Key factors:

-

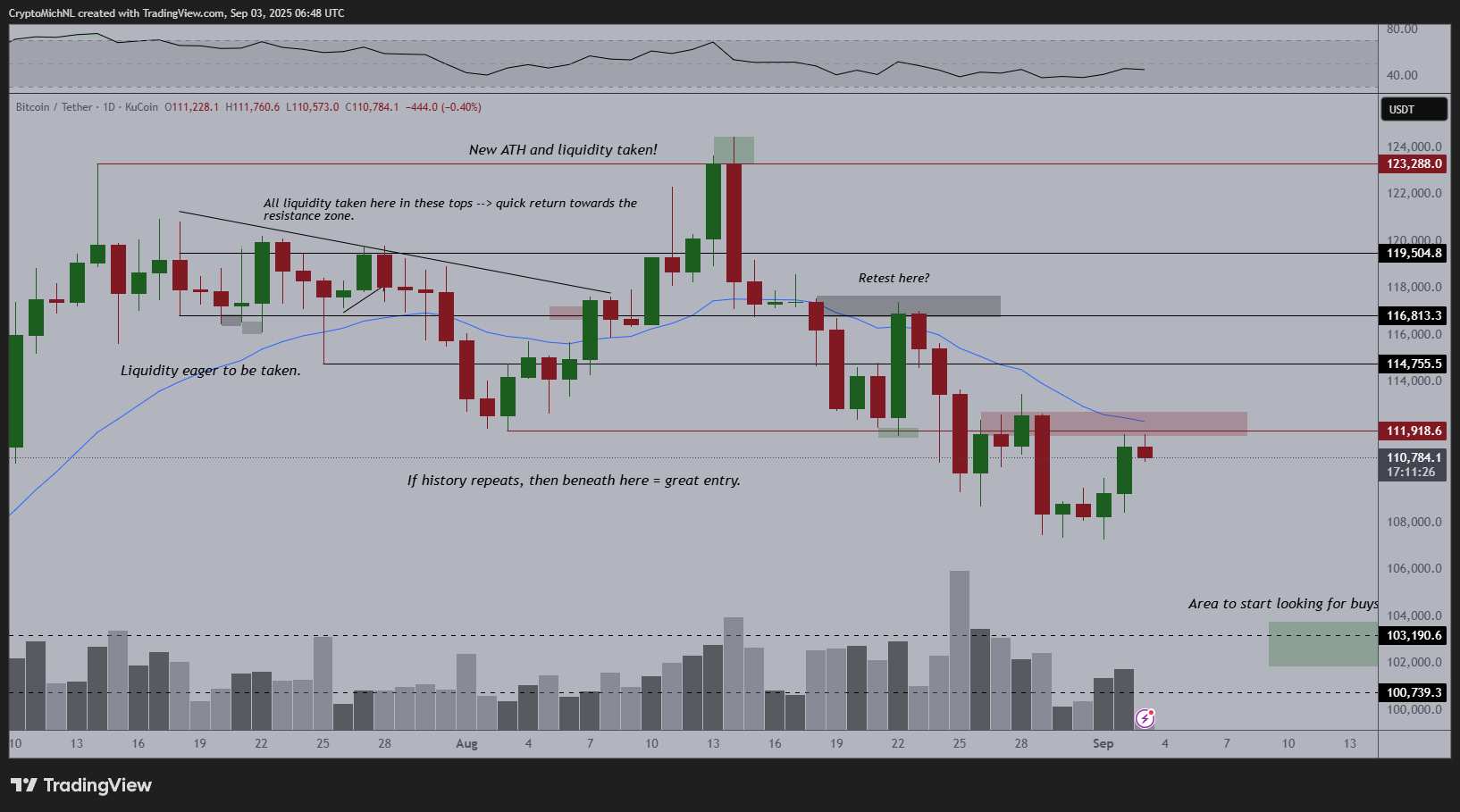

Bitcoin manages a day by day candle shut outdoors its downtrend for the primary time since mid-August.

-

Because of this a breakout must be “confirmed,” based on evaluation.

-

BTC worth expectations range between merchants, with many nonetheless anticipating new lows.

Bitcoin (BTC) has a brand new reversal sign that would finish two weeks of BTC worth losses, evaluation hints.

BTC worth closes above key development line

Knowledge from Cointelegraph Markets Professional and TradingView reveals BTC/USD closing outdoors a downward development line for the primary time since Aug. 13.

Bitcoin proponents are desperate to see affirmation that the majority of the most recent bull market correction is over.

Early cues corresponding to a bullish divergence on the relative power index (RSI) have accompanied a rebound from multiweek lows of $107,270.

Now, the whole retracement from August’s all-time highs is getting challenged on the day by day chart.

As famous by standard dealer and analyst Rekt Capital, Tuesday’s day by day candle sought to interrupt by means of a number of weeks of downward resistance — one thing that worth in the end succeeded in doing.

“BTC is making an attempt to interrupt its two-week previous Every day Downtrend,” he wrote in an X publish on the time.

“Every day Shut above the Downtrend and/or post-breakout retest would affirm the breakout.”

Bitcoin merchants eye $112,000 quick liquidations

BTC/USD circled $111,000 on the time of writing Wednesday forward of some key US macroeconomic knowledge prints.

Associated: Bitcoin to see ‘another massive thrust’ to $150K, ETH stress builds: Commerce Secrets and techniques

Amongst market members, nevertheless, opinions continued to diverge over the destiny of the Bitcoin bull market.

Requires a retest of $100,000 or decrease remained, with pseudonymous dealer and analyst Il Capo of Crypto, identified for his bearish market takes, telling X followers to “prepare for influence” on the day.

Prepare for influence.

— il Capo Of Crypto (@CryptoCapo_) September 3, 2025

Many positioned significance on $112,000 as a resistance flip goal.

“Very eager to see what $BTC can do at this resistance,” crypto dealer, analyst and entrepreneur Michaël van de Poppe summarized.

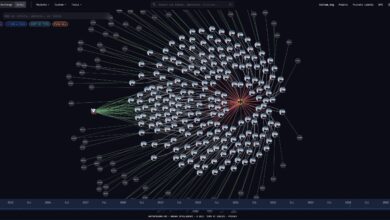

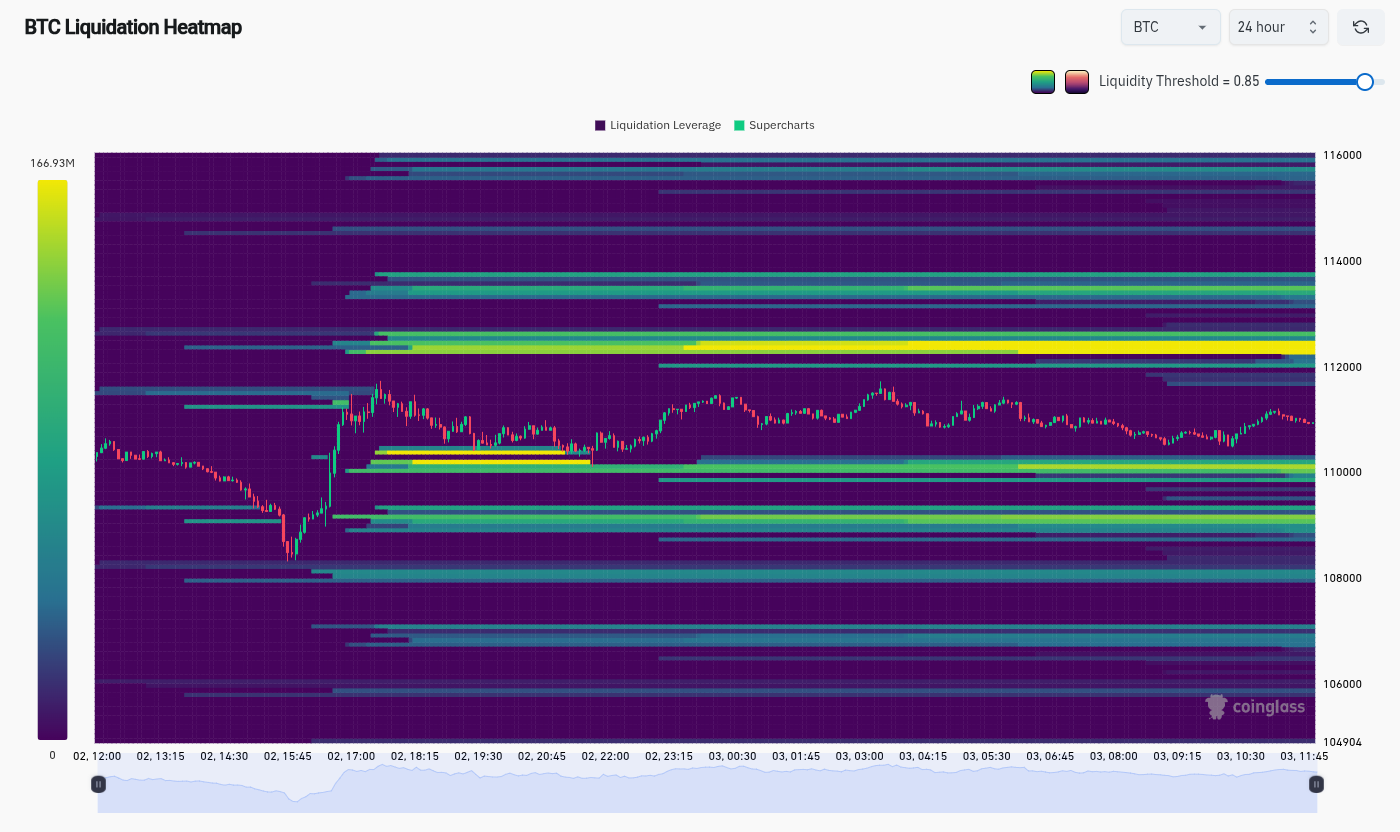

That space coincided with a patch of ask liquidity on change order books, as flagged by CoinGlass.

“Liquidations constructing above 112-112.4K,” standard dealer Killa famous, with fellow dealer Daan Crypto Trades calling $114,000 a “main space to look at” for a similar purpose.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.