One thing uncommon is constructing in $9.81 billion of Bitcoin futures flows and it might break both means

Bitcoin’s derivatives market entered September with a cut up message: merchants are taking up extra positions, however the steadiness of buying and selling exercise is leaning in opposition to worth energy.

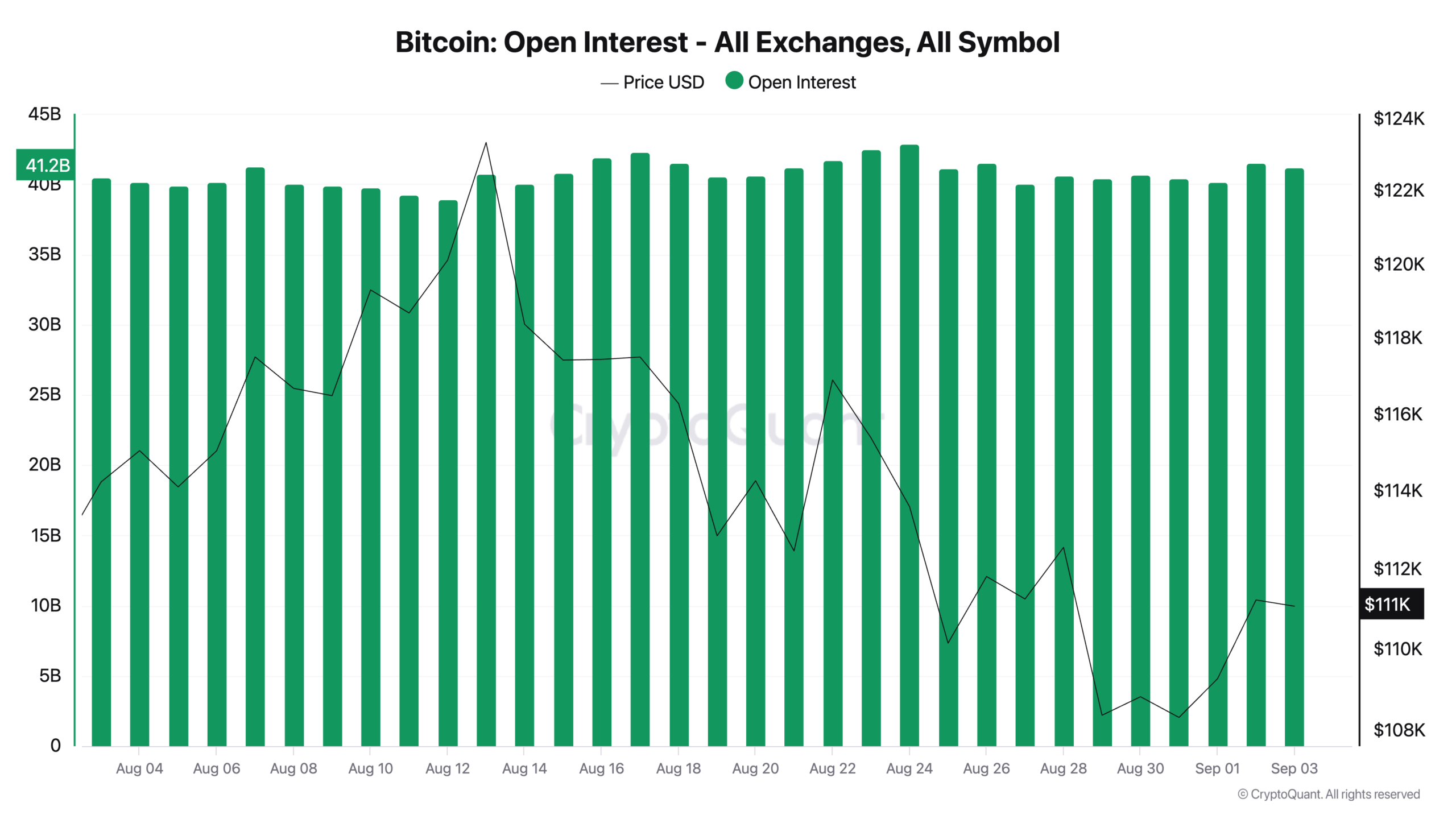

Open curiosity climbed to $41.19 billion on September 3, a rise of $1.02 billion over the previous month. On the similar time, Bitcoin’s spot worth slipped under $110,000.

This reveals that whereas extra leverage is in play, conviction out there has not been robust sufficient to push the value larger.

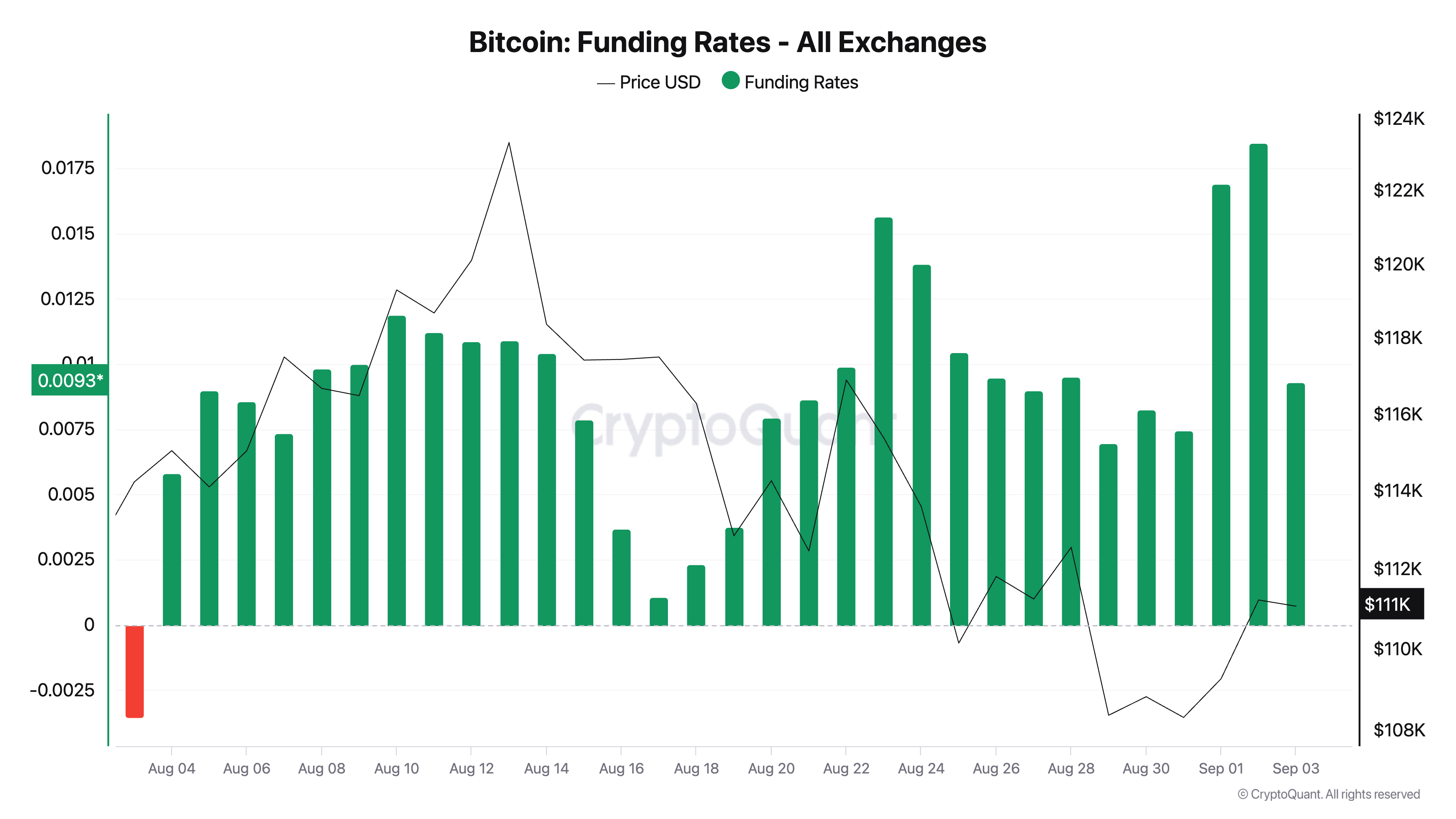

Funding charges additional verify this. In perpetual futures markets, merchants who’re lengthy pay a funding payment to those that are brief when demand for leverage tilts upward. On September 3, the every day funding price was 1.73%, with the seven-day common at 1.21% and the thirty-day common at 0.96%.

