Crypto firm The Ether Machine secured $654 million in a non-public financing spherical, accumulating 150,000 Ether from outstanding Ethereum advocate Jeffrey Berns.

The funds might be transferred to the corporate’s pockets later this week, in response to a Tuesday report by Reuters. Berns, recognized for his early investments in Ethereum infrastructure and Web3 initiatives, will be part of the board of administrators.

The increase is a part of the corporate’s broader technique to construct a considerable Ether (ETH) treasury forward of its anticipated Nasdaq debut later this yr.

The Ether Machine was fashioned by means of a merger between the Ether Reserve and blank-check agency Dynamix Company. Whereas the preliminary purpose was to boost over $1.5 billion from traders, together with Blockchain.com, Kraken and Pantera Capital, the agency has since adjusted its technique.

Associated: Who owns probably the most Ether in 2025? The ETH wealthy record, revealed

Ether Machine to go public with 495,000 ETH

The Ether Machine is now anticipated to go public whereas holding over 495,000 ETH, valued at about $2.16 billion, and an extra $367 million earmarked for future ETH acquisitions, per Reuters.

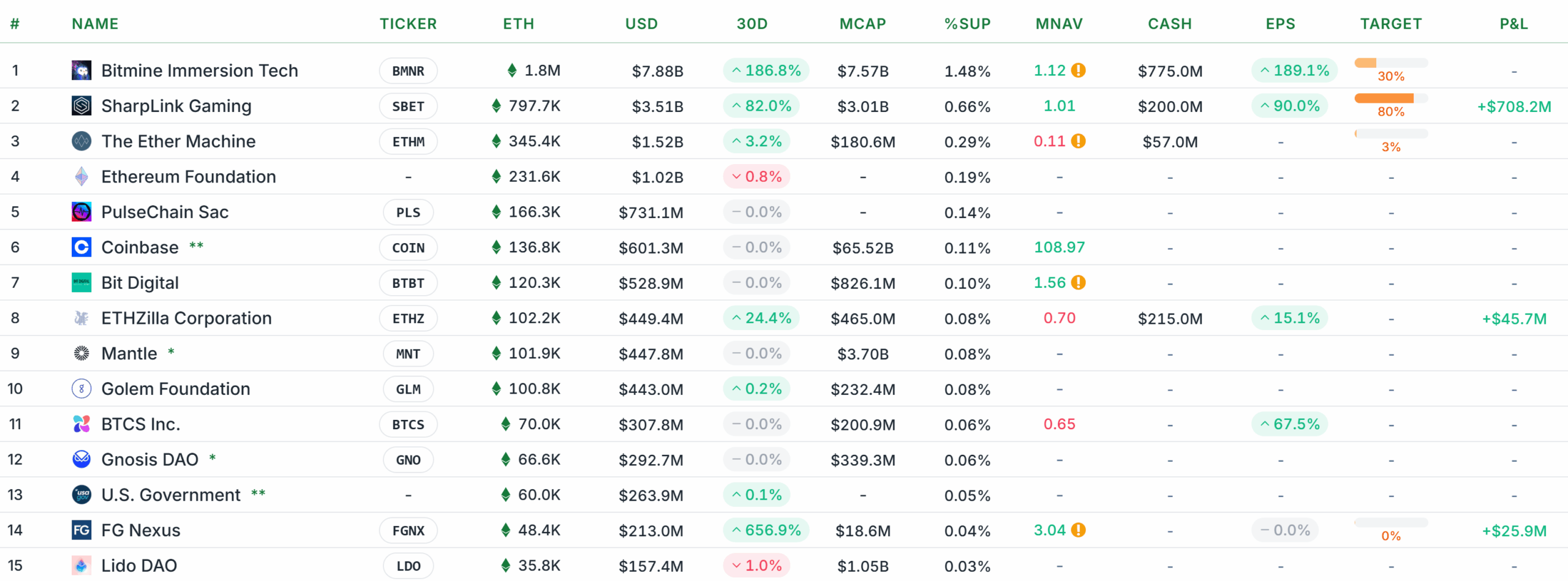

In response to StrategicETHReserve information, The Ether Machine is at the moment the third-largest company holder of ETH with over 345,400 cash, outdistancing the Ethereum Basis’s reported 231,600 ETH.

Treasury corporations like Ether Machine usually make the most of convertible debt and most well-liked fairness to boost capital whereas preserving their internet asset worth per share. In response to co-founder and chairman Andrew Keys, the corporate’s onchain yield era technique is anticipated to outperform conventional exchange-traded funds (ETFs).

“Between debt issuance and yield mechanics, we imagine we are able to preserve a market premium over our internet asset worth indefinitely,” Keys instructed Reuters.

Ether Machine can also be launching a 3rd capital increase led by Citibank. Keys mentioned the brand new spherical is concentrating on at the least $500 million and can begin on Wednesday.

Associated: Ether breaks beneath ‘Tom Lee’ trendline: Is a ten% incoming?

$11 billion Bitcoin whale rotates into Ether

A mysterious Bitcoin whale price greater than $11 billion has steadily rotated funds into Ether. The investor just lately offered $215 million price of Bitcoin to amass $216 million in spot Ether through Hyperliquid, bringing their whole ETH holdings to 886,371 ETH, now valued at over $4 billion.

The whale first started rotating funds on Aug. 21, exchanging $2.59 billion in BTC for a $2.2 billion ETH spot place and $577 million in ETH perpetual longs. After closing a part of the leveraged place with $33 million in revenue, the investor resumed shopping for spot Ether.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder