Regulatory momentum in Washington and crypto exchange-traded funds have pushed the US up two spots into second place for crypto adoption, in response to Chainalysis.

The US trailed solely India, which maintained the highest spot for the third yr in a row, and contributed to the Asia Pacific area being topped the fastest-growing between July 2024 and June 2025, Chainalysis mentioned in its 2025 International Adoption Index printed on Wednesday.

Chainalysis chief economist Kim Grauer advised Cointelegraph that crypto adoption is generally accelerating in mature markets with clearer guidelines and institutional rails, and in rising markets the place stablecoins are reworking how folks handle cash.

“The largest driver of this adoption is utility: whether or not it’s stablecoins used for remittances, financial savings in inflation-prone economies, or decentralized apps assembly native wants, folks undertake crypto when it solves actual issues.”

Pakistan was one of many largest movers, climbing six spots to 3rd place, whereas Vietnam and Brazil rounded out the highest 5.

Nigeria dropped from second to sixth place regardless of making some regulatory progress over the previous yr, whereas Indonesia, Ukraine, the Philippines and Russia stuffed out the highest 10.

The general rankings factored in 4 subindexes, which assessed the crypto worth obtained from retail and establishments by centralized and decentralized providers.

US rises to second on ETF adoption, clearer guidelines

The US rose from fourth in Chainalysis’ final report back to second place, sparked by elevated spot Bitcoin (BTC) ETF adoption and clearer rules that legitimized crypto’s position in conventional finance.

“Regulatory readability is especially vital for giant corporates and conventional monetary establishments, for whom compliance, authorized and reputational issues are inclined to rank extremely,” Grauer mentioned.

Farside Traders knowledge reveals that the US spot Bitcoin ETFs have taken in $54.5 billion value of inflows since launching final January, with the overwhelming majority of these flows coming between final June and this previous July.

Funding advisers and hedge funds additionally began aggressively accumulating spot Ether (ETH) ETFs within the second quarter, shopping for $1.3 billion and $687 million, respectively, Bloomberg reported late final month.

India’s lead pushes APAC to fastest-growing area

Regardless of regulatory setbacks in recent times, India ranked first in all 4 subindexes, fueled partly by its tech-savvy inhabitants and its massive diaspora that makes India a sizzling spot for crypto remittance funds.

“Grassroots crypto adoption will are inclined to comply with the place these real-world wants exist and are urgent, even the place regulatory situations will not be facilitative,” Grauer mentioned.

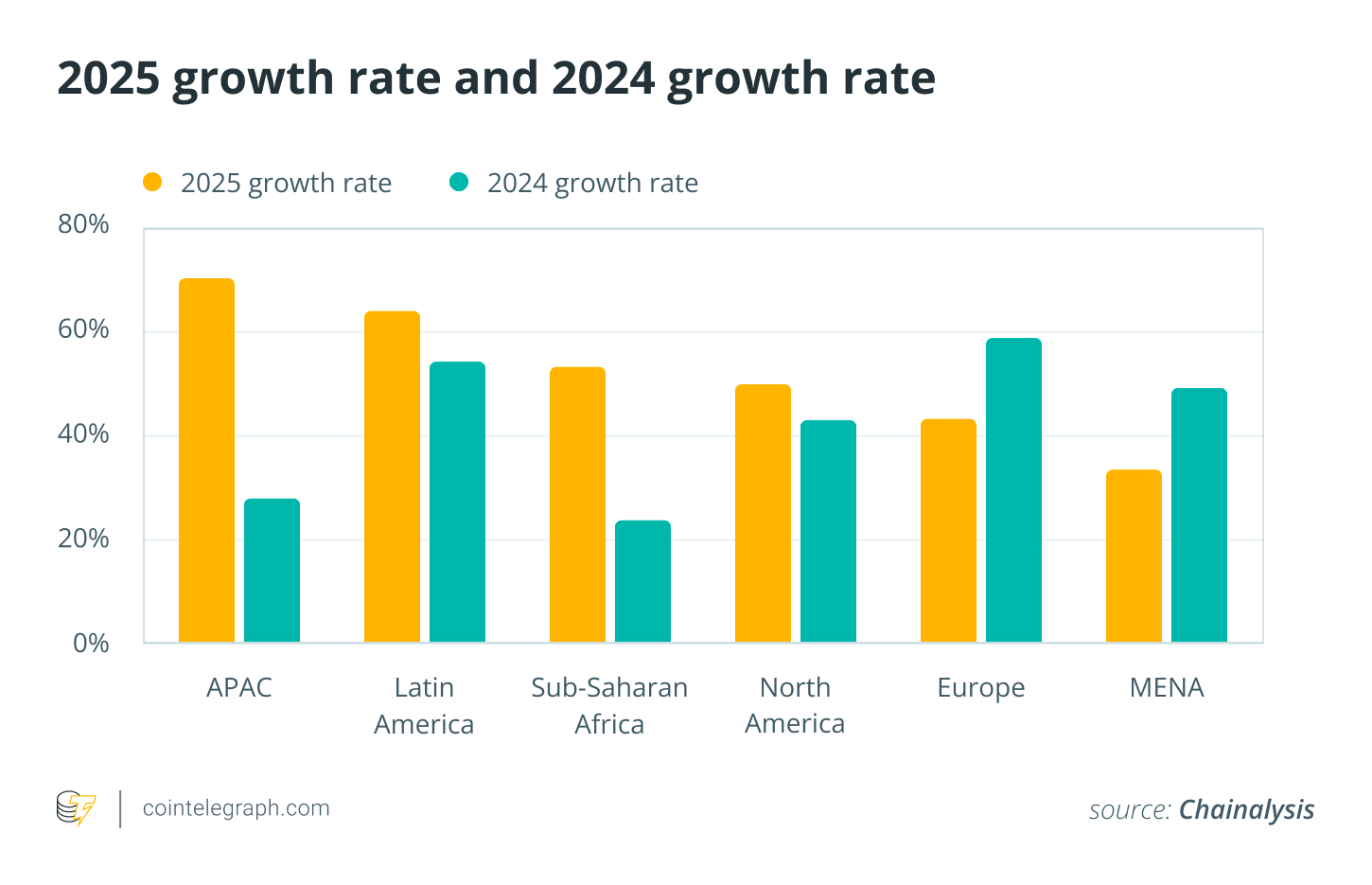

The Asia-Pacific area noticed the best year-on-year progress, with whole worth obtained up 69% to $2.36 trillion, led by India, Pakistan and Vietnam, whereas the Philippines, South Korea and Thailand additionally featured within the prime 20.

Progress in Latin America elevated 10%, “reinforcing the area’s trajectory as one in all crypto’s fastest-growing hubs,” Chainalysis mentioned within the report, which noticed Brazil and Argentina characteristic within the prime 20.

Japanese Europe leads per-capita crypto adoption

The Chainalysis rankings paint a distinct image when assessing adoption on a per-capita foundation, with Japanese European international locations Ukraine, Moldova and Georgia topping the record.

Associated: Tether USDT stablecoin seen on Bolivian retailer worth tags

Different international locations within the area that featured within the prime 20 included Latvia, Montenegro, Slovenia, Estonia and Belarus.

Chainalysis mentioned a mixture of financial uncertainty, a scarcity of belief within the banking system and powerful technical literacy throughout the area seemingly contributed to the sturdy adoption on a per-capita foundation.

“These elements make crypto an interesting various for each wealth preservation and cross-border transactions, particularly in international locations dealing with inflation, struggle, or banking restrictions.”

Bitcoin continues to be king, knowledge suggests

Bitcoin stays the dominant entry level into crypto, accounting for greater than $4.6 trillion in fiat inflows, the Chainalysis findings confirmed.

The following class was layer 1 tokens, excluding Bitcoin and Ether, which additionally topped $4 trillion, whereas stablecoins have been a distant third at simply wanting $1 trillion.

Memecoins noticed round 1 / 4 of a trillion {dollars} in inflows over the identical time-frame.

The US led with $4.2 trillion in on-ramp quantity, whereas South Korea got here in second at $1 trillion. Bitcoin’s share was notably sturdy within the UK and the EU, the place almost half of fiat purchases went into Bitcoin.

Journal: The one factor these 6 world crypto hubs all have in frequent…