Decentralized lending protocols are surging in whole worth, set to additional capitalize on the rising institutional adoption of stablecoins and tokenized property, based on Binance Analysis.

Decentralized finance (DeFi) lending protocols are automated techniques that facilitate lending and borrowing for buyers by way of good contracts, eliminating the necessity for monetary intermediaries akin to banks.

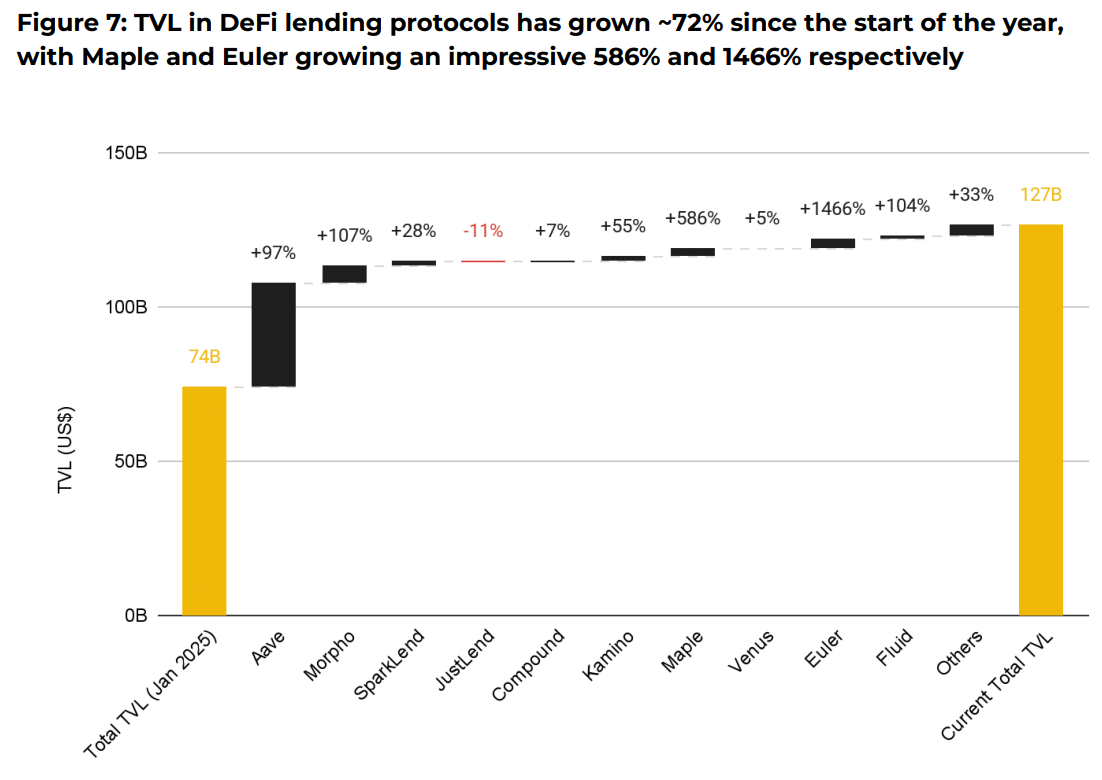

DeFi lending protocols rose over 72% year-to-date (YTD), from $53 billion firstly of 2025 to succeed in over $127 billion in cumulative whole worth locked (TVL) on Wednesday, based on Binance Analysis.

The explosive progress is attributed to DeFi lending protocols benefiting from the accelerated institutional adoption of stablecoins and tokenized real-world property (RWAs).

“As stablecoin and tokenized asset adoption accelerates, DeFi lending protocols are more and more positioned to facilitate institutional participation,” wrote Binance Analysis in a Wednesday report shared completely with Cointelegraph.

A good portion of this progress was attributed to Maple Finance and Euler, which noticed an explosive 586% and 1466% rise, respectively.

Associated: Crypto is one ‘progress cycle’ away from mainstream adoption, 5B customers

DeFi lending to seize extra institutional participation from RWA collateral adoption

Binance Analysis sees DeFi lending protocols as rising facilitators of institutional participation, particularly because of the launch of institutional-grade merchandise, akin to Aave Labs’ Horizon.

Horizon is an institutional lending market that permits debtors to make use of tokenized RWAs as collateral for stablecoin loans.

Merchandise like Horizon “intention to unlock new liquidity and convert RWAs into productive property inside the decentralized finance ecosystem,” added the report.

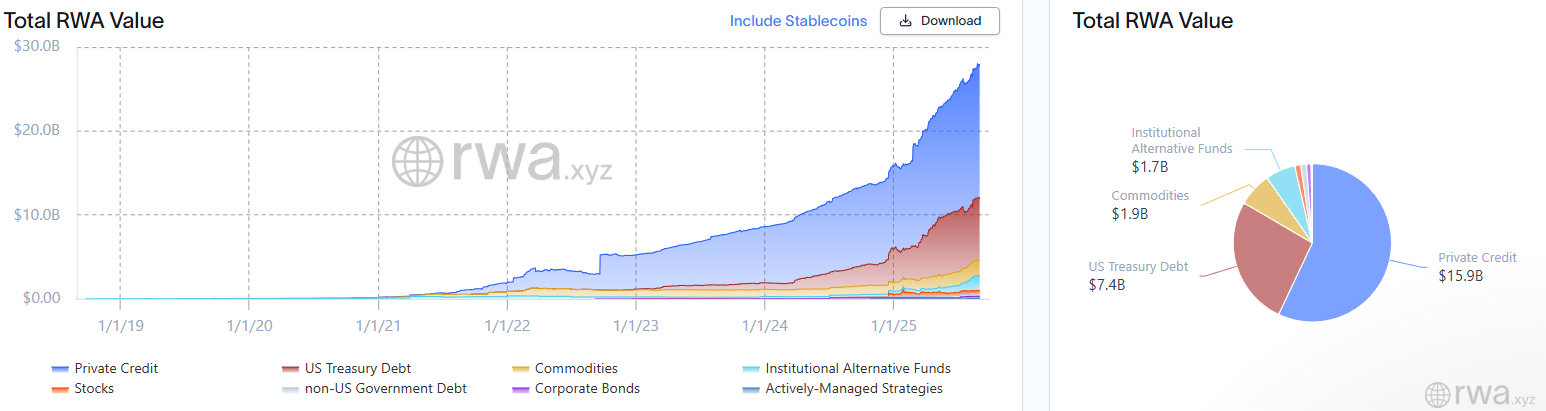

Tokenized monetary merchandise, akin to non-public credit score and US Treasury bonds, grew to become a focal focal point for establishments. Tokenized non-public credit score represents the bulk, or $15.9 billion, of the whole $27.8 billion RWAs onchain, adopted by $7.4 billion value of US Treasuries, based on information from RWA.xyz.

Associated: Company crypto treasury holdings high $100B as Ether shopping for accelerates

Some RWA protocols allow using yield-bearing tokenized US Treasury merchandise as collateral for a number of DeFi actions.

Nonetheless, utilizing US Treasuries as collateral for leveraged crypto buying and selling created new threat transmission pathways throughout markets, akin to cascading results for DeFi protocols, based on a June report from score service Moody’s.

Journal: Ethereum is destroying the competitors within the $16.1T TradFi tokenization race