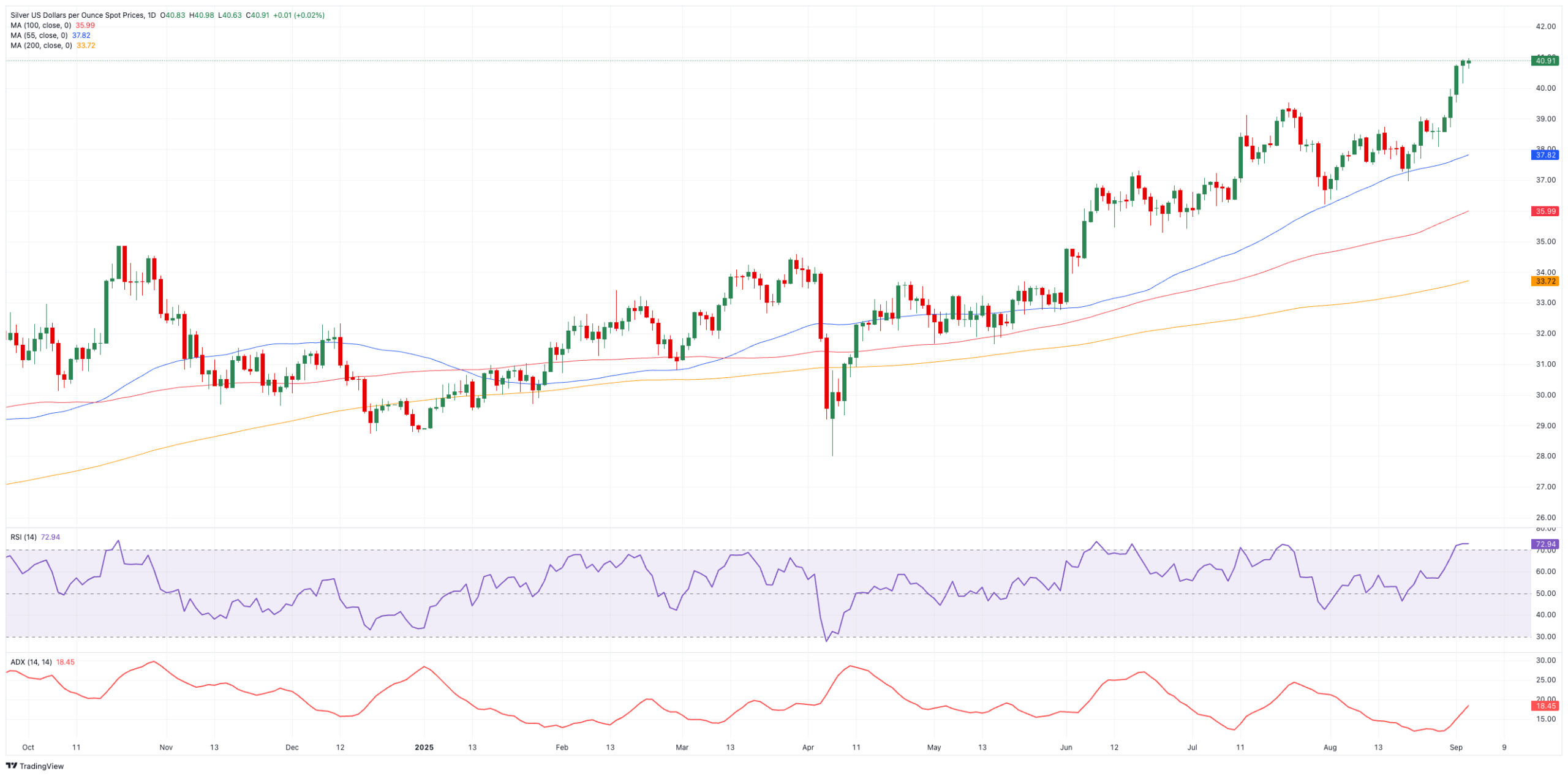

- Silver costs commerce near the $41.00 mark per ounce on Wednesday.

- A technical correction seems possible, with the RSI properly within the overbought zone.

- Prospects for additional fee cuts by the Federal Reserve underpin the metallic.

Costs of Silver advance for the fourth day in a row on Wednesday, buying and selling at shouting distance from the important thing barrier at $41.00 per ounce.

Fed fee reduce bets and a weak Greenback help the rally

The commercial metallic manages to take care of its upside development properly in place for yet one more day on Wednesday, navigating the world of 14-year tops close to $41.00 on the again of modest losses within the US Greenback.

The extraordinary transfer increased in Silver costs and round treasured metals generally is propped up by traders’ persistent bets on additional fee cuts by the Federal Reserve within the second half of the yr, beginning as quickly as later this month.

Nonetheless across the Fed, President Trump’s makes an attempt to undermine the Fed’s independence by way of repeated requires (a lot) decrease rates of interest and his current intentions to fireside FOMC Governor Lisa Cook dinner have additionally given additional wings to Silver up to now few weeks, all towards the backdrop of a extra politicised Fed mendacity forward.

As well as, the resurgence of commerce uncertainty, geopolitical effervescence, and rising inflows into Gold and Silver ETFs have additionally been bolstering the strong efficiency of these metals.

Shifting ahead, traders’ consideration is anticipated to be on the upcoming Nonfarm Payrolls knowledge for August on Friday, which ought to shed additional particulars on the Fed’s upcoming rate of interest choices.

What about techs?

Subsequent on the upside for Silver comes its 2025 excessive at $40.97 (September 3). However, there are minor helps on the weekly troughs of $38.09 (August 27) and $36.97 (August 20), all previous the late July ground at $36.22 (July 31).

Momentum seems combined, because the ADX close to 18 indicators a nonetheless juiceless development, whereas the RSI close to 73 is indicative of overbought circumstances, which may in flip spark a technical correction within the not-so-distant future.

Silver FAQs

Silver is a treasured metallic extremely traded amongst traders. It has been traditionally used as a retailer of worth and a medium of change. Though much less in style than Gold, merchants might flip to Silver to diversify their funding portfolio, for its intrinsic worth or as a possible hedge throughout high-inflation intervals. Buyers can purchase bodily Silver, in cash or in bars, or commerce it by way of autos akin to Trade Traded Funds, which observe its value on worldwide markets.

Silver costs can transfer because of a variety of things. Geopolitical instability or fears of a deep recession could make Silver value escalate because of its safe-haven standing, though to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with decrease rates of interest. Its strikes additionally rely upon how the US Greenback (USD) behaves because the asset is priced in {dollars} (XAG/USD). A robust Greenback tends to maintain the value of Silver at bay, whereas a weaker Greenback is prone to propel costs up. Different elements akin to funding demand, mining provide – Silver is far more ample than Gold – and recycling charges may also have an effect on costs.

Silver is broadly utilized in business, notably in sectors akin to electronics or photo voltaic power, because it has one of many highest electrical conductivity of all metals – greater than Copper and Gold. A surge in demand can improve costs, whereas a decline tends to decrease them. Dynamics within the US, Chinese language and Indian economies may also contribute to cost swings: for the US and notably China, their huge industrial sectors use Silver in numerous processes; in India, customers’ demand for the valuable metallic for jewelry additionally performs a key function in setting costs.

Silver costs are likely to comply with Gold’s strikes. When Gold costs rise, Silver usually follows go well with, as their standing as safe-haven property is comparable. The Gold/Silver ratio, which exhibits the variety of ounces of Silver wanted to equal the worth of 1 ounce of Gold, might assist to find out the relative valuation between each metals. Some traders might contemplate a excessive ratio as an indicator that Silver is undervalued, or Gold is overvalued. Quite the opposite, a low ratio may recommend that Gold is undervalued relative to Silver.