Key takeaways:

-

Ethereum charges and DApps exercise surged, surpassing Tron and Solana.

-

ETH derivatives information present warning, however rising institutional reserves reinforce ETH’s long-term bullish case.

Ether (ETH) has held agency across the $4,300 degree regardless of a 15% decline from the Aug. 24 all-time excessive. The pullback got here amid a broader cryptocurrency market correction, possible reflecting worsening macroeconomic circumstances. Whereas derivatives metrics present little optimism, a number of key onchain indicators counsel ETH may break above $5,000 within the close to time period.

Adverse remarks from US President Donald Trump in regards to the business relationship with India added traders selection to chop. Trump’s feedback got here after Indian Prime Minister Narendra Modi met with Chinese language and Russian leaders on Monday. The tech-heavy Nasdaq dropped 1.3%, whereas gold reached an all-time excessive, supported by continued international central financial institution demand.

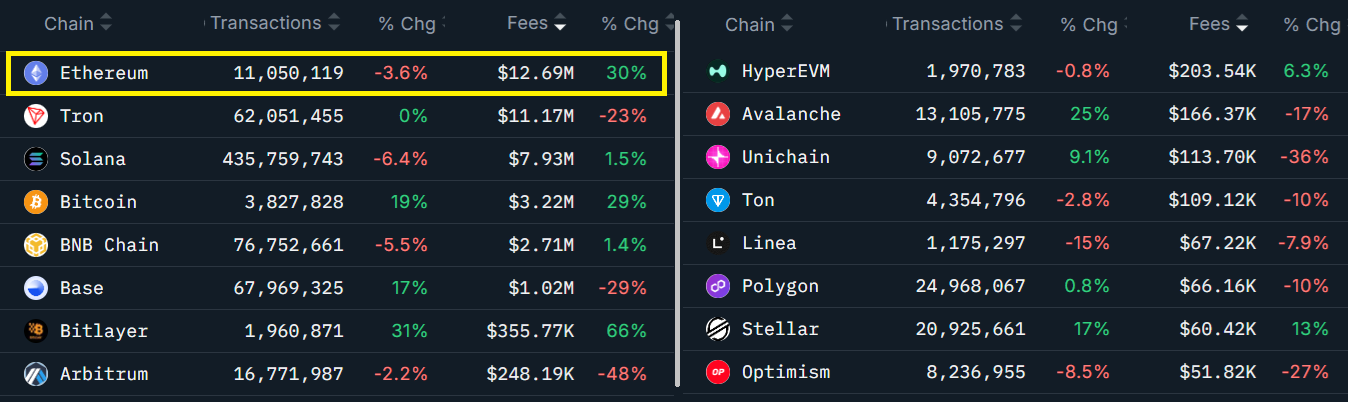

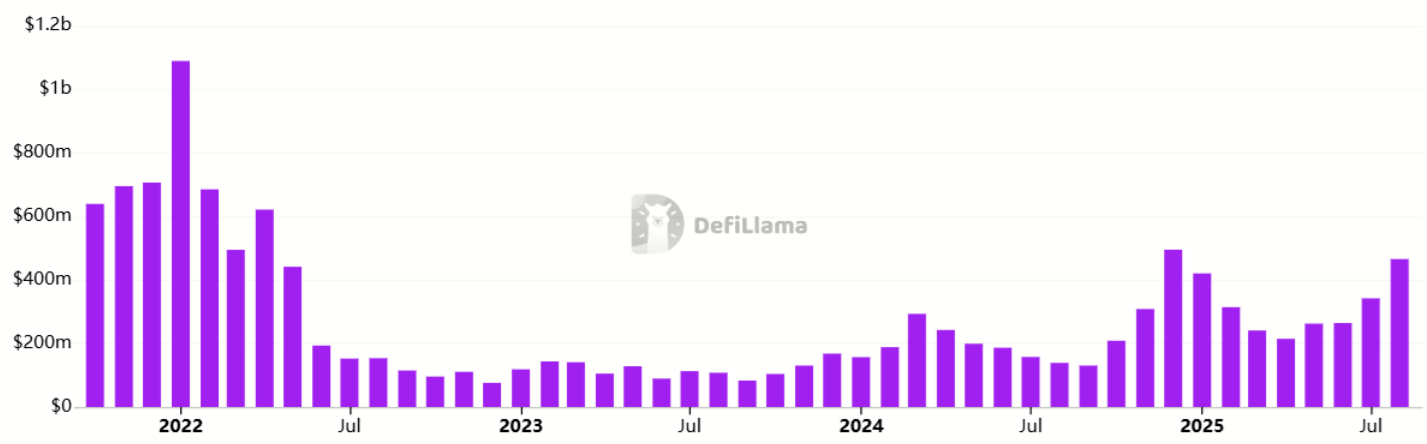

Ethereum’s community exercise additionally confirmed notable energy. A 30% weekly surge in charges allowed Ethereum to overhaul Tron because the highest-grossing community. Together with layer-2 exercise, Ethereum’s complete charges reached $16.3 million, greater than double Solana’s $7.9 million. In accordance with DefiLlama, Ethereum posted its second-highest decentralized utility (DApp) charges since February 2022.

In August, Ethereum DApps generated $466 million in charges, a 36% enhance from the earlier month. In distinction, Solana DApp charges fell 10% over the identical interval, whereas BNB Chain noticed a 57% contraction. Amongst Ethereum’s high contributors had been Lido with $91.7 million, Uniswap with $91.2 million, and Aave with $82.9 million in 30-day charges.

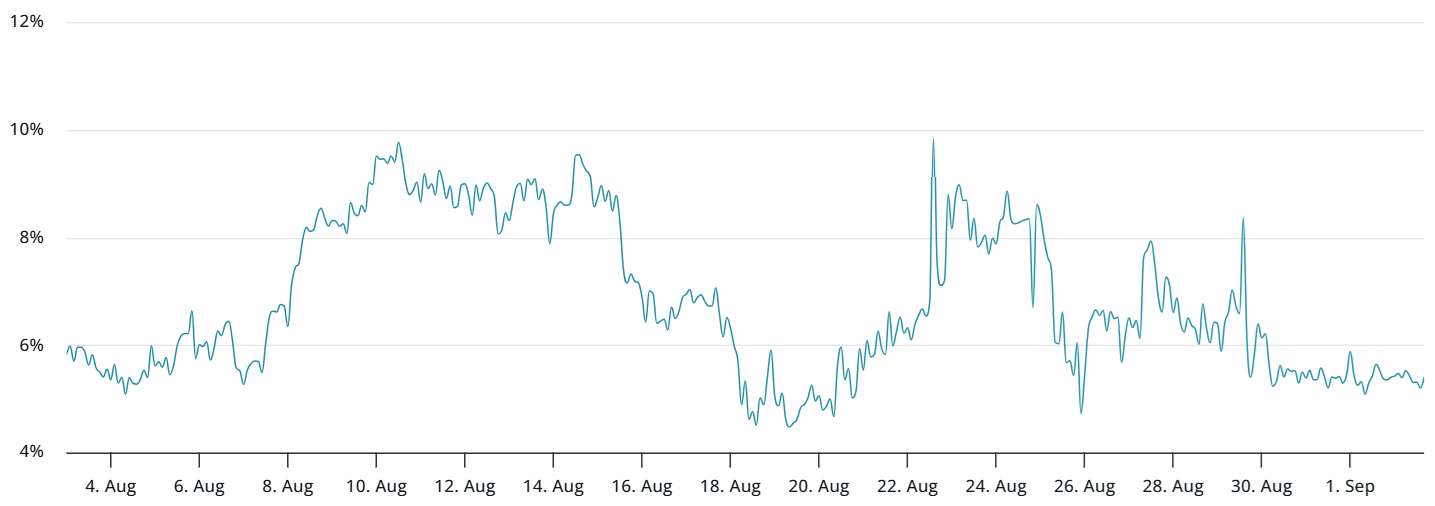

Whereas onchain exercise reveals progress, Ether derivatives counsel merchants stay skeptical about ETH reclaiming $5,000 within the brief time period.

The month-to-month futures premium stands at 5%, hovering on the fringe of a neutral-to-bearish market. Such warning is anticipated after a 15% pullback from the Aug. 24 all-time excessive. But, futures combination open curiosity has risen 26% in 30 days, reaching $58.5 billion, signaling that merchants should not abandoning the asset.

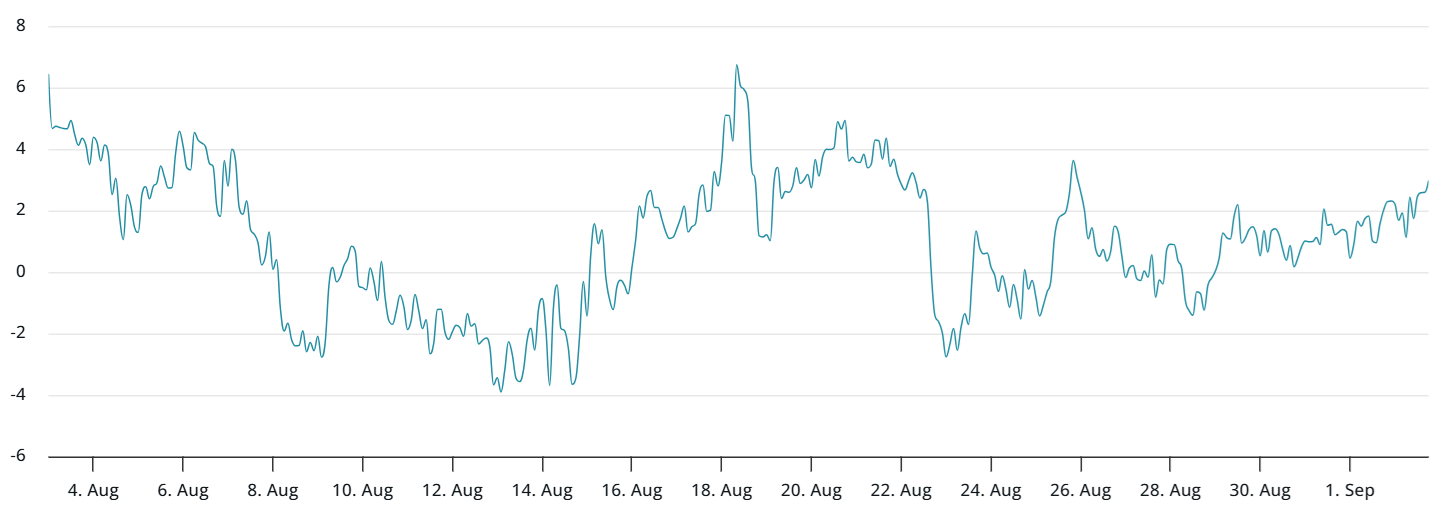

Ether choices skew measured 3% on Monday, properly inside the -6% to +6% impartial band, as merchants assigned related chances to shock strikes in both path. A pointy rise above the impartial threshold would have prompt expectations of a breakdown beneath $4,200, however that has not materialized.

Will company adoption proceed to drive ETH worth?

Institutional adoption additionally continues to construct. Companies have added 2 million ETH to reserves over the previous 30 days, in accordance with information from StrategicETHReserve.xyz. Companies together with Bitmine Immersion Tech (BMNR), SharpLink Gaming (SBET) and The Ether Machine (ETHM) now maintain a mixed 4.71 million ETH, valued at greater than $20.2 billion.

Extra considerably, a few of these firms are starting to deploy capital into Ethereum-based DApps. ETHZilla (ETHZ) introduced new commitments on Tuesday, underscoring the rising exercise throughout the ecosystem. This growth of real-world utilization strengthens ETH’s function inside decentralized functions and will additional differentiate Ethereum from opponents.

In the end, regardless of cautious indicators from derivatives markets, Ethereum’s rising community exercise leaves ETH well-positioned to regain bullish momentum.

This text is for basic info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.