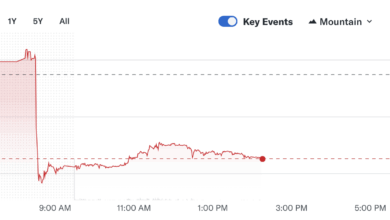

Technique, the enterprise intelligence agency previously often called MicroStrategy, has bolstered its Bitcoin place with one other massive buy.

In a Sept. 2 submitting with the US Securities and Change Fee (SEC), the corporate reported buying 4,048 BTC for $449.3 million, paying a median of $110,981 per coin.

The transfer lifts Technique’s whole Bitcoin steadiness to 636,505 BTC, obtained at a mixed value of $46.95 billion, or roughly $73,765 per coin. At present market costs, that stash is valued at $69.24 billion.

Based on Bitcoin Treasuries information, the agency’s holdings now symbolize simply over 3% of Bitcoin’s most provide, giving Technique one of many largest company positions within the asset.

Following this buy, Technique introduced that it had adjusted the dividend charge on its STRC most well-liked inventory, elevating the annual payout from 9% to 10%. The safety, launched in July, is non-convertible and designed to ship variable-rate earnings.

‘Lowered leverage’

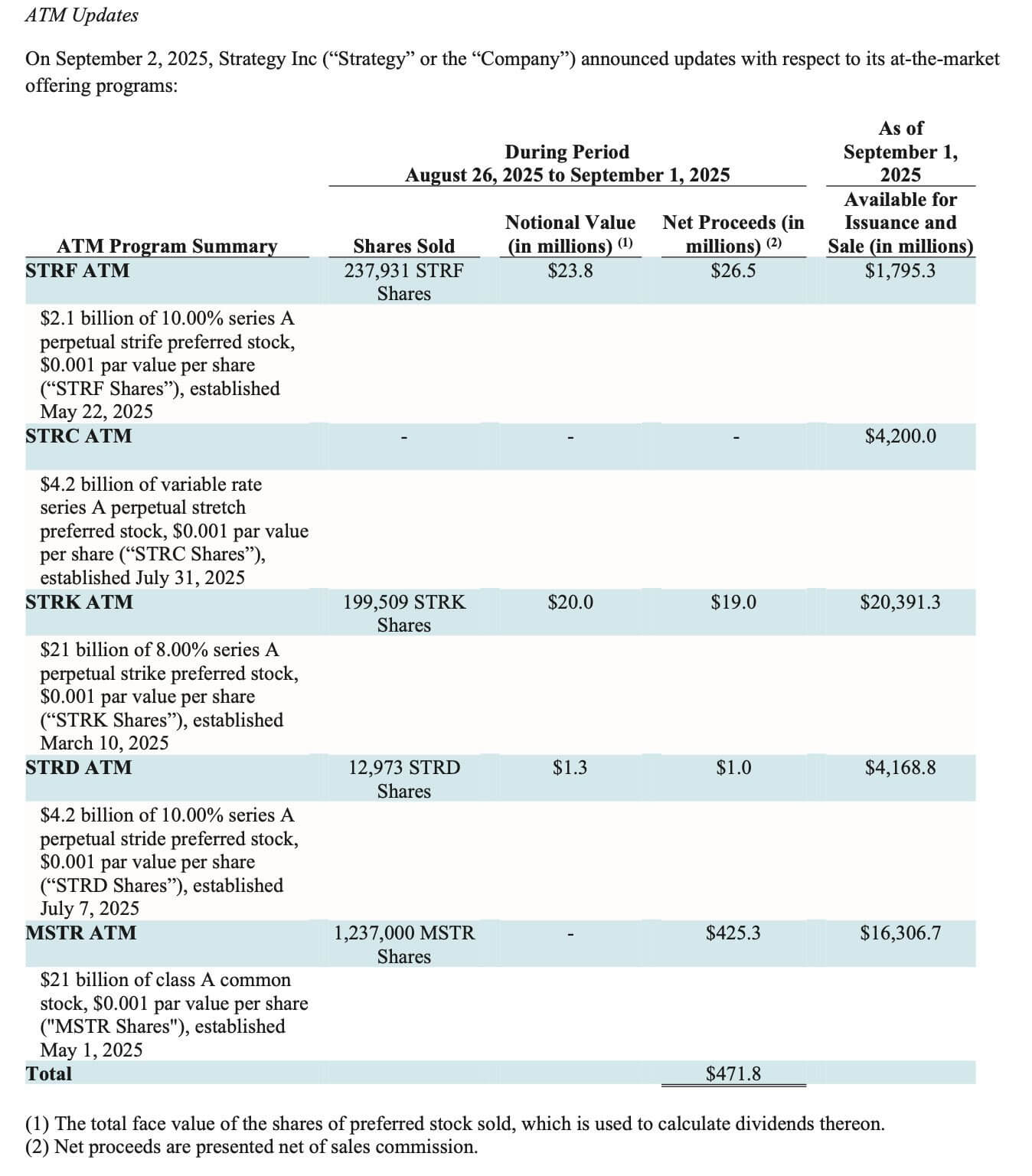

The most recent deal was financed via a mixture of widespread and most well-liked inventory choices.

Based on the submitting, Technique offered 1.24 million shares of its Class A standard inventory for $425.3 million. The corporate raised the $46.5 million steadiness via its most well-liked share applications, together with STRK, STRF, and STRD.

This imbalance drew criticism from brief vendor James Chanos, who has publicly guess in opposition to the agency.

Chanos argued that the heavy reliance on widespread inventory suggests buyers stay cautious of the popular choices, that are structured for earnings seekers and higher-risk individuals.

He wrote:

“MSTR continued to REDUCE its leverage this previous week. 90% of its securities offered was from the widespread fairness ATM.”

Regardless of Chanos’s declare, Technique has already raised $5.6 billion in 2025 via the preliminary public choices of those securities. Notably, the IPOs account for 12% of all US preliminary public choices this yr.

Contemplating this, Technique’s supporters proceed to argue that there’s a important demand for these belongings available in the market.