SmartGold, a gold-backed particular person retirement account (IRA) supplier, has partnered with tokenization platform Chintai Nexus to let U.S. buyers put their gold holdings on blockchain rails and earn a yield in decentralized finance (DeFi) protocols.

With the construction, IRA-held gold is tokenized 1:1 on Chintai’s regulated platform, then might be put to work as collateral on DeFi lending markets similar to Morpho and Kamino. That collateral can unlock liquidity, which can be reinvested elsewhere whereas the underlying gold stays vaulted and insured. The account’s tax-deferred standing stays intact, in keeping with the press launch shared with CoinDesk.

The transfer addresses a longstanding trade-off for retirement savers: gold provides stability however sometimes produces no revenue. Buyers holding bodily gold in an IRA have traditionally had to decide on between the tax benefits of the account and the prospect to deploy the steel in yield-generating methods. IRS guidelines made combining the 2 practically not possible with out triggering penalties.

“For many years, gold buyers have confronted a tough selection: safety or yield,” SmartGold managing director Aaron Haley stated in a press release. “We’re turning the final word safe-haven asset into a strong, productive software for constructing wealth.”

The rollout opens entry to tokenization for SmartGold’s $1.6 billion in vaulted belongings, making it one of many largest deployments of tokenized gold to this point and the primary tailor-made to U.S. retirement accounts.

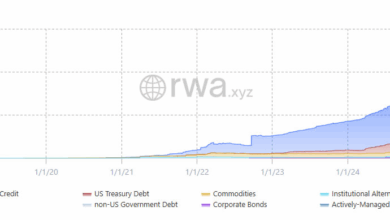

It additionally underscores the rising concentrate on tokenizing real-world belongings like commodities, equities and funds, a sector that has attracted curiosity from main monetary corporations.

Learn extra: Tokenized Gold Market Tops $2.5B because the Treasured Metallic Nears Report Highs