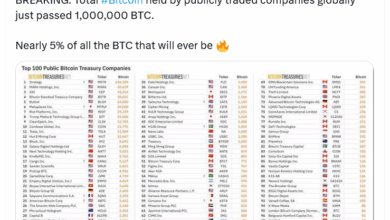

U.S. Financial institution stated it restarted cryptocurrency custody choices for institutional funding managers, broadening the service to incorporate bitcoin exchange-traded funds (ETFs).

This system, first rolled out in 2021 and placed on maintain in 2022, is accessible on an early entry foundation by U.S. Financial institution’s International Fund Providers division, the financial institution stated Wednesday.

Custody operations can be supported by NYDIG, which is appearing because the financial institution’s sub-custodian for bitcoin.

Stephen Philipson, vice chair of U.S. Financial institution Wealth, Company, Industrial and Institutional Banking, stated the transfer was prompted by renewed regulatory readability.

“We’re proud that we have been one of many first banks to supply cryptocurrency custody for fund and institutional custody purchasers again in 2021, and we’re excited to renew the service this 12 months,” he stated within the launch.

NYDIG CEO Tejas Shah framed the partnership as a option to deliver institutional-grade safeguards to bitcoin entry. “Collectively, we will bridge the hole between conventional finance and the fashionable economic system,” he stated.

U.S. Financial institution had over $11.7 trillion in belongings beneath custody and administration as of June 30. Its providers span ETFs, fund custody, fund administration, company belief and wealth administration.