Former kickboxing champion and controversial influencