Ukraine has begun formal steps to legalize the crypto business, shifting from a largely unregulated market to 1 with an outlined authorized standing.

On Sept. 3, Ukrainian lawmaker Yaroslav Zhelezniak revealed that he and his colleagues permitted a invoice that legalizes and taxes the usage of digital property within the nation.

In line with him, the draft invoice introduces a tax framework that makes transactions topic to an 18% earnings levy and a 5% army contribution.

To encourage compliance, the invoice affords a one-year window throughout which withdrawals transformed to fiat foreign money could be taxed at simply 5%.

He added that regulators for the area have but to be named, with each the Nationwide Financial institution of Ukraine and the Nationwide Securities and Inventory Market Fee being thought-about.

In the meantime, he identified that new revisions could be made to the invoice earlier than the second studying.

Ukraine’s crypto business

The legislative transfer comes as Ukraine faces mounting strain to deliver its crypto sector below tighter oversight.

A current examine by the Royal United Companies Institute (RUSI) prompt the nation might get well as much as $10 billion by constructing a extra strong regulatory system.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

In line with the report, the nation’s thriving over-the-counter markets have turn into a focus for illicit monetary flows, together with buying restricted army elements, utilizing money-mule networks, and gaps in donor verification guidelines.

The report linked these weaknesses to broader geopolitical dangers, warning that they create alternatives for overseas actors to launder cash into politics and undermine democratic techniques.

Consultants on the institute additionally cautioned that Russian intelligence could also be exploiting Ukraine’s wartime distractions to channel illicit funds by means of native intermediaries.

Contemplating this, the report argued that Ukraine dangers being perceived as a hub for crypto-based cash laundering with out stronger oversight, which might harm its monetary stability and worldwide partnerships.

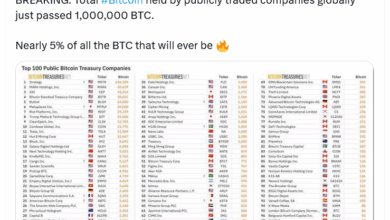

The report comes at an thrilling time, as Ukraine ranks among the many world’s most lively crypto customers. Information from Chainalysis positioned the nation within the international prime ten for adoption and first in Jap Europe.

That prime degree of retail and institutional exercise has given lawmakers added urgency, as crypto regulation is now seen as essential to seize tax income and protect the economic system from illicit exercise.