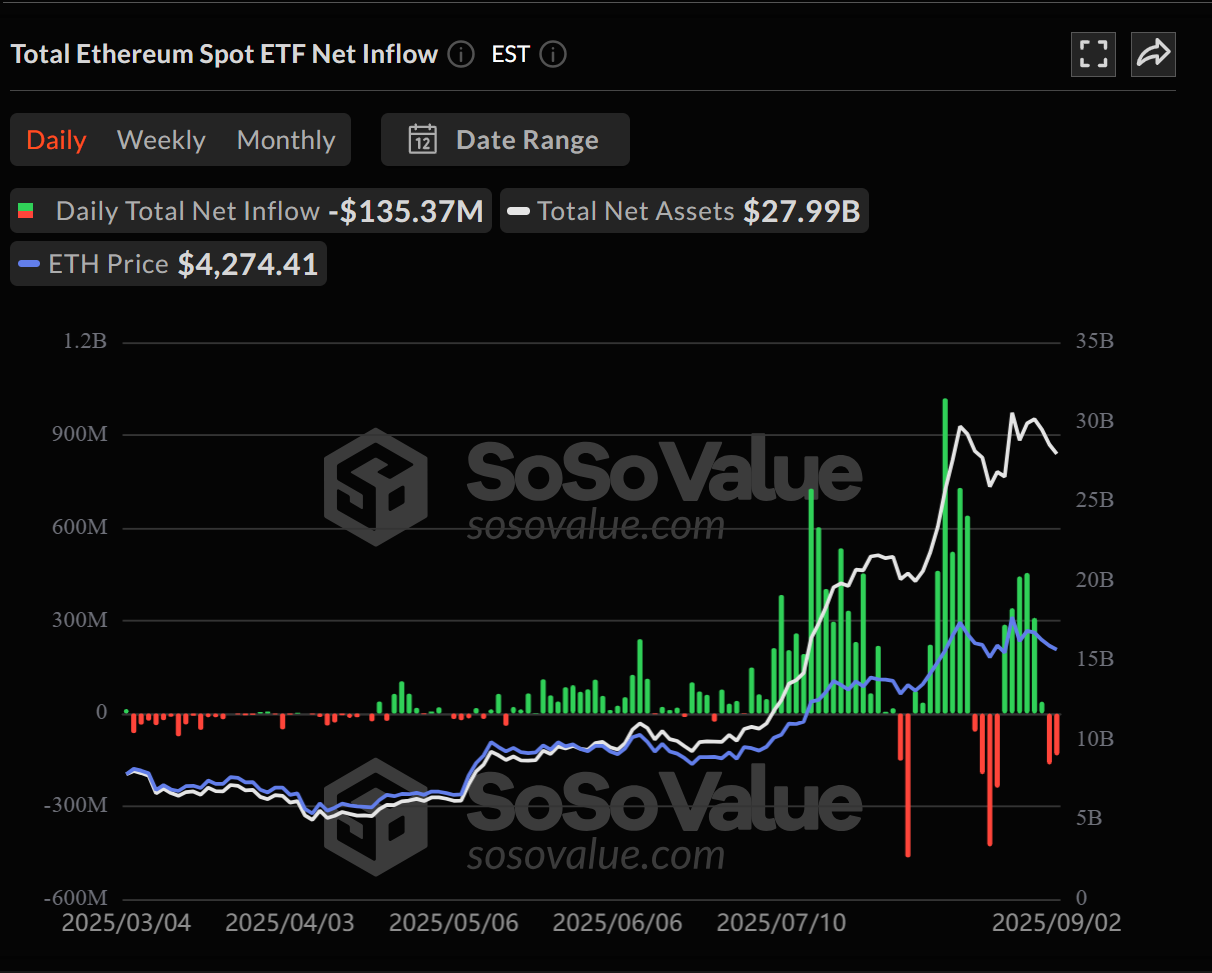

Spot Bitcoin exchange-traded funds (ETFs) recorded $332.7 million in internet inflows on Tuesday, outpacing their Ethereum counterparts, which noticed $135.3 million in internet outflows, in keeping with knowledge from SoSoValue.

Constancy’s FBTC led the surge, attracting $132.7 million, adopted by BlackRock’s IBIT with $72.8 million. Further inflows have been reported throughout different main issuers, together with Grayscale, Ark 21Shares, Bitwise, VanEck and Invesco.

Ether (ETH) ETFs posted outflows. Constancy’s FETH accounted for the majority of the bleed, dropping $99.2 million, whereas Bitwise’s ETHW shed $24.2 million. Ether ETFs additionally noticed $164 million in outflows on Friday.

The reversal got here after a powerful August for Ethereum funds, which noticed $3.87 billion in inflows in contrast with Bitcoin (BTC) ETFs’ $751 million outflows.

Associated: How excessive can Bitcoin value go as gold hits document excessive above $3.5K?

Bitcoin’s ‘digital gold’ narrative regains momentum

The renewed surge in spot Bitcoin ETFs comes as Bitcoin’s “digital gold” narrative is making a comeback. “Bitcoin is as soon as once more attracting institutional flows as its digital gold narrative regains traction,” Vincent Liu, the chief funding officer at Kronos Analysis, informed Cointelegraph.

“With gold at all-time highs, urge for food for laborious property is clearly strengthening. On this setting of macro uncertainty, BTC is standing out towards ETH, which seems to be coming into a interval of profit-taking,” he added.

Liu mentioned this development may proceed so long as international markets stay shaky, with buyers favoring Bitcoin for its perceived stability and safe-haven enchantment.

Associated: Uptick in Bitcoin spot buying and selling hints at attainable breakout to $119K

Crypto funds rebound with $2.48 billion in weekly inflows

As reported, crypto funding merchandise rebounded final week, pulling in $2.48 billion in internet inflows after the earlier week’s $1.4 billion outflow.

August wrapped with $4.37 billion in inflows. Yr-to-date inflows now stand at $35.5 billion, up 58% in comparison with the identical timeline in 2024. Whole property underneath administration dropped 7% week-over-week to $219 billion.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder