Gold-backed IRA supplier SmartGold is shifting $1.6 billion of vaulted property onchain by way of a partnership with tokenization platform Chintai Nexus, probably opening the door to tokenized gold investments by way of self-directed US Particular person Retirement Accounts (IRAs).

Every gold token is backed one-for-one with bodily bullion and might be deployed as collateral throughout decentralized finance (DeFi) lending protocols, the businesses mentioned Tuesday.

The construction works by having buyers buy and retailer vaulted gold by way of a SmartGold self-directed IRA. Chintai then tokenizes the holdings, issuing digital representations tied on to the bodily asset.

These tokens can be utilized as collateral on platforms equivalent to Morpho and Kamino, giving buyers entry to US greenback–denominated liquidity. The borrowed capital might be reinvested into different yield-generating methods, whereas the underlying gold stays saved and the account’s tax-deferred standing is preserved.

Self-directed IRAs carry the identical tax advantages as conventional or Roth accounts however give retirement planners entry to a broader vary of property, together with cryptocurrencies, non-public fairness and actual property. In line with Pacific Premier Belief, they symbolize 2% to five% of the $10.8 trillion held in US IRAs.

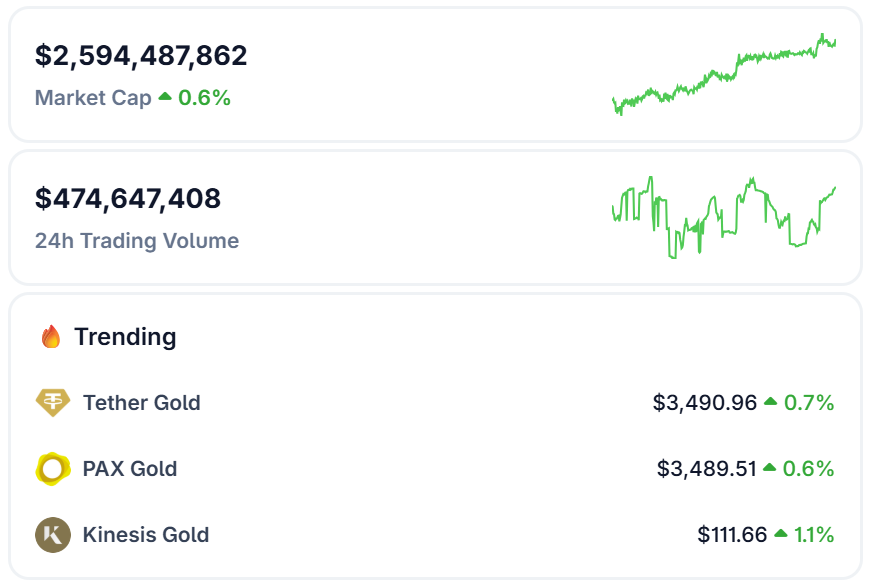

The SmartGold–Chintai launch comes amid rising demand for tokenized gold. The Worldwide Treasured Metals Bullion Group has rolled out tokenized merchandise throughout its provide chain, whereas stablecoin issuer Tether has gained traction with Tether Gold, which topped $800 million in worth earlier this summer season and has since grown to $1.3 billion.

In the meantime, medical know-how firm BioSig has not too long ago pivoted towards tokenization by way of a merger with real-world asset platform Streamex. The mixed entity secured $1.1 billion in development financing to deliver gold and different commodities onchain.

Associated: Why tokenized gold beats different paper options — Gold DAO

Gold: The unique hedge good points momentum

Whereas many crypto advocates spotlight Bitcoin (BTC) as “digital gold” for its shortage, divisibility and potential to protect buying energy, the unique inflation hedge has been the standout performer this 12 months.

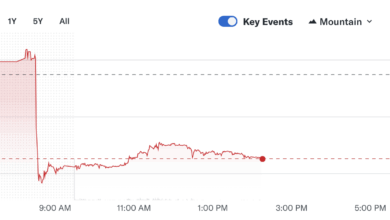

Comex gold futures rose to a file excessive of $3,557 a troy ounce on Monday, extending the yellow steel’s year-to-date acquire to 34%.

Demand has been fueled by geopolitical and political uncertainty, heavy central financial institution shopping for and protracted considerations about inflation and the broader economic system.

As The Wall Road Journal reported, gold has additionally benefited from mounting questions over Federal Reserve independence, as US President Donald Trump has sought to shake up the establishment, criticizing it for not chopping charges aggressively sufficient.

Finally month’s Jackson Gap symposium, Fed Chair Jerome Powell signaled that charge cuts might be on the desk in September as policymakers shift their focus to the labor market.

Associated: Greenback stability questioned as Trump ousts Federal Reserve governor