CleanCore Options, a Nebraska-based maker of aqueous ozone cleansing techniques, noticed its shares plunge over 60% Tuesday after asserting plans to turn out to be a Dogecoin treasury firm.

The corporate disclosed a $175 million non-public placement backed by over 80 institutional and crypto-native buyers, together with Pantera, GSR, FalconX and Borderless.

Proceeds will likely be used to amass Dogecoin (DOGE) as CleanCore’s main reserve asset, with the initiative led by newly appointed board Chairman Alex Spiro, Elon Musk’s longtime legal professional.

The brand new DOGE treasury firm can be partnering with the Dogecoin Basis and its industrial arm, Home of Doge.

As a part of the deal, Dogecoin Basis Director Timothy Stebbing and Home of Doge CEO Marco Margiotta will take board and government roles at CleanCore, with Margiotta appointed chief funding officer.

The Home of Doge and crypto-ETF issuer 21Shares will advise on treasury technique and governance, together with plans to discover staking-like yield alternatives and institutional funding merchandise tied to DOGE.

“By anchoring Dogecoin with an official foundation-backed treasury technique, we’re setting a precedent for the way public corporations can align with foundations to construct actual utility round digital forex,” Margiotta mentioned in a press release.

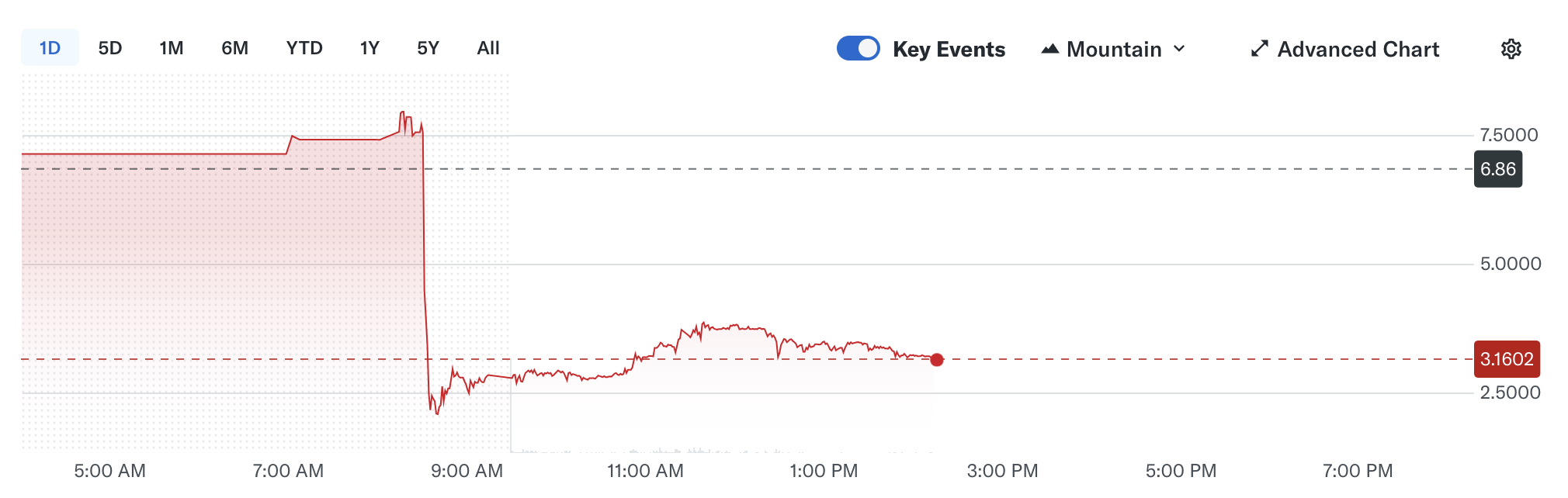

CleanCore’s inventory plunged to $2.69 in early buying and selling on Tuesday from $6.86 at Friday’s shut. As of this writing, shares of the Nasdaq-listed firm are down 54%.

Associated: Dogecoin transition from proof-of-work to proof-of-stake: Why is it necessary?

Dogecoin treasury corporations abound

A number of different publicly traded corporations have moved to construct Dogecoin treasuries in 2025.

In January, Spirit Blockchain Capital, an funding agency centered on blockchain infrastructure, introduced plans to leverage its DOGE holdings for yield era methods. Dogecoin Money Inc., previously a hashish and telehealth firm, introduced in July the acquisition 1 billion DOGE by way of its new subsidiary, Dogecoin Treasury Inc.

In July, Bit Origin, a former Chinese language pork producer that pivoted into Bitcoin mining, introduced plans to launch a Dogecoin treasury backed by as much as $500 million in fairness and convertible debt financing.

The businesses have seen lower than stellar outcomes since asserting Dogecoin treasury methods.

12 months-to-date, Spirit Blockchain Capital is down over 88%, and Dogecoin Money Inc. is declining 70% over the identical interval. Bit Origin’s inventory has additionally fallen about 64%.

In the meantime, DOGE has fallen about 33% in 2025, in line with information from TradingView.

Journal: Commerce Secrets and techniques: Elon Musk Dogecoin pump incoming? SOL tipped to hit $300 in 2025