What’s “Pay with Crypto” by PayPal?

Pay with Crypto is PayPal’s blockchain-based settlement function for US retailers. It permits funds in over 100 cryptocurrencies, together with Bitcoin (BTC), Ether (ETH), Solana (SOL), USDC (USDC), Tether’s USDt (USDT), XRP (XRP), BNB (BNB) and others.

Customers will pay in crypto, whereas retailers obtain both US {dollars} or PayPal USD (PYUSD), PayPal’s dollar-pegged stablecoin. The automated crypto-to-fiat conversion on PayPal ensures no publicity to cost volatility, thereby providing a well-recognized settlement course of akin to a conventional payout.

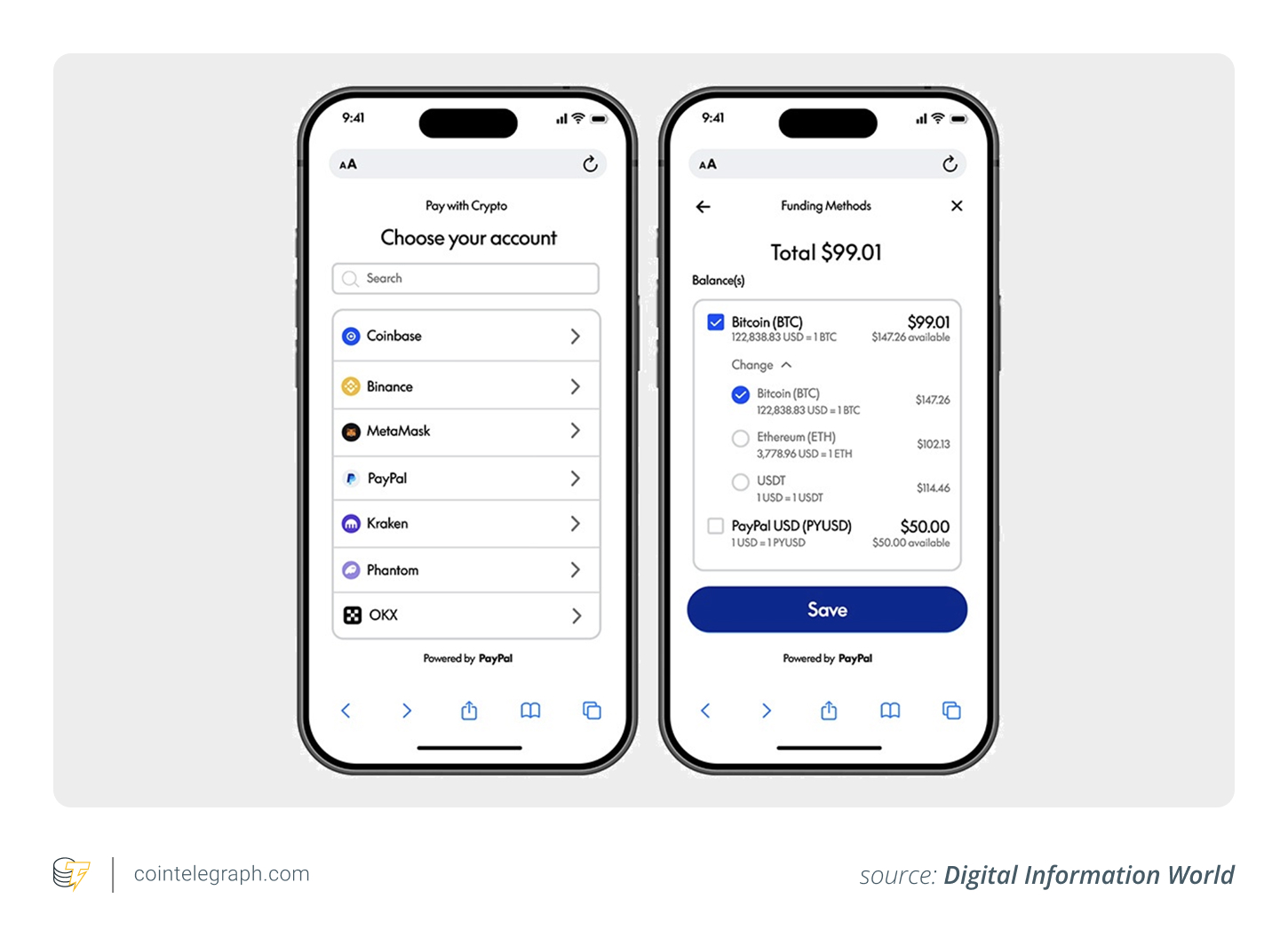

This PayPal crypto settlement instrument can be designed to be wallet-agnostic. Buyers can use Coinbase Pockets, MetaMask, Binance, Kraken, Phantom, Exodus and others with out requiring pre-transfer funds into PayPal.

General, the method is streamlined: join an exterior pockets at checkout and pay instantly.

The corporate has eliminated legacy boundaries by embedding crypto funds instantly into PayPal’s pockets. US retailers can now settle for cross-border funds with immediate settlement and stable-value payouts. This method additionally helps broaden PayPal’s world attain.

General, it’s a serious step in PayPal enabling crypto for retailers at scale.

Do you know? PayPal’s inaugural company cost utilizing PYUSD occurred on Sept. 23, 2024, to Ernst & Younger by way of SAP’s digital platform.

Over 650 million crypto customers to pay with crypto on PayPal?

PayPal crypto funds in 2025 are shaping as much as be a robust driver of mainstream crypto adoption.

With the launch of Pay with Crypto, PayPal is unlocking entry to a $3-trillion crypto financial system and a possible viewers of 650 million crypto customers (a large leap from its present 426 million account holders).

This manner, PayPal is increasing its footprint from fiat-native customers to crypto-native spenders by overlaying stablecoin-enabled transactions onto its present infrastructure. This consists of seamless help for PayPal stablecoin integration and deeper use of PayPal’s blockchain infrastructure to shut the hole between digital property and real-world commerce.

In impact, PayPal turns into an inclusive digital commerce supplier — one which serves each conventional customers and the rising inhabitants of Web3 pockets holders.

PayPal permits crypto for retailers (and why it issues)

Retailers profit from Pay with Crypto: They save on charges, get pleasure from near-instant settlement, earn stablecoin yield and entry world markets.

Decrease transaction charges

The present promotional charge of 0.99% for PayPal crypto transactions (legitimate by mid-2026) is considerably decrease than the standard 1.5%-3.5% card processing charges.

Even with a later improve to round 1.5%, it stays aggressive, particularly for cross-border sellers utilizing crypto with PayPal.

Close to-instant settlement

Funds are settled in fiat or PYUSD nearly instantly — no want to attend one to a few enterprise days. This PayPal blockchain settlement function removes volatility for sellers whereas bettering money movement.

Stablecoin rewards

Retailers who select to carry proceeds in PYUSD stablecoin on PayPal can reportedly earn round 4% APY, turning balances into income-generating property.

International attain for SMEs

For small companies, significantly these working internationally, the mix of quick settlement and decrease charges means simpler entry to world demand. PayPal’s crypto service provider instruments are tailored for small and medium-sized enterprises (SMEs) priced out of conventional cross-border finance.

Do you know? As of mid-2025, PayPal supported over 15.4 million lively enterprise accounts globally, thus providing a broad alternative for crypto acceptance by way of Pay with Crypto.

Cross-border crypto funds from PayPal; Shopper implications

From a purchaser’s perspective, paying with crypto on PayPal is now as simple as utilizing a card.

At checkout, customers can choose “Pay with Crypto” alongside their common choices. After connecting a pockets (MetaMask, Binance, Coinbase Pockets or Phantom), they’ll pay with crypto cash reminiscent of BTC, ETH or stablecoins.

The crypto-to-fiat conversion on PayPal occurs immediately. The service provider receives a steady payout, whereas the client enjoys a frictionless, crypto-native cost expertise with out having to manually swap property or cope with volatility.

This function transforms digital property into usable forex, enabling real-world utility past speculative buying and selling. It’s particularly impactful for customers preferring non-custodial wallets and wish to pay instantly with crypto, with out touching centralized exchanges.

PayPal’s broader imaginative and prescient for crypto settlement

PayPal is laying the inspiration for crypto-enabled infrastructure on a worldwide scale.

Its upcoming PayPal World digital pockets alliance, set to launch in fall 2025, will join wallets throughout main cost ecosystems: UPI in India, Tenpay International in China, Mercado Pago in Latin America and Venmo within the US. The objective is to roll out seamless cross-border crypto funds by way of PayPal for practically 2 billion customers.

To help this, PayPal is increasing its partnership with Fiserv, working towards stablecoin interoperability by the combination of its PYUSD stablecoin and Fiserv’s FIUSD.

The result’s real-time, programmable funds throughout hundreds of banks and tens of millions of retailers with no added tech overhead. This PayPal-Fiserv stablecoin partnership may very well be central to creating PayPal blockchain settlement options accessible to the mainstream.

Dangers of PayPal’s stablecoin integration

Whereas PayPal permits crypto for retailers, rollout isn’t but common.

PYUSD continues to be pending approval from the New York State Division of Monetary Providers, which means New York residents can’t but use PayPal crypto funds involving the stablecoin.

There are additionally user-side dangers. Regardless of PayPal supporting 100 cryptocurrencies, neither PYUSD nor any crypto held in wallets is insured by the Federal Deposit Insurance coverage Company or the Securities Investor Safety Company. Which means customers could be uncovered to loss if wallets, custodians or blockchains fail — an necessary caveat for anybody exploring find out how to pay with crypto on PayPal.

Moreover, whereas the present PayPal crypto transaction charges sit at a gorgeous 0.99%, this promotional charge will finish in mid-2026. As soon as it rises to 1.5%, it is going to stay aggressive, however the lack of long-term pricing certainty might deter some retailers from counting on PayPal crypto settlement as their default.