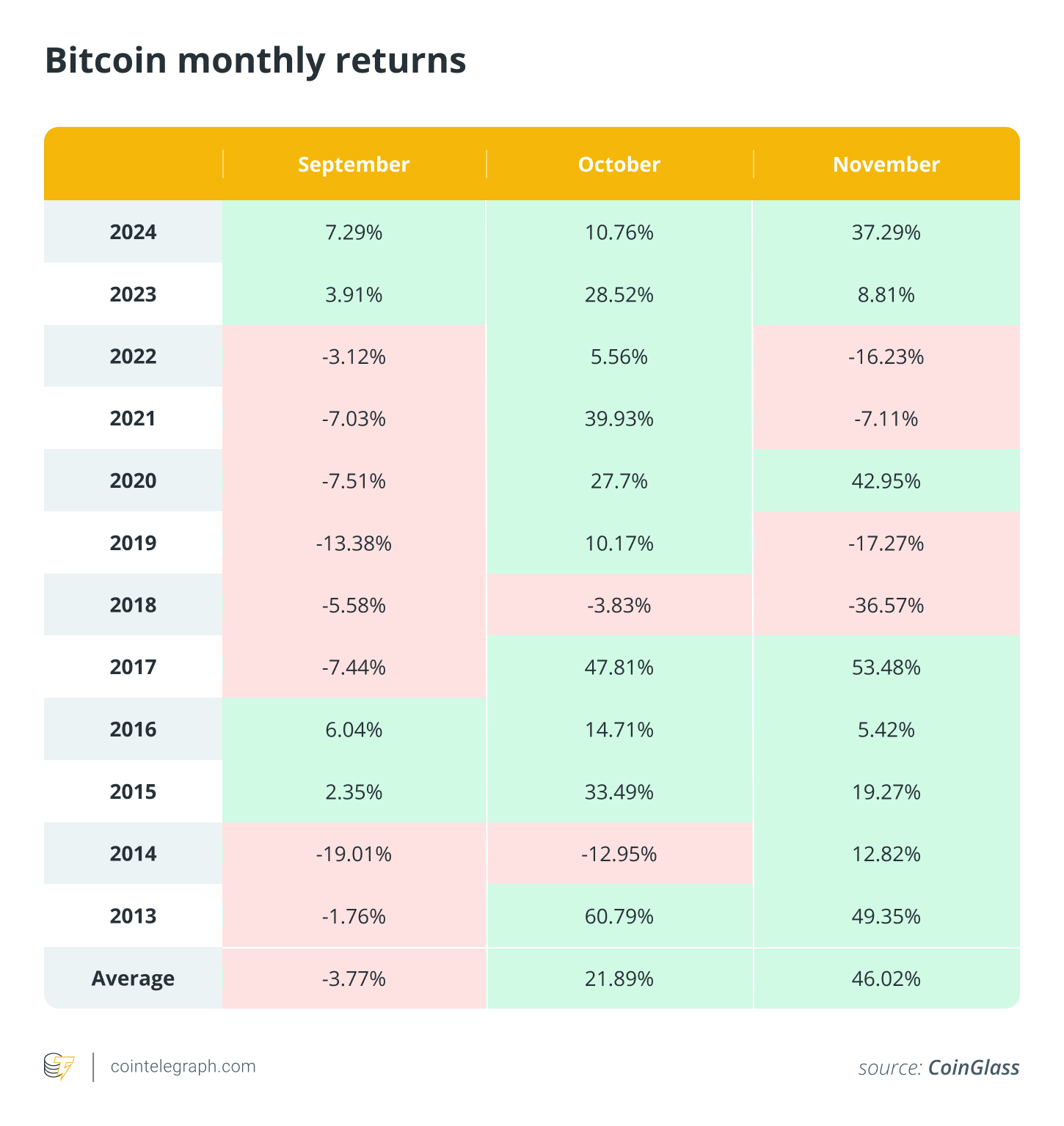

Bitcoin snapped a three-year streak of detrimental summer time common returns, but it surely now enters its worst month, generally known as “pink September.”

September carries the dreaded nickname as a result of it has delivered the bottom month-to-month returns for Bitcoin (BTC), averaging –3.77% throughout 12 years from 2013. Additionally it is the month China imposed a pair of main crypto bans in 2017 and 2021.

That file is weighed down by six consecutive years of losses from 2017 to 2022. The tables turned in 2023, and Bitcoin has now posted two straight September positive aspects, together with its greatest September ever in 2024, when it closed the month up 7.29%.

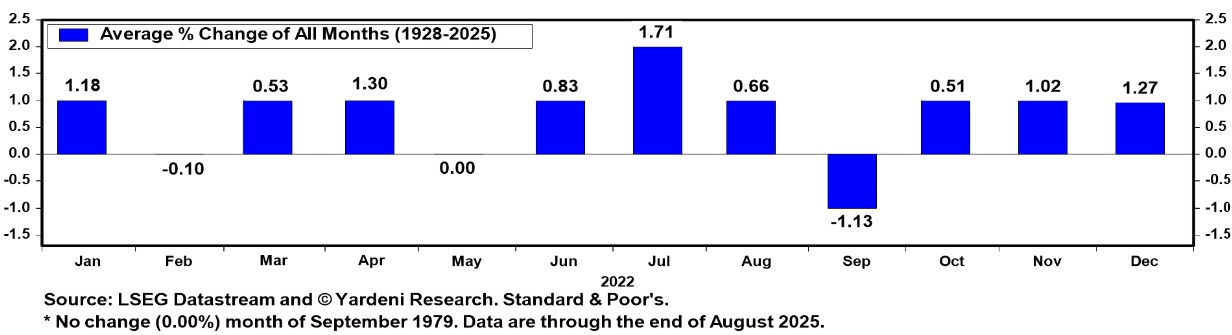

The fame comes from equities, the place September can be the weakest month for the S&P 500. It’s when traders return from summer time with a extra risk-off posture and funds rebalance heading into the fourth quarter.

The gloom typically doesn’t final. September’s losses have traditionally given approach to October, or “Uptober,” a month that has delivered positive aspects in six consecutive years and solely two losses in Bitcoin’s historical past, based on CoinGlass.

Crimson September’s regulatory drag on Bitcoin

In Bitcoin’s early years, its worth was scattered and never broadly tracked. The asset first breached $1,000 in 2013, drawing mainstream media consideration and prompting higher archival information. That very same 12 months noticed the launch of industry-native aggregator CoinMarketCap, adopted by CoinGecko in 2014.

Associated: June stays Bitcoin’s hazard zone, whereas S&P 500 eyes summer time rally

Between 2013 and 2016, Bitcoin’s September efficiency was evenly cut up, with two optimistic months and two detrimental ones. The sample broke in 2017 throughout the preliminary coin providing (ICO) increase, when Bitcoin crossed $1,000 for the second time and handed $2,000 for the primary. The speculative frenzy led China’s central financial institution to ban ICOs on Sept. 4, sparking the primary of six consecutive pink Septembers. South Korea adopted with its personal ICO ban on Sept. 29, whereas regulators elsewhere issued warnings.

The aftermath ushered in what grew to become generally known as the primary crypto winter, as numerous ICO tokens crashed. By September 2018, Bitcoin had dropped from its December 2017 all-time excessive close to $20,000 to beneath $7,000. A Sept. 5 media report claimed Goldman Sachs was abandoning its crypto desk plans. The financial institution later dismissed the story as “faux information.”

September 2019 added one other blow with the long-awaited launch of Bakkt’s Bitcoin futures. Regardless of excessive expectations for institutional inflows, buying and selling volumes have been weak, and the debut was branded a flop. Three days later, Bitcoin plunged from close to $10,000 to beneath $8,000. A Binance Analysis report revealed on Sept. 30, 2019, cited Bakkt’s “disappointing begin” as a contributing issue to Bitcoin’s worth decline.

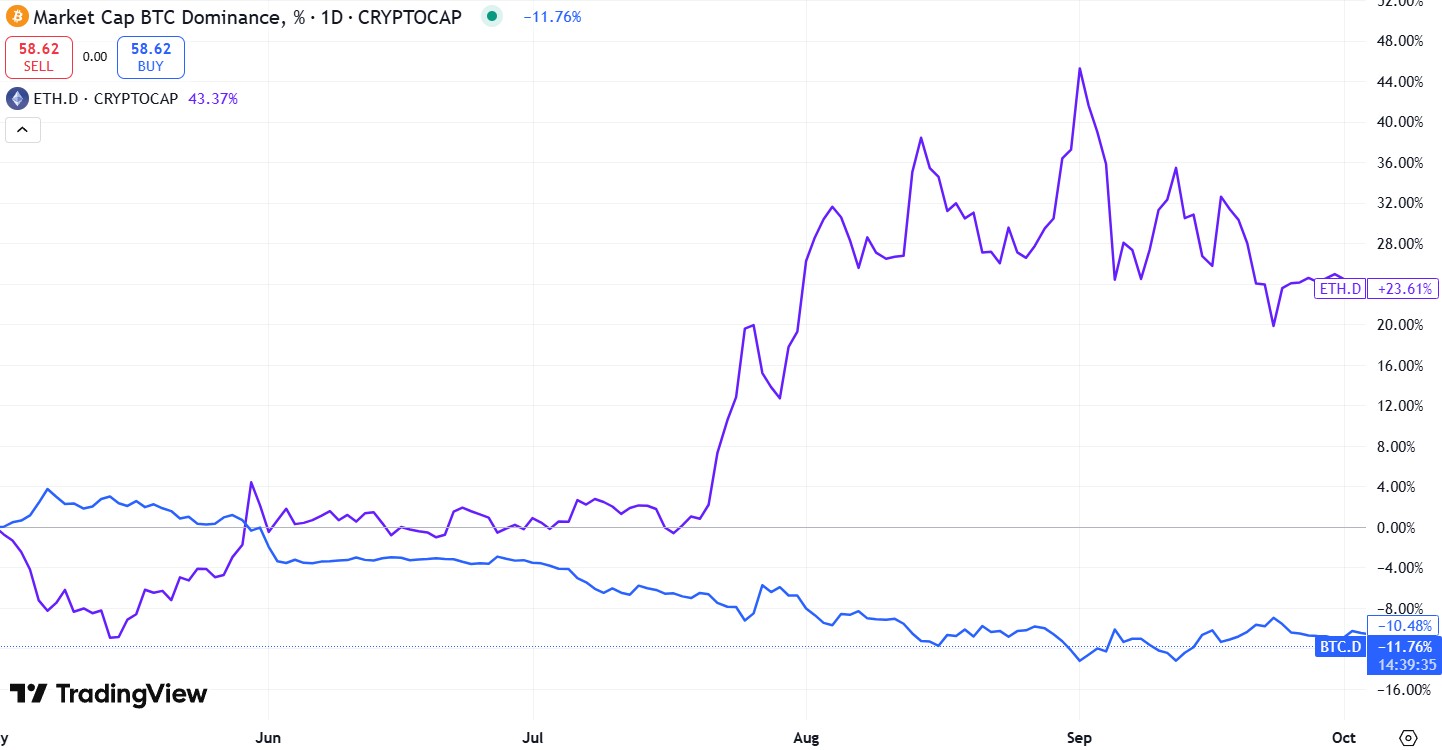

The subsequent three Septembers mirrored the pandemic period and its fallout. Whereas COVID-19 initially boosted Bitcoin’s narrative as an inflation hedge, September 2020 noticed capital rotate into Ether (ETH) throughout the “DeFi Summer season.”

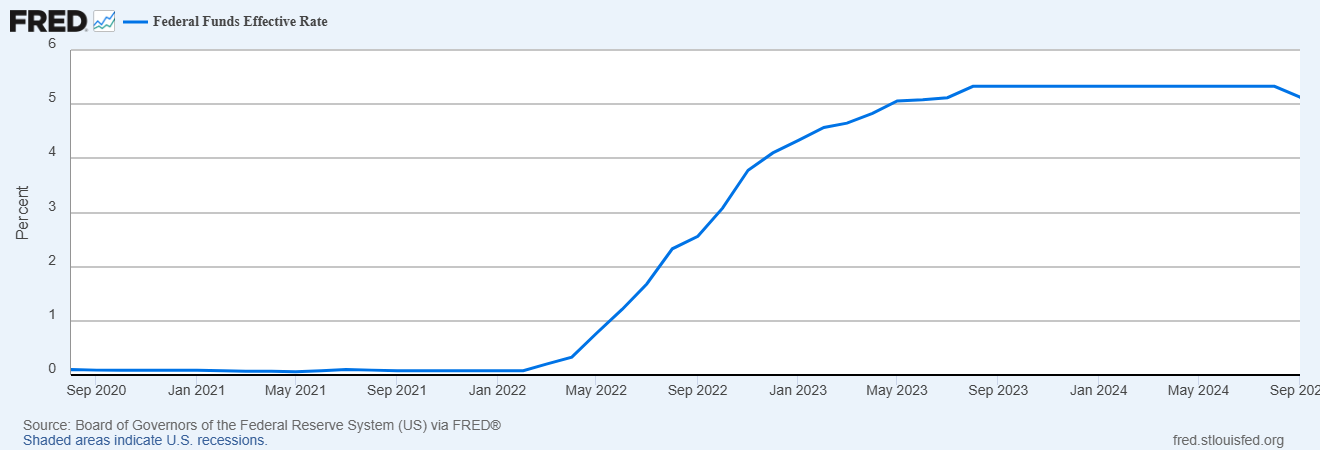

In September 2021, China struck once more with a ban on crypto mining and buying and selling. The subsequent 12 months, the Terra/LUNA collapse in Might left deep scars, and September’s 0.75 proportion level price hike — its fifth in a 12 months of seven hikes — added salt to Bitcoin’s damage.

Bitcoin’s “pink September” streak breaks

After six straight years of September losses, Bitcoin snapped the streak in 2023. A pivotal catalyst got here on Aug. 29 when a federal appeals courtroom dominated that the US Securities and Alternate Fee’s rejection of Grayscale’s bid to transform its Bitcoin belief right into a spot exchange-traded fund (ETF) was “arbitrary and capricious.”

The choice pressured regulators to revisit the applying and revived confidence {that a} US spot Bitcoin ETF was inevitable. The ruling carried momentum into September, serving to Bitcoin climb about 4% on the month. The US Federal Reserve additionally aided sentiment by holding charges regular after 11 hikes in 12 conferences ranging from March 2022.

Associated: Bitcoin treasury flops: These companies fumbled their BTC bets

Spot Bitcoin ETFs have been accepted and listed within the US in early 2024. By midyear, the monetary devices have been routinely posting billions of {dollars} in day by day buying and selling quantity. Macro circumstances added gas because the Fed delivered a price reduce on Sept. 18, 2024, which was the primary since March 2020.

Then got here the launch of World Liberty Monetary on Sept. 16, 2024, which was shortly woven into US election narratives. Framed as a Donald Trump-aligned crypto enterprise, it debuted whereas he was within the midst of what would grow to be a profitable presidential marketing campaign, signaling a political embrace of cryptocurrencies on the highest degree.

One other price reduce might assist Bitcoin break the “pink September” curse

Bitcoin is heading into September 2025 carrying the load of historical past. The month has lengthy been a stumbling block, marked by regulatory shocks and tightening cycles that scarred investor sentiment.

This 12 months, the backdrop seems to be stronger than in previous downcycles. Spot Bitcoin ETFs proceed to submit billions in turnover and have grow to be a gateway for institutional capital. All through 2025, struggling firms have turned to Bitcoin treasury methods in a bid to flip their misfortunes.

The crypto {industry} additionally brings recent hypothesis from August out of China, with rumors swirling that authorities might permit stablecoins pegged to the offshore yuan. To date, officers have made no affirmation.

Jerome Powell delivers dovish remarks in his remaining Jackson Gap speech. Supply: Related Press

Traders’ consideration is squarely on the US, the place the Fed seems to have pivoted. In late August, Fed Chair Jerome Powell delivered his remaining Jackson Gap speech earlier than his time period ends in Might 2026. The symposium is without doubt one of the most carefully watched occasions in international economics, as it’s typically utilized by Fed chairs to trace at coverage route.

In 2022, Powell warned of “ache” for households and companies because the Fed pressed on with aggressive price hikes. This 12 months, he struck a dovish tone, saying that “shifting stability of dangers” could warrant adjusting the Fed’s coverage stance.

One other discount is broadly anticipated on the Federal Open Market Committee assembly scheduled for Sept. 16-17.

Journal: Bitcoin to see ‘yet another large thrust’ to $150K, ETH stress builds: Commerce Secrets and techniques