Key takeaways:

-

Bitcoin worth recaptures $110,000, however bearish stress persists.

-

BTC should flip the $110,500-$112,000 zone into new help to keep away from a deeper correction towards $100,000.

Bitcoin (BTC) worth was up on Tuesday, rising 2.4% over the previous 24 hours to commerce above $110,000. Nonetheless, whereas some indicators pointed to an area backside, different metrics advised the BTC market construction remained “fragile,” in line with Glassnode.

Bitcoin merchants undertake “defensive stance”

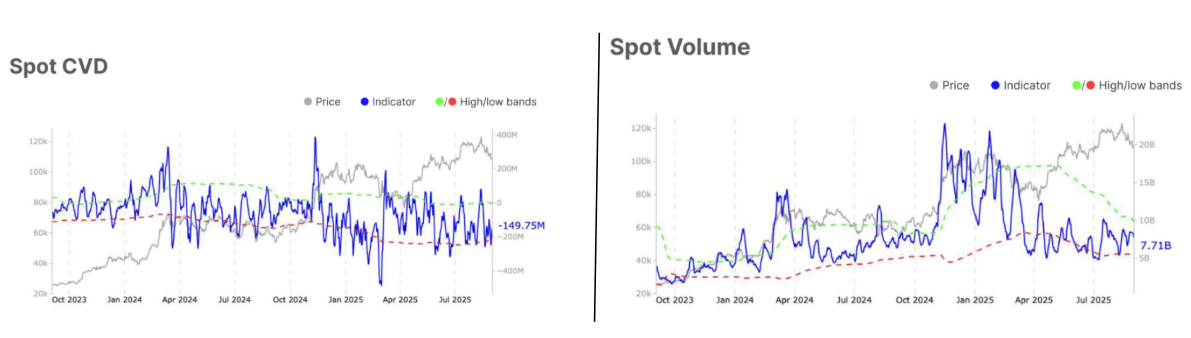

Bitcoin’s spot demand was subdued over the previous week, with buying and selling quantity falling to $7.7 billion from $8.5 billion, a 9% lower, Glassnode information reveals.

The decline in spot quantity “indicators waning investor participation,” the market intelligence agency stated in its newest Weekly Market Pulse report, including that decrease volumes mirror “weaker conviction” amongst merchants.

Whereas spot Cumulative Quantity Delta (CVD) has improved barely, indicating easing promoting stress, “total spot metrics level to a fragile demand,” Glassnode added.

The futures market confirmed cautious positioning, with futures open curiosity (OI) lowering to $45 billion from $45.8 billion. This advised reasonable unwinding of positions and a shift towards risk-off conduct, as merchants confirmed lowered demand for leverage following the drawdown from all-time highs.

Futures funding charges dropped to $2.8 billion from $3.8 billion, signalling much less demand for lengthy publicity and unwillingness to pay greater premiums to maintain positions open.

Glasnode stated:

“Merchants seem much less prepared to increase danger, underscoring a defensive stance after current volatility.”

As Cointelegraph reported, Bitcoin institutional buyers had been stepping again, with demand plunging to its lowest stage since early April.

Key Bitcoin worth ranges to look at

Bitcoin bounced off the decrease boundary of the descending parallel channel at $107,300 on Monday, rising 2.45% to the present ranges round $110,000.

The value was combating resistance from the higher boundary of the channel at $110,500. A day by day candlestick shut above this stage would sign a attainable breakout from the downtrend, with the subsequent barrier on the $110,000-$117,000 liquidity zone, the place each the 50-day easy transferring common (SMA) and the 100-day SMA are.

Bulls should push BTC worth above this space to extend the possibilities of a restoration towards new all-time highs.

The center boundary of the channel at $108,000 and Monday’s low round $107,300 had been the rapid help ranges to look at on the draw back.

Beneath that, the channel’s decrease boundary at $105,300 offered a final line of protection, which, if misplaced, would doubtless set off a drop towards the important thing help stage at $100,000.

MN Capital Founder Michael van de Poppe stated {that a} “clear break” above $112,000 was wanted to take BTC to new all-time highs.

“In any other case, I would be taking a look at $103Kish for a terrific alternative.“

The world stays the identical for $BTC.

If we are able to clearly break $112K, we’ll be onto a brand new ATH.

In any other case, I would be taking a look at $103Kish for a terrific alternative.

Curiously sufficient, Gold is but to make a brand new ATH.

When Bitcoin? pic.twitter.com/JDruy5ba8O

— Michaël van de Poppe (@CryptoMichNL) September 2, 2025

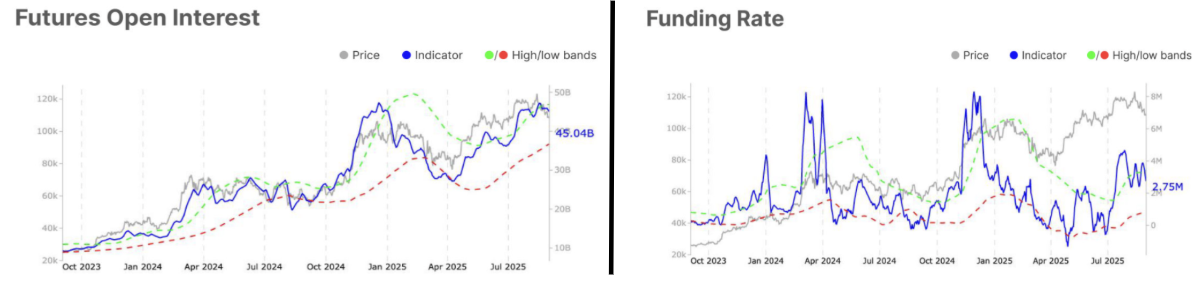

In the meantime, the Bitcoin liquidity map revealed important liquidity clusters between $110,000 and $111,000 on the upside, and $105,500-$107,000 beneath spot worth.

Merchants have to maintain a watch out for these areas as they usually act as native reversal zones and/or magnets when the value will get near them.

Bitcoin is on a “liquidity hunt,” stated analyst AlphaBTC in a Tuesday publish on X, including:

“Seems to be like they’re coming for that massive cluster of shorts 110K-111K, then doubtless again to run the Monday low and the longs from the weekend.”

As Cointelegraph reported, Bitcoin must rapidly reclaim the 20-day EMA at $112,500; failure to take action will enhance the opportunity of a drop to $105,000 after which to $100,000.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.