Bitcoin has stormed again in 2025, hitting a brand new all-time excessive of over $124,000 in August after a turbulent begin to the 12 months. The rally is greater than a speculative rebound. It’s the manifestation of crypto’s long-promised integration into the worldwide monetary system.

However in contrast to earlier cycles, this rally isn’t lifting the complete market. Buyers at the moment are rewarding utility and the CoinDesk 20 Index is rising because the benchmark for separating sign from noise.

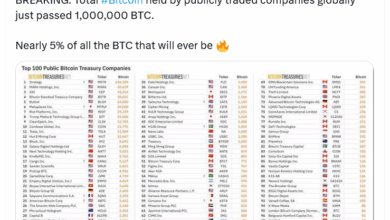

Establishments are all-in

Bodily bitcoin change traded merchandise (ETPs) pulled in practically $38 billion over the previous 12 months, pushing international AUM past $165 billion. Hedge funds are exploiting foundation trades, corporates are stockpiling bitcoin and the U.S. has gone so far as making a strategic bitcoin reserve.

On the similar time, liquidity and infrastructure have remodeled. Per Glassnode, CME-listed futures now cowl bitcoin, ether, SOL and XRP, whereas bitcoin choices open curiosity has topped $50 billion. Bitcoin has by no means appeared extra institutional.

Macro tailwind

Trump’s second-term tax cuts and a U.S. debt pile north of $34 trillion have buyers bracing for greenback debasement. International reserve managers are hedging with gold and alternate options. Bitcoin’s shortage and neutrality make it the apparent complement.

Our mannequin locations bitcoin at $250,000 by 2030 underneath base-case financial growth assumptions.. If fiscal coverage turns extra reckless, that upside may speed up.

Altcoins face a actuality test

Crucially, this bull cycle is not a few rising tide lifting all boats. Buyers are rewarding protocols that ship real-world affect. Solana has developed into the main consumer-grade blockchain. Ethereum has fashioned because the institutional spine of on-chain finance. XRP, armed with authorized readability, is cementing itself as a low-cost, high-speed settlement layer for cross-border finance.

The market is lastly demanding fundamentals, and initiatives with out substance are fading into irrelevance.

CoinDesk 20: investible core

For establishments, the problem is allocating with out getting misplaced in noise. The CoinDesk 20 Index is quick changing into the selector’s benchmark. Protecting practically 85% of the investible market cap, it excludes memecoins and illiquid small caps, focusing as an alternative on the property that matter.

In some ways, it’s crypto’s S&P 500: curated, liquid and institutionally scalable. For allocators seeking to enter the market with conviction however with out chaos, the CoinDesk 20 is the good first step.

Backside line

Crypto’s actual financial system second has arrived. Bitcoin anchors the macro hedge, however the future is a broader, extra useful market the place utility drives worth.

For a deeper dive, see WisdomTree’s autumn market outlook.