Key takeaways:

-

BTC has rallied between 145% and 304% inside a 12 months of previous gold peaks.

-

The highest crypto can rally to as excessive as $400,000 if the gold fractal repeats.

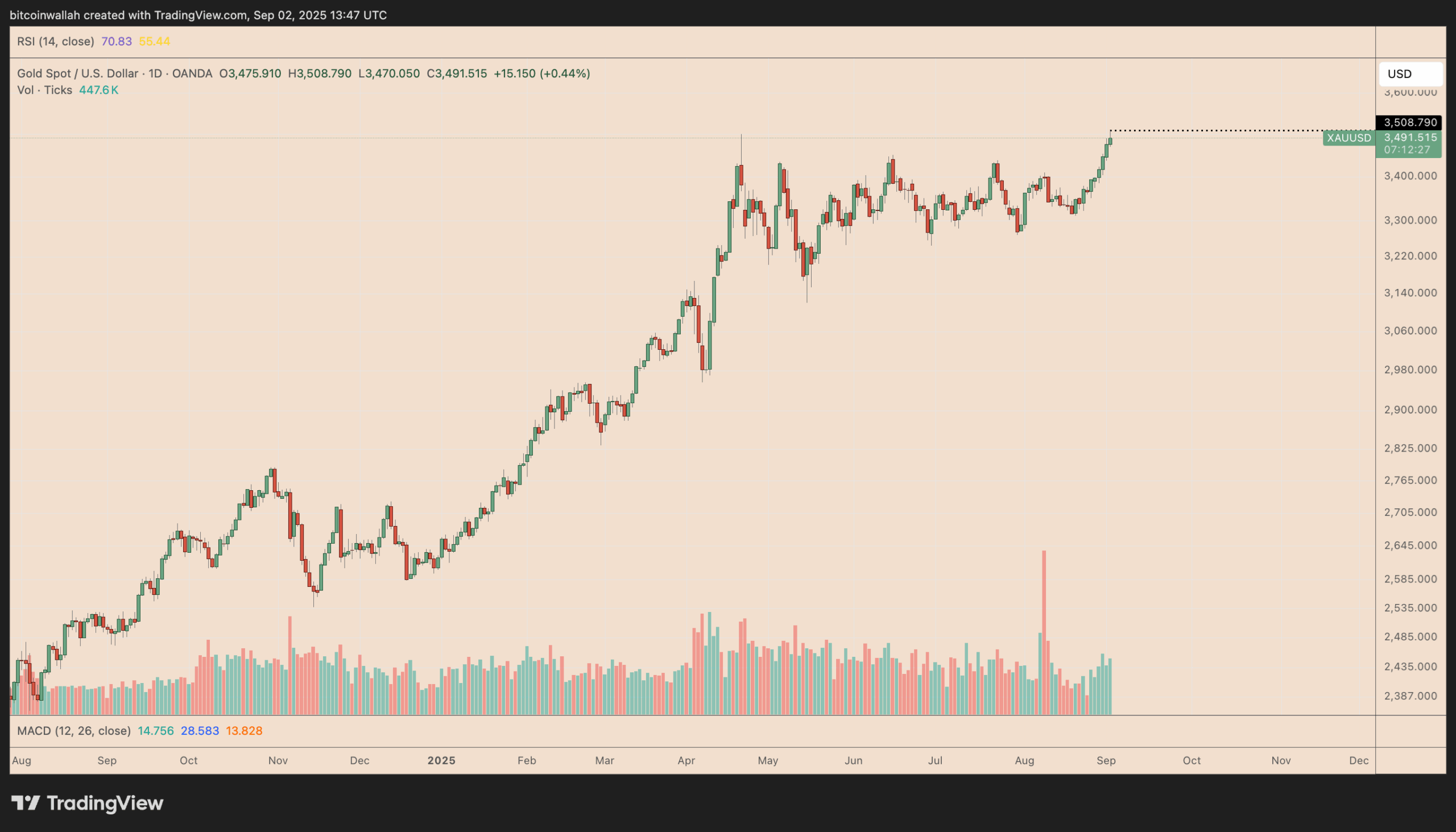

Gold worth (XAU) simply printed a contemporary file above $3,500 (per ounce), pushed by bets on upcoming Fed price cuts.

Its “safe-haven” rival, Bitcoin (BTC), might comply with with a stronger, higher-beta transfer inside a 12 months if historical past is a information.

BTC worth rallies a minimal 145% after gold peaks

Earlier gold all-time highs present BTC often lags at first, then outperforms on a 6–12 month horizon.

In August 2011, when gold hit $1,921, Bitcoin rose by 145% a 12 months later. After the dear steel’s August 2020 peak of round $2,070, BTC gained 68% in three months, 286% in six, and 315% in twelve.

Extra just lately, when gold hit a file excessive of $3,500 in April, BTC rose by round 35% over the subsequent three months.

Throughout the 2 accomplished cycles (2011 and 2020), BTC’s median post-gold-ATH return is about 30% at three months and 225% at twelve months, exhibiting that gold units the tone, however Bitcoin often takes the lead.

This occurs as a result of gold is the standard first selection when traders get nervous. Nevertheless, as soon as gold is up and other people begin on the lookout for greater good points, cash usually strikes into Bitcoin, which many merchants think about a higher-risk, higher-reward “digital gold.”

How excessive can Bitcoin worth go subsequent?

A repeat of the historic 30% median acquire over three months after gold’s file highs would put Bitcoin within the $135,000–$145,000 vary by early December, when measured from its present degree close to $110,000.

However BTC’s worth might go as excessive because the $200,000–$400,000 vary over the subsequent 12 months if it repeats its historic 145–304% good points seen after previous gold data. That aligns with upside targets shared by a number of analysts, together with Commonplace Chartered.

These worth predictions hinge on how macro situations unfold, notably Fed coverage, inflation tendencies, and US jobs knowledge.

Associated: Spot BTC, ETH ETFs see outflows as inflation ticks up beneath Trump tariffs

As of Tuesday, futures markets priced a 90% probability of a Fed price minimize in September, in contrast with roughly 80% a month earlier, in line with CME.

A key threat is the bearish divergence on Bitcoin’s weekly chart: worth is making greater highs whereas RSI tendencies decrease.

The identical setup preceded the November 2021 peak, resulting in a 70% decline, elevating warning amongst merchants for now.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.