Funding was optimistic each single day for the previous month, which suggests longs have been persistently paying to take care of publicity. This creates a expensive setting for merchants betting on upside, particularly when costs aren’t transferring of their favor.

Paying larger carry prices with out worth positive aspects normally forces fast-moving accounts to scale back danger except one thing shifts the steadiness.

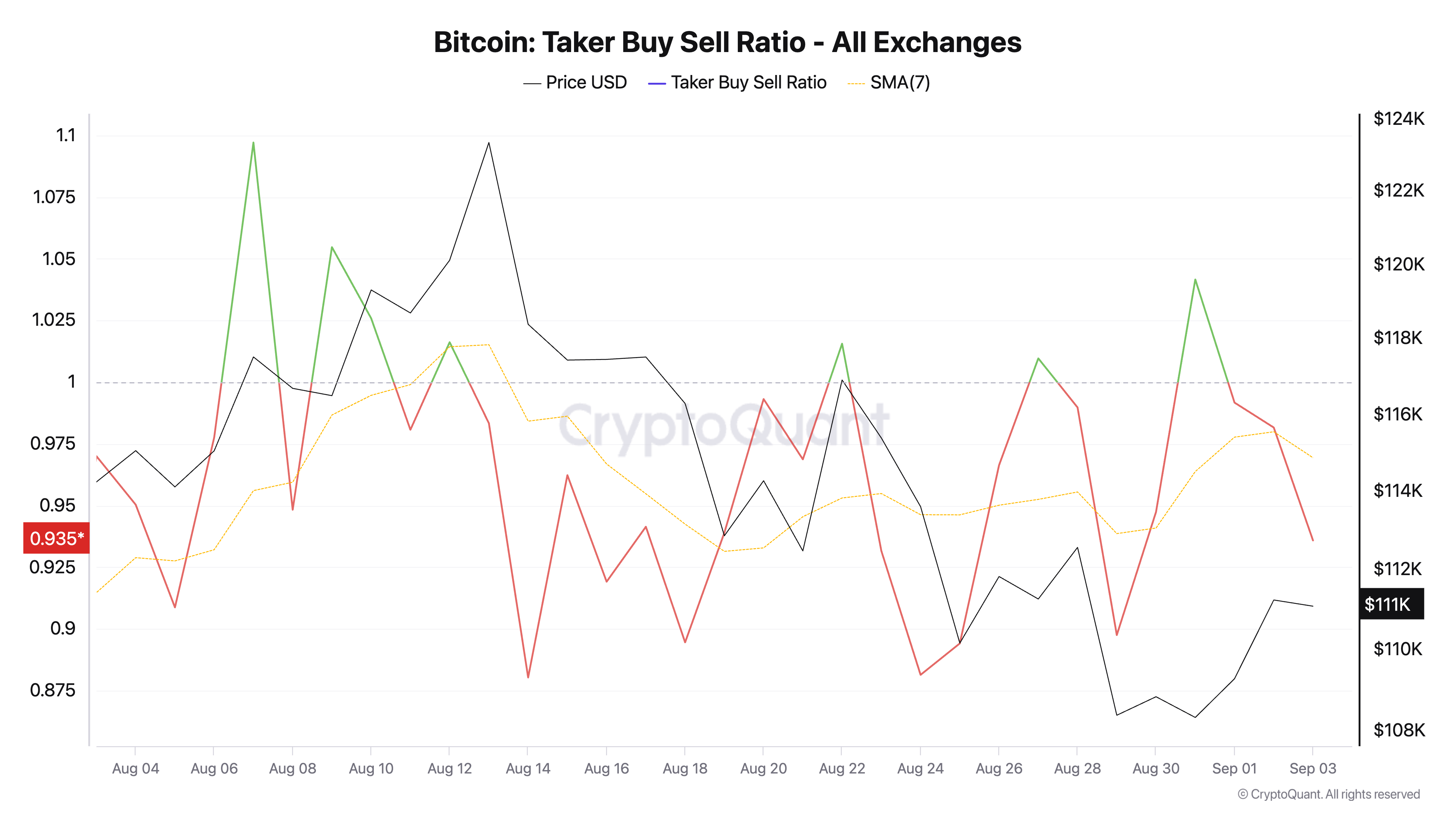

Buying and selling exercise itself explains why the value has been heavy. A helpful gauge is the taker purchase/promote ratio, which compares the amount of market orders shopping for contracts versus promoting them. When the ratio is under one, it means extra merchants are hitting the promote button aggressively.

On September 3, the ratio was 0.913, very near the 30-day common of 0.965.

Internet move from these market orders was firmly adverse: −$9.81 billion throughout the previous month, together with −$1.75 billion within the final week. In different phrases, the merchants who moved the value by crossing the unfold have been primarily promoting.

The significance of that is clear within the statistics: during the last 90 days, every day returns correlated strongly with web taker move (0.76) and the taker ratio (0.64). In distinction, open curiosity and funding confirmed virtually no hyperlink to every day returns.

Liquidation knowledge reveals us the place a lot of the losses come from. Previously 30 days, $17.68 billion in lengthy positions have been liquidated in comparison with $8.33 billion in shorts, which means 68% of liquidations fell on longs. The most important occasion got here on August 25, when $4.32 billion in longs have been worn out as Bitcoin fell 3.04% in someday.

The following session noticed a 1.52% rebound, a standard sample after main liquidations because the market stabilizes. One other wave hit on August 29 with $2.40 billion in lengthy liquidations throughout a 3.72% drop, adopted once more by a small rebound.

On the brief aspect, August 11 introduced a $1.61 billion wipe as Bitcoin gained, adopted by one other acquire the following day. The same transfer occurred on September 1, when $670 million in shorts have been liquidated into a virtually 1% every day enhance that prolonged one other 1.79% the next session.

These episodes present the imbalance in positioning. The market has been extra closely lengthy, so pullbacks set off massive long-side liquidations and fast rebounds. Brief wipes happen, however they’re smaller in scale and fewer frequent.

So long as aggressive buying and selling continues to return from the promote aspect, rallies can be exhausting to maintain.

The dimensions of buying and selling additionally places this into perspective. Within the final 30 days, gross taker move (the mixed worth of market purchase and promote orders) reached about $490.71 billion. In comparison with this, open curiosity of $41.19 billion equals simply 8.39% of latest buying and selling turnover.

That ratio reveals the present inventory of positions is small relative to latest move, which means positions might develop quickly if sentiment flips. However for now, the imbalance between who holds contracts and who trades most aggressively retains strain in the marketplace.

The image hasn’t modified a lot within the shorter time period both. Over the past week, Bitcoin fell 0.25%, open curiosity added 2.85%, and web taker move was adverse by $1.75 billion.

Funding prices climbed additional, hitting 1.73% on the final day. Collectively, these present extra contracts being opened, longs paying larger charges to maintain them, and merchants nonetheless hitting the promote aspect, a mix that holds the value down.

The execution knowledge (taker flows and liquidations) is what’s steering returns. Open curiosity and funding present how a lot leverage is within the system and the way costly it’s to carry, however they don’t drive the day-to-day strikes.

For that, the important thing sign is who’s crossing the unfold. A sustained interval the place the taker ratio rises above one, mixed with optimistic web taker move, could be the primary signal of a shift.

Till then, the market will stay vulnerable to long-side liquidations and reflexive rallies moderately than sturdy positive aspects.

The submit One thing uncommon is constructing in $9.81 billion of Bitcoin futures flows and it might break both means appeared first on CryptoSlate.