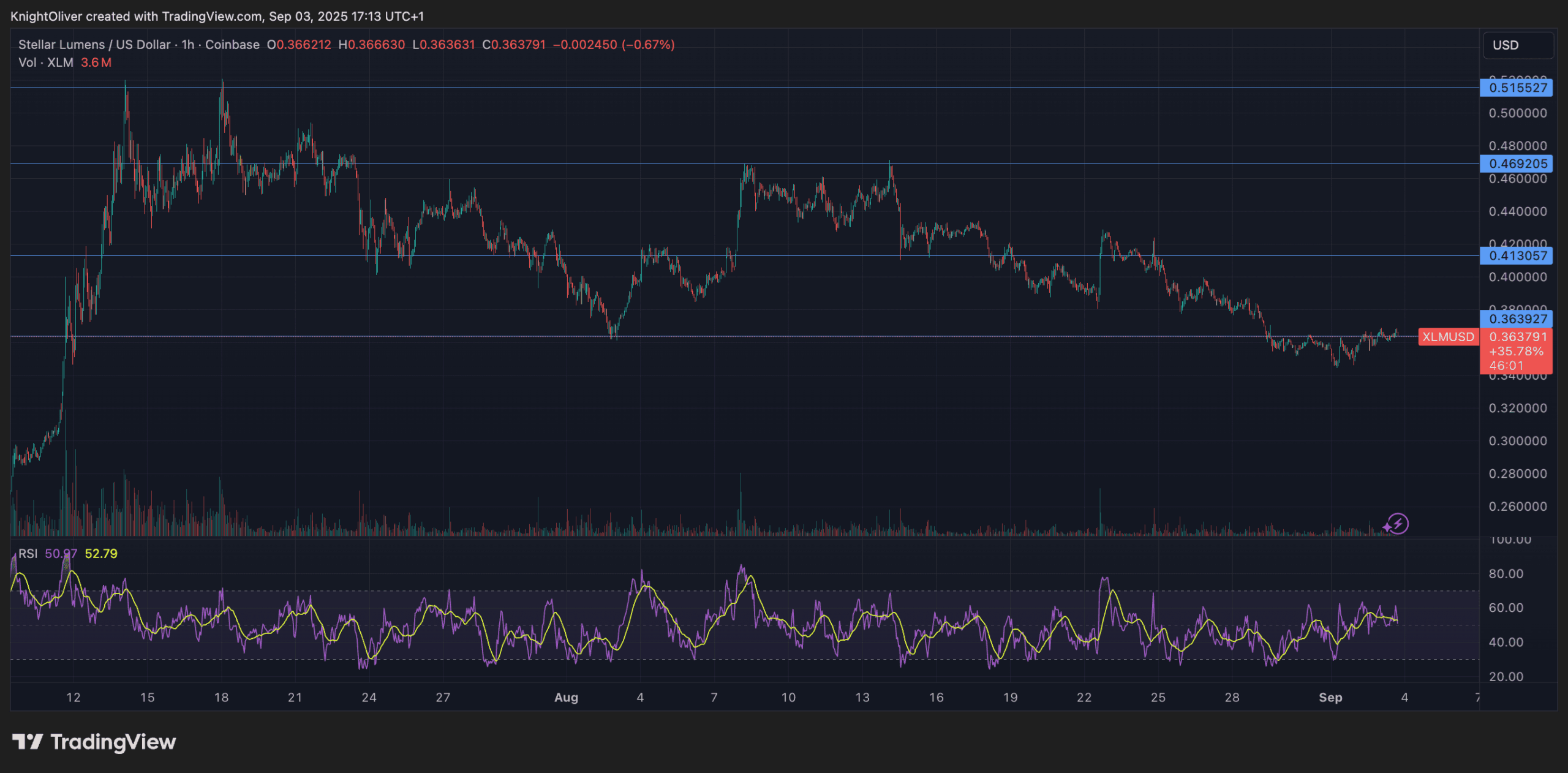

XLM traded in a slender band between $0.36 and $0.37 within the 24 hours main as much as the improve, with quantity spikes coinciding with exams of resistance on the higher finish of that vary.

Regardless of a number of makes an attempt to interrupt via $0.37, promoting strain stored costs capped, whereas robust help shaped at $0.36. Analysts counsel this consolidation displays institutional accumulation, with market individuals watching carefully for a decisive breakout.

The ultimate hour of buying and selling earlier than the suspension noticed heightened volatility, with XLM briefly touching $0.37 earlier than slipping again to $0.36. The worth motion underscores the community’s significance in cross-border funds and the rising institutional give attention to digital asset infrastructure.

Broader momentum can be being fueled by rising curiosity in central financial institution digital currencies (CBDCs) and enterprise blockchain adoption, together with partnerships involving Hedera.

With Stellar’s Protocol 23 improve underway, merchants are eyeing two important ranges: the $0.45 resistance, which XLM has didn’t clear on 4 separate events since June, and the $0.30–$0.32 help zone, seen as a possible accumulation space. Market observers say the result of the improve might dictate whether or not Stellar lastly breaks via its ceiling or retreats to rebuild help at decrease ranges.

Principal Technical Indicators

- Value Parameters: XLM traded inside a $0.36-$0.37 hall through the 24-hour interval with 3% mixture volatility.

- Quantity Evaluation: Peak buying and selling exercise of 28.91 million throughout resistance examination on the $0.37 threshold.

- Help/Resistance Dynamics: Sturdy resistance established at $0.37 with help sustaining integrity round $0.36.

- Breakout Configurations: A number of unsuccessful makes an attempt to maintain valuations above the $0.37 resistance threshold.

- Institutional Participation: Quantity surges coinciding with key technical ranges counsel accumulation patterns amongst subtle market individuals.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.