Round 80% of the highest 10 largest holders of World Liberty Monetary’s WLFI token took earnings inside a day of the asset’s launch.

On Sept. 2, pseudonymous blockchain analyst Aixpta reported that eight of the highest ten WLFI holders had both partially or totally bought their positions. In accordance with the evaluation, solely the second and fifth largest wallets have but to maneuver their tokens.

For context, blockchain researcher Ember CN had acknowledged that WLFI’s lively largest holder, moonmanifest.eth, unlocked 200 million WLFI, value almost $59.5 million, earlier than promoting 10 million tokens for $2.1 million at $0.21 apiece simply 5 hours later.

In the meantime, different prime holders acted extra decisively in the course of the reporting interval.

The sixth-largest pockets, tied to convexcuck.eth, bought $3.8 million value of tokens via Whales Market to 36 separate consumers.

Moreover, a number of further wallets ranked among the many prime ten despatched their holdings on to centralized exchanges minutes after WLFI started buying and selling on Sept. 1.

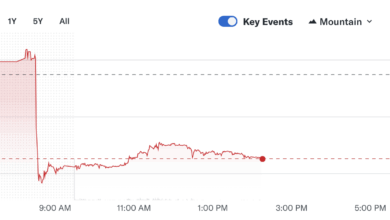

These speedy sell-offs counsel that early buyers moved rapidly to safe earnings, even because the challenge confronted mounting volatility throughout its first buying and selling day.

Phishing threats emerge

Whereas early promoting has weighed on WLFI’s market momentum, blockchain safety specialists are warning of a rising phishing menace focusing on the token holders.

Over the previous days, Yu Xian, founding father of SlowMist, has repeatedly warned of phishing assaults that exploit Ethereum’s new EIP-7702 commonplace and are focused at WLFI token claimers.

Xian cited the instance of 1 WLFI pockets that was drained throughout a number of addresses after attackers deployed a malicious contract tied to Ethereum’s 7702 delegate perform.

In accordance with the Slowmist founder, as soon as a personal secret’s compromised, the exploit permits the hacker to pre-plant a delegate tackle that siphons away all property, together with ETH meant for fuel charges, leaving the sufferer with nothing.

In the meantime, Xian famous that holders can nonetheless defend towards the exploit by front-running it. This entails paying fuel to override the malicious delegate contract, changing it with a protected one, and transferring tokens in the identical block via flashbots.