Key takeaways:

-

Bitcoin thrives when yields rise on debt and inflation fears, however struggles when central banks tighten aggressively.

-

Immediately’s bond market stress seems inflation- and debt-driven, suggesting BTC may observe gold’s file run with higher-beta beneficial properties.

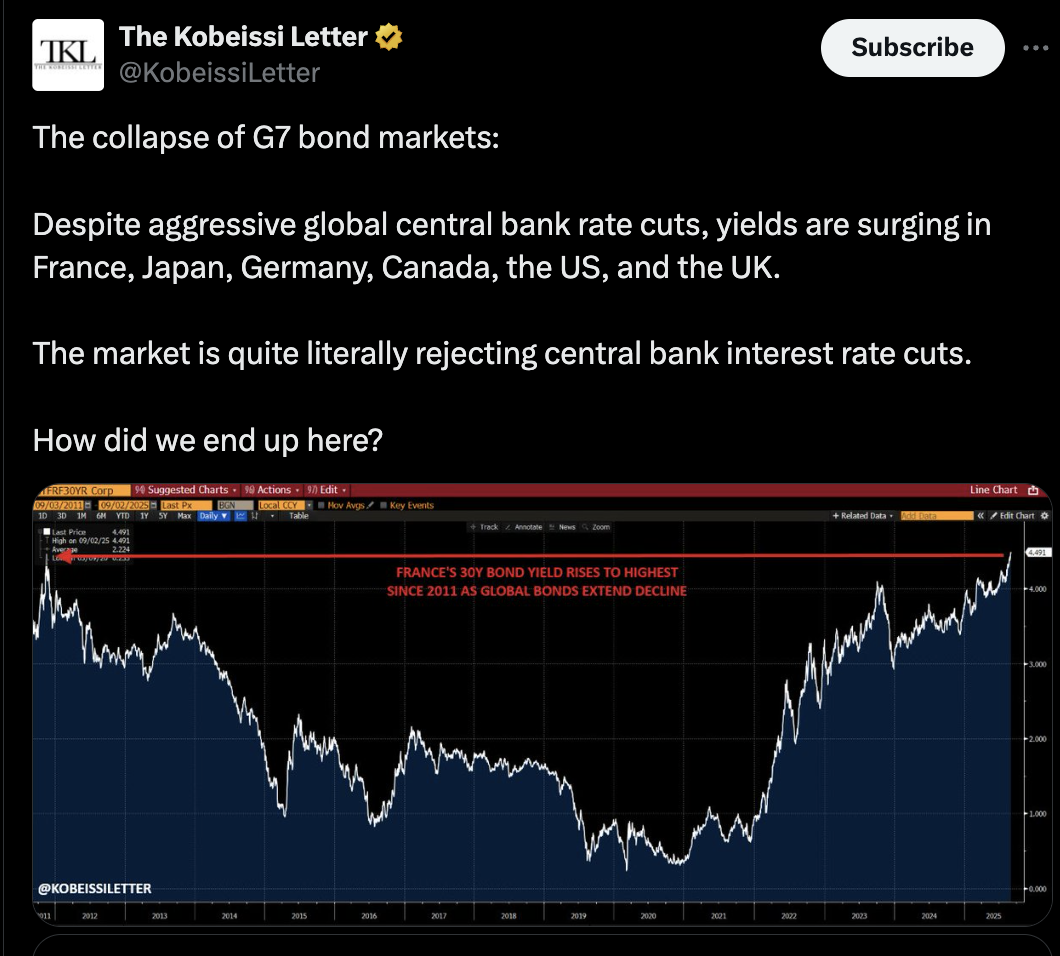

Lengthy-term authorities bond yields are ripping throughout the US, Europe, Japan and the UK, at the same time as central banks slash coverage charges.

The 30-year US Treasury is again close to 5%, France’s lengthy bond trades above 4% for the primary time since 2011, and UK gilts are testing 27-year highs. Japan’s 30-year yield has reached file ranges, prompting analysts to name it the “collapse of world G7 bond markets.”

However what occurs to Bitcoin amid this regarding macroeconomic outlook? Let’s study.

How Bitcoin reacted throughout previous yield spikes

Historical past reveals that Bitcoin’s response to rising authorities bond yields relies on why yields are climbing. Typically it rallies like “digital gold,” different occasions it struggles like a danger asset.

Take the 2013 taper tantrum.

When the Federal Reserve hinted it will gradual its money-printing program, the US 10-year yield shot towards 3%. Buyers grew anxious about inflation and debt, a sentiment that aligned with Bitcoin’s worth explosion from below $100 to over $1,000.

An analogous story performed out in early 2021.

Yields climbed as markets priced in larger inflation through the post-COVID restoration. Bitcoin moved in keeping with gold, surging to round $65,000 by April.

Nevertheless, in 2018, the result was the other.

Yields rose above 3% not due to inflation or debt fears, however as a result of the Fed was mountaineering aggressively. Actual returns on bonds regarded engaging, and Bitcoin plunged by about 85% throughout the identical interval.

It reveals that Bitcoin behaves like a hedging asset with extra upside when yields rise attributable to inflation, deficits or extra debt provide. Bitcoin normally struggles when yields rise as a result of central banks are tightening into progress.

Are rising bond yields bullish for Bitcoin this time?

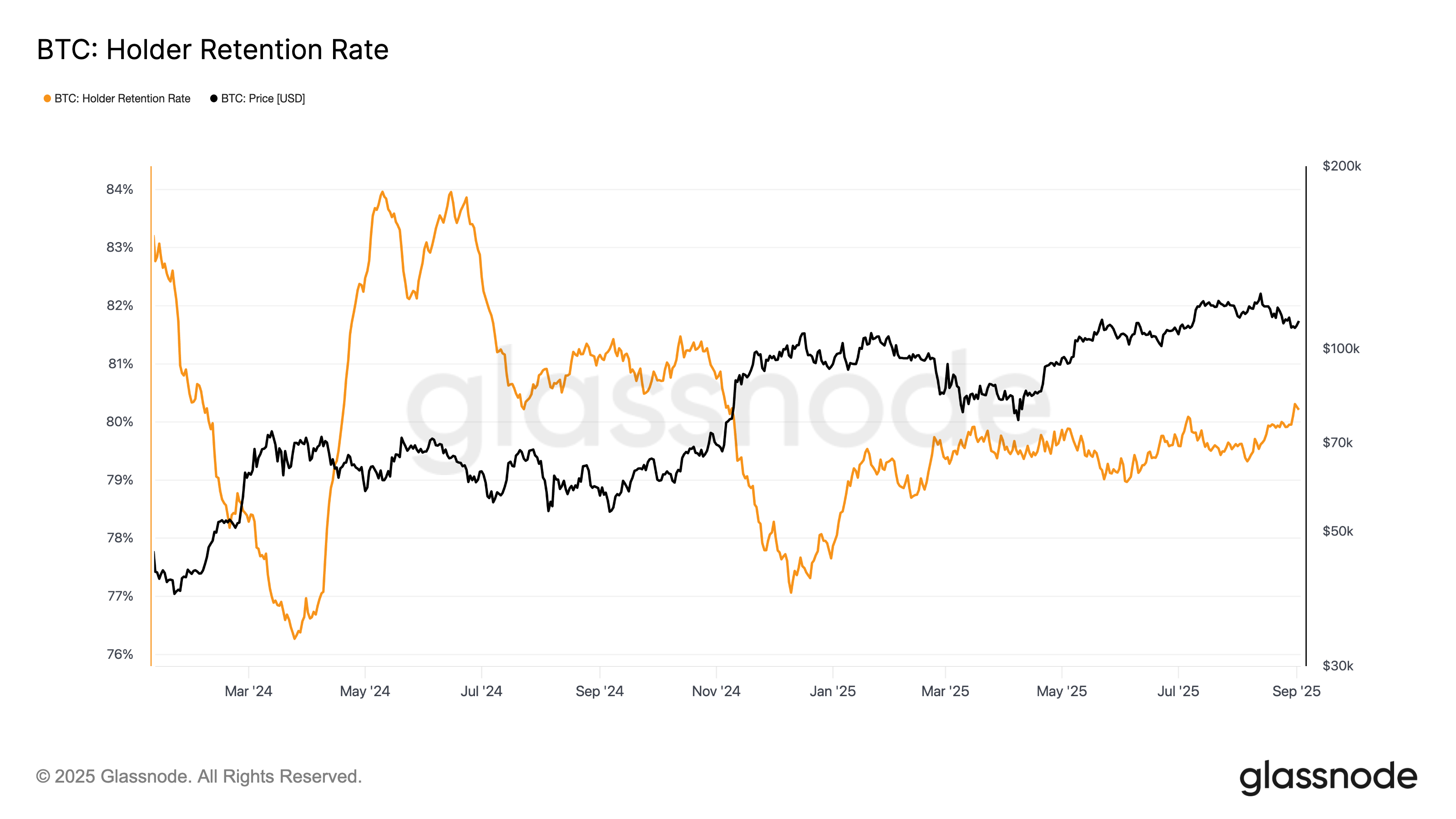

Bitcoin has risen by 4.2% up to now three days, transferring in lockstep with a surge in long-term Treasury debt within the US and different G7 nations.

On the similar time, its holder retention price is climbing, displaying that extra merchants are selecting to carry onto BTC as a hedge as an alternative of promoting.

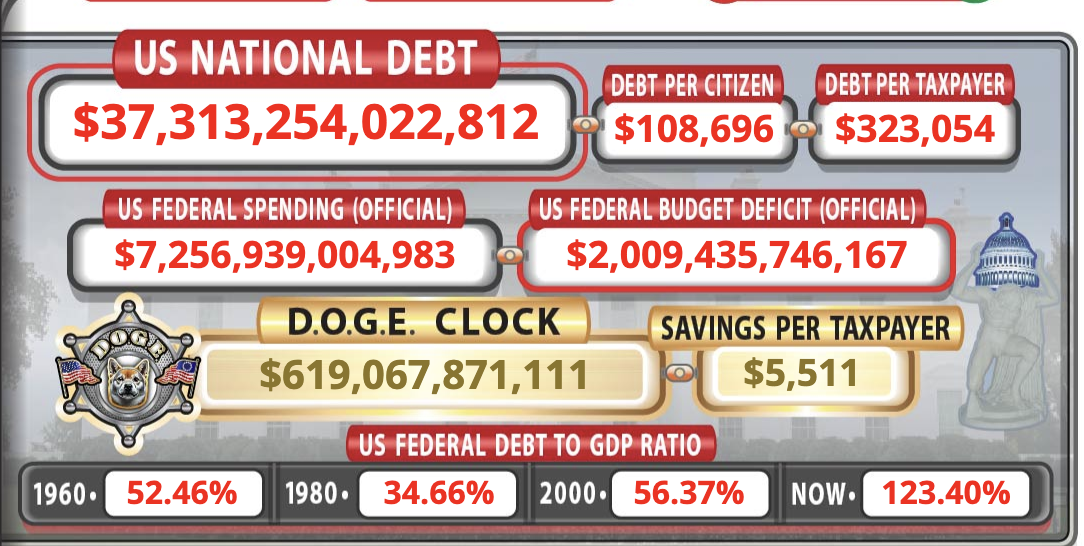

The backdrop is tough to disregard. US authorities debt jumped from $36.2 trillion in July to $37.3 trillion by September, up by over $1 trillion in simply two months.

Throughout the Atlantic, Europe and the UK are going through related borrowing waves.

The end result has been record-sized bond auctions that solely clear at larger yields. It is a signal that demand for presidency bonds is weakening. UK’s 30-year bond yield, for example, reached its highest stage since 1998 on Wednesday.

Gold has already confirmed the shift in investor conduct, away from trusting authorities bonds and towards arduous property.

The steel’s surge to file highs above $3,500 this week reveals that markets are actively hedging towards runaway debt and inflation.

Traditionally, Bitcoin advantages from such capital rotations slightly later than gold. However as soon as it does, it strikes quicker and additional than the valuable steel, performing because the higher-beta refuge from financial and financial extra.

Associated: Winklevoss, Nakamoto-backed Treasury launches with 1,000 BTC

“The central banks are dropping management of the lengthy finish of the curve,” famous Mark Moss, chief of Bitcoin Strategist at UK-based DeFi agency Satsuma Know-how, including:

“Seems like YCC (yield curve management) coming to a bond market close to you quickly. Going lengthy Bitcoin is such an apparent transfer.”

Many analysts see Bitcoin reaching a file excessive of $150,000-200,000 by 2026.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.