Key takeaways:

XRP (XRP) worth printed a bull flag sample on the each day chart, a technical sample related to robust bullish momentum following an upward breakout. Is that this the beginning of XRP’s rally to $5?

XRP worth bull flag targets $5

The each day chart reveals XRP buying and selling inside a bull flag, with the worth dealing with resistance from the sample’s higher trendline at $3.

A bull flag is a bullish continuation sample in technical evaluation, forming a small falling rectangle after a pointy worth rise, signaling consolidation. It usually resolves with an upward breakout, persevering with the preliminary bullish pattern.

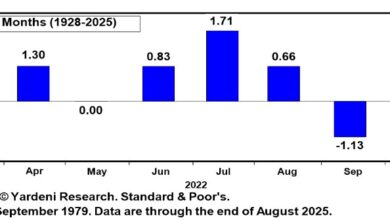

Associated: Is XRP going to crash in September?

A each day candlestick shut above $3 will affirm a bullish breakout for XRP, clearing the trail for an increase towards the sample’s goal at $5. Such a transfer would symbolize a 77% improve from the present worth.

Nevertheless, earlier than reaching this goal, bulls must overcome resistance from the 50-day easy transferring common (SMA) at $3.08, which has suppressed the worth since Aug. 24. Different obstacles sit at $3.40 and the multi-year excessive of $3.66 reached on July 18.

On the draw back, the realm to look at is between the 100-day SMA at $2.68 and the 200-day SMA at $2.48, which stay key assist zones for XRP worth. Bulls should maintain the worth above this degree to keep away from invalidating the bull flag setup.

“$XRP might be gearing up for its subsequent huge breakout towards $5,” mentioned analyst Crypto Pulse after recognizing the sample final week.

In keeping with the analyst, the worth was required to carry above the Aug. 3 low of $2.75 to maintain the bullish construction intact.

“Lose $2.75 and see potential retest of the $2.5–$2.6 confluence zone earlier than one other push greater, ” Crypto Pulse mentioned, including:

“General, XRP nonetheless seems to be bullish; the breakout affirmation is what I’m watching subsequent.”

As Cointelegraph reported, consumers are required to defend the essential assist round $2.73 to keep away from a deeper correction towards $2.

Spot XRP ETF approval attracts nearer

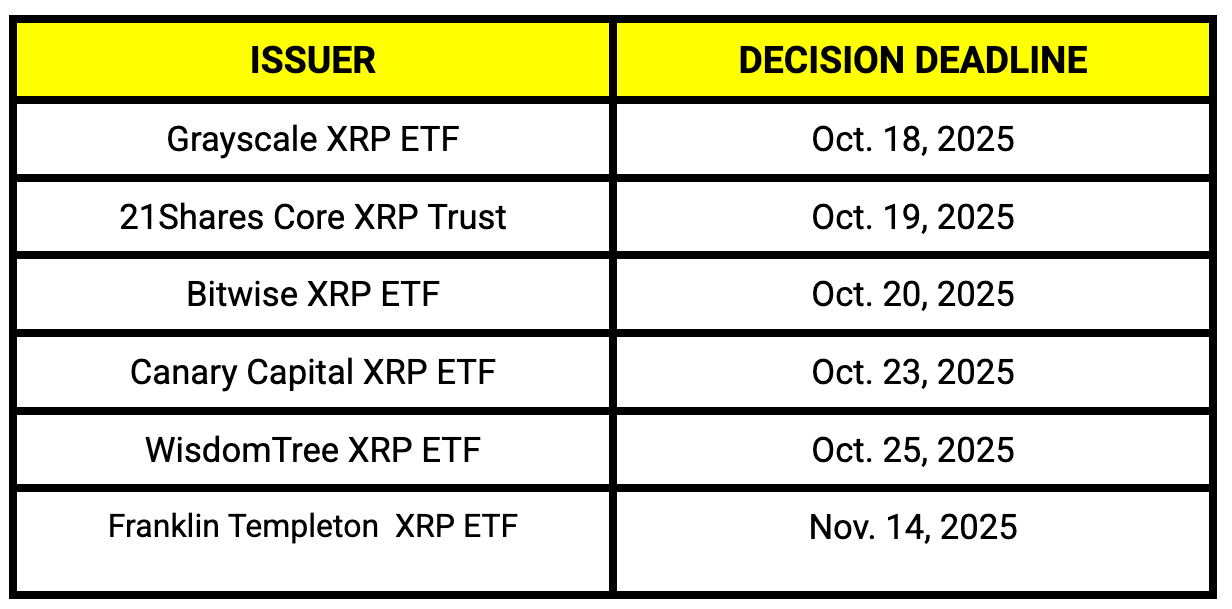

The US Securities and Change Fee is ready to determine on spot XRP exchange-traded fund (ETF) purposes in a few months, with key deadlines for many of the purposes falling between Oct. 18 and Oct. 25. The deadline for the choice on the Franklin Templeton XRP ETF is Nov. 14.

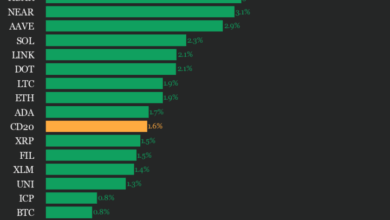

Roughly 11 proposals are beneath overview, following Ripple’s 2024 authorized victory clarifying XRP’s non-security standing.

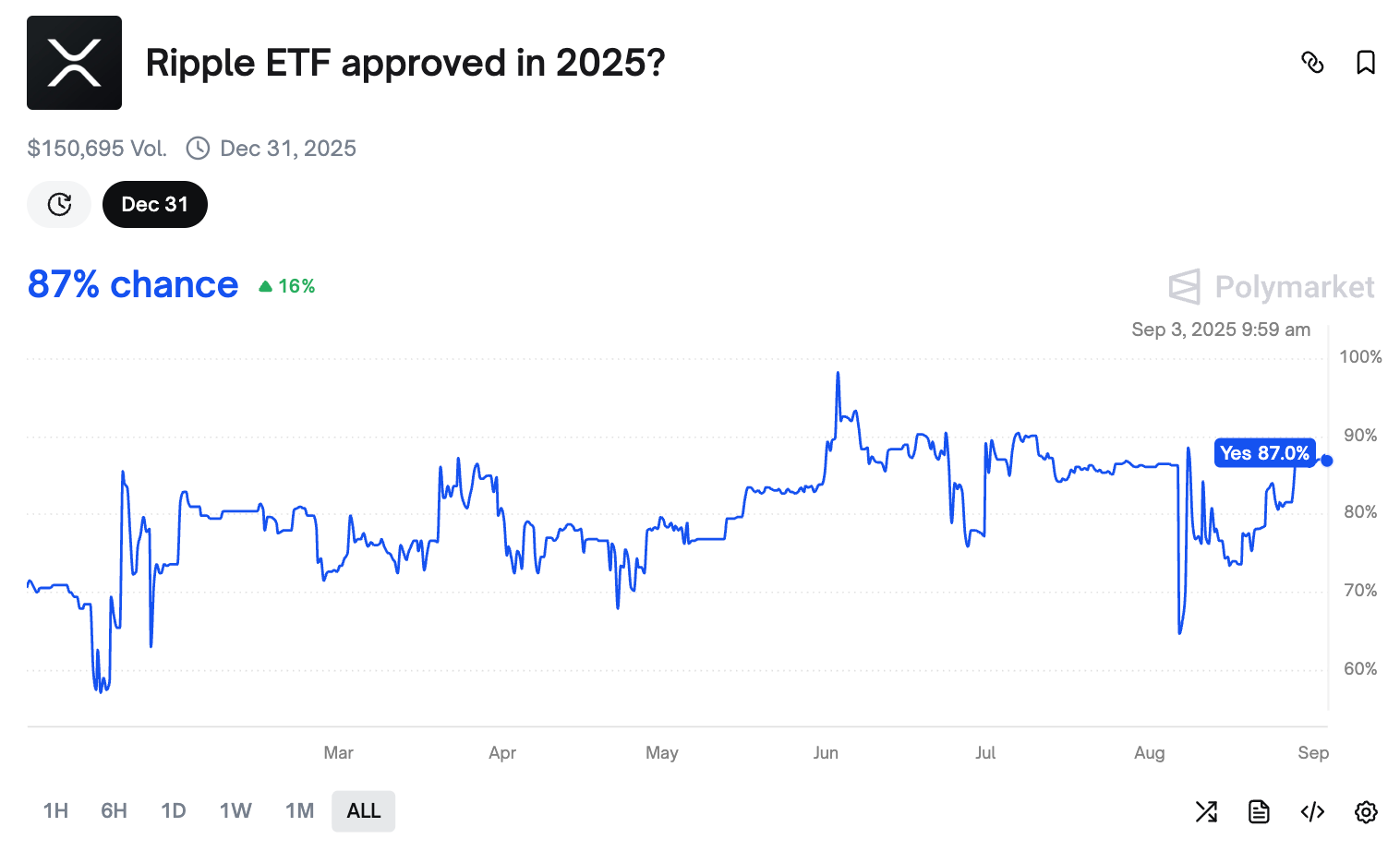

Market members are optimistic, with betting odds for an XRP ETF approval by Dec. 31 now standing at 87% on Polymarket. Over the previous month, the likelihood of approval has risen 23% in favor from round 64% on Aug. 6.

Nate Geraci, head of the ETF Retailer, emphasizes that the approval potentialities are nearly sure as the choice deadlines draw nearer.

“Personally, I believe the percentages are nearer to 100%,” he mentioned in an X put up on Tuesday in response to the growing odds.

Bloomberg senior ETF analyst Eric Balchunas estimates a 95% approval likelihood, citing regulatory readability and the change in management on the SEC.

Approval might doubtlessly unlock institutional capital, amplifying demand for XRP tokens, doubtlessly driving costs towards $10-$20, with some analysts predicting $50 if main gamers like BlackRock be a part of.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.