- Gold worth jumps to close $3,550 amid meltdown in bonds globally.

- Rising bonds yields point out mounting fiscal issues.

- Buyers await key US JOLTS Job Openings information for July.

Gold worth (XAU/USD) extends its profitable streak for the seventh buying and selling day on Wednesday. The dear metallic posts a contemporary all-time excessive close to $3,550 as traders have dumped long-dated authorities bonds throughout the globe.

Decrease yields on interest-bearing belongings enhance demand for non-yielding belongings, corresponding to Gold.

Surging authorities bond yields signify mounting issues over authorities fiscal debt, which regularly result in a decline in welfare spending, and henceforth will increase enchantment of safe-haven bets.

One more reason behind energy within the Gold worth is agency expectations that the Federal Reserve (Fed) will reduce rates of interest within the coverage assembly this month. In line with the CME FedWatch device, there’s an nearly 92% probability that the Fed will reduce rates of interest within the September coverage assembly.

Decrease rates of interest by the Fed bode properly for non-yielding belongings, corresponding to Gold.

Currently, Federal Open Market Committee (FOMC) members supported rate of interest cuts amid escalating draw back employment dangers.

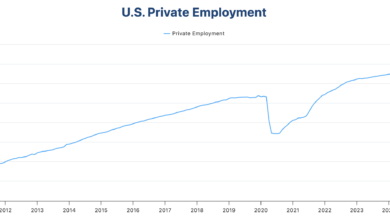

In the meantime, traders await United States (US) JOLTS Job Openings information for July, which might be revealed at 14:00 GMT. Buyers can pay shut consideration to the job information to get cues concerning the present standing of the labor demand.

US employers are anticipated to have posted contemporary 7.4 million jobs, nearly according to the prior studying of seven.44 million.

Gold technical evaluation

Gold worth trades in uncharted territory after a breakout of the Symmetrical Triangle formation on a day by day timeframe. A breakout of the above-mentioned chart sample usually results in excessive quantity and wider ticks on the upside.

Rising 20-day Exponential Shifting Common (EMA) round $3,410 signifies that the near-term development is bullish.

The 14-day Relative Power Index (RSI) jumps to close 75.00. A corrective transfer within the Gold worth appears probably because the momentum oscillator turns overbought.

Wanting down, the 20-day will act as key help for the key. On the upside, the spherical determine of $3,600 can be the important thing hurdle for the pair.

Gold day by day chart

Gold FAQs

Gold has performed a key position in human’s historical past because it has been extensively used as a retailer of worth and medium of change. At the moment, aside from its shine and utilization for jewellery, the dear metallic is extensively seen as a safe-haven asset, which means that it’s thought of a great funding throughout turbulent instances. Gold can also be extensively seen as a hedge in opposition to inflation and in opposition to depreciating currencies because it doesn’t depend on any particular issuer or authorities.

Central banks are the largest Gold holders. Of their purpose to help their currencies in turbulent instances, central banks are likely to diversify their reserves and purchase Gold to enhance the perceived energy of the financial system and the foreign money. Excessive Gold reserves generally is a supply of belief for a rustic’s solvency. Central banks added 1,136 tonnes of Gold price round $70 billion to their reserves in 2022, in response to information from the World Gold Council. That is the best yearly buy since information started. Central banks from rising economies corresponding to China, India and Turkey are rapidly growing their Gold reserves.

Gold has an inverse correlation with the US Greenback and US Treasuries, that are each main reserve and safe-haven belongings. When the Greenback depreciates, Gold tends to rise, enabling traders and central banks to diversify their belongings in turbulent instances. Gold can also be inversely correlated with threat belongings. A rally within the inventory market tends to weaken Gold worth, whereas sell-offs in riskier markets are likely to favor the dear metallic.

The value can transfer resulting from a variety of things. Geopolitical instability or fears of a deep recession can rapidly make Gold worth escalate resulting from its safe-haven standing. As a yield-less asset, Gold tends to rise with decrease rates of interest, whereas increased price of cash normally weighs down on the yellow metallic. Nonetheless, most strikes depend upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAU/USD). A powerful Greenback tends to maintain the worth of Gold managed, whereas a weaker Greenback is prone to push Gold costs up.