The Trump household’s crypto challenge, World Liberty Monetary, has begun burning its namesake token in a bid to spice up its worth, which has been in decline since launching to the broader public on Monday.

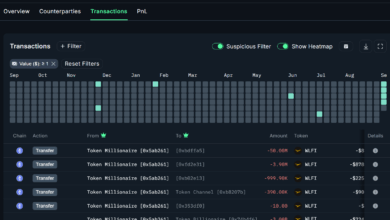

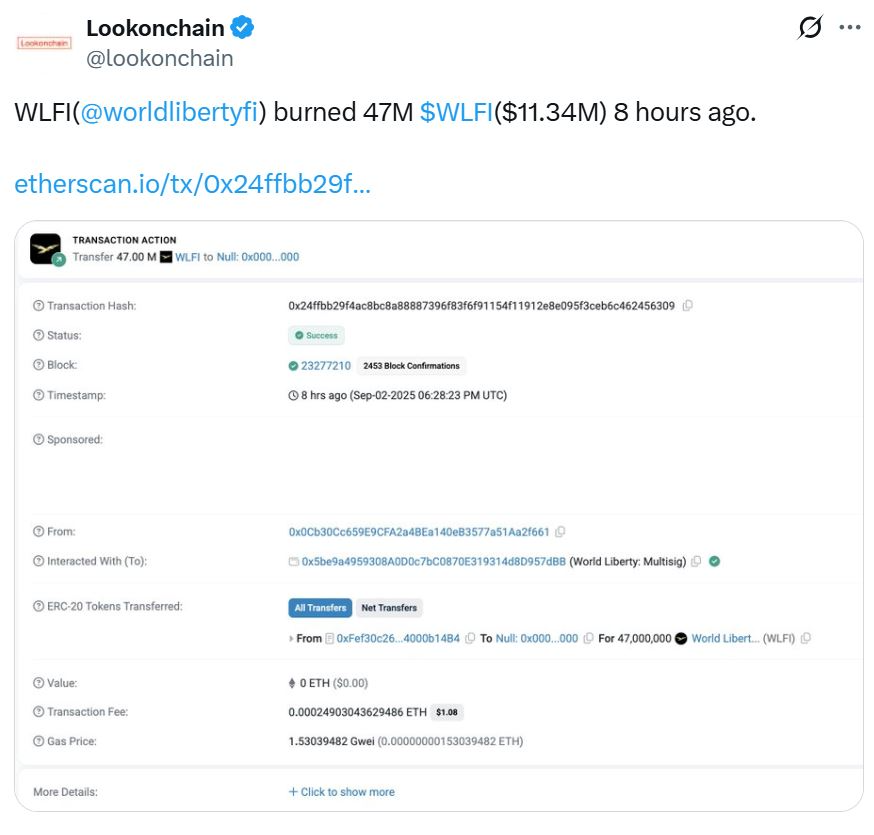

On-chain information first reported by Lookonchain confirmed the platform burned 47 million World Liberty Monetary (WLFI) tokens on Wednesday, completely eradicating them from the availability.

The token started buying and selling on secondary markets for the primary time on Monday, with its early buyers allowed to promote their holdings to the general public. The token briefly hit a peak of $0.331 however it has continued to say no, dropping 3.8% prior to now day to only over 23 cents.

Crypto tasks undertake token burns in a bid to tighten provide and theoretically enhance the worth of the remaining tokens.

Burn a fraction of WLFI’s provide

CoinMarketCap exhibits round 24.66 billion tokens, or simply over 25% of WLFI’s unique 100 billion provide, have to date been unlocked, with the burn representing 0.19% of the token’s circulating provide.

The transaction on Etherscan exhibits that the tokens had been despatched to a burn pockets on Sept. 2, with Etherscan now exhibiting that the tokens’ complete provide has been lowered to only over 99.95 billion.

World Liberty put ahead a proposal on Tuesday to implement a token buyback and burn program utilizing protocol-owned liquidity charges in an effort to drive up the shortage and worth.

The workforce claims within the proposal {that a} token burn would “enhance the relative possession proportion of dedicated long-term holders,” whereas eradicating from circulation tokens “held by members not dedicated to WLFI’s long-term development.”

The token is down over 31% from its opening excessive on its launch day, as brief sellers offloaded the token, an issue the token burn goals to deal with.

Nearly all of the 133 respondents within the feedback part under the proposal have voiced approval, with an official vote but to happen.

Token launch exhibits market wants time to mature

Kevin Rusher, founding father of real-world asset borrowing and lending ecosystem RAAC, mentioned in an announcement after the launch, he thinks the hype across the WLFI token exhibits crypto remains to be struggling to develop up.

He argues that true longevity within the ecosystem shall be decided by institutional adoption, not “movie star tokens or short-term hype.”

Associated: Trump household’s World Liberty stake surges to $5B after token unlock

“The priority, nevertheless, is that such blatantly speculative buying and selling continues to wreck belief in crypto, and that’s the other of what’s required to construct a really resilient, long-term monetary system,” Rusher added.

In the meantime, Mangirdas Ptašinskas, head of selling and neighborhood at Web3 identification and rewards platform Galxe, mentioned the token launch despatched Ethereum fuel charges “into the stratosphere,” which he thinks needs to be a warning to builders that “Our job remains to be removed from finished.”

“If a spike in buying and selling can all of the sudden push charges on a $200 switch to $50, there may be nonetheless work required to organize the crypto ecosystem for the mainstream adoption that’s undoubtedly coming,” he mentioned.

Journal: The one factor these 6 world crypto hubs all have in widespread…