The marketplace for tokenized equities might increase to just about $190 trillion throughout the subsequent 20 years, in response to new projections from Galaxy Analysis.

Galaxy made this projection after it grew to become one of many first public corporations to tokenize its inventory on the Solana blockchain by way of Superstate, which makes a speciality of compliant tokenization infrastructure.

Talking on the transfer, Alex Thorn, Galaxy’s Head of Analysis, stated:

“Onchain GLXY is actual Galaxy Class A Frequent Inventory. Should you maintain the token, you personal widespread fairness in galaxy, the identical as for those who purchased our inventory by in your conventional brokerage account. no publicly traded firm has ever performed this earlier than within the US.”

As of press time, 32,374 Galaxy Class A shares had been issued on Solana, held by 21 token holders, in response to Dune Analytics information.

Based on the agency, this transfer illustrates its conviction that tokenization is viable and a possible blueprint for the way listed corporations could improve market accessibility.

‘Uniswap second’

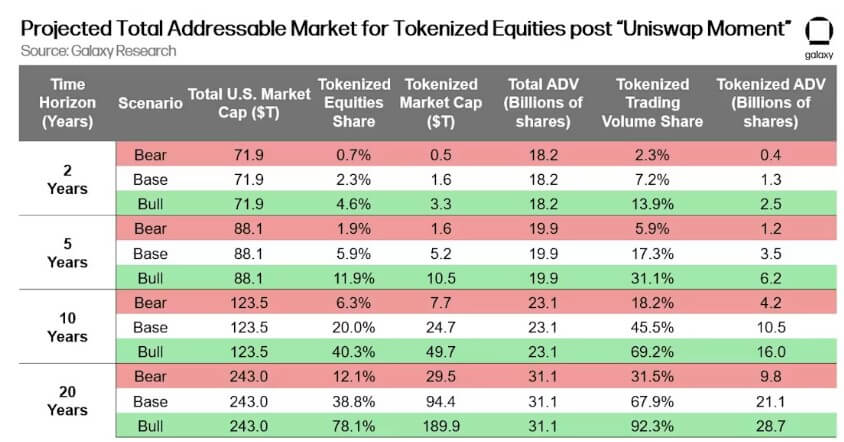

Contemplating this, the agency modeled bear, base, and bull situations as an instance how blockchain adoption could reshape monetary markets as soon as decentralized buying and selling achieves vital mass.

Galaxy describes the tipping level as a “Uniswap second,” when on-chain buying and selling is extensively thought to be fairer, quicker, cheaper, and safer than legacy constructions. At that stage, conventional centralized exchanges would step by step lose market share to blockchain-based platforms.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

In its near-term outlook, Galaxy expects tokenized equities to signify between 0.7% and 4.6% of US market capitalization throughout the first two years of adoption—equal to $0.5 trillion to $3.3 trillion.

Beneath a bullish 10-year state of affairs, tokenized shares might seize 40% of the market, value nearly $50 trillion.

In the meantime, the forecasts diverge additional over twenty years. A bear case sees tokenization reaching 12% of the US fairness market, or $29.5 trillion, whereas the bull case envisions as a lot as 78% penetration or an estimated $189.9 trillion.

Curiously, the agency stated buying and selling actions might observe an analogous trajectory.

In probably the most optimistic state of affairs, Galaxy tasks that tokenized equities could account for 93% of all US fairness buying and selling quantity, essentially altering liquidity, settlement instances, and investor entry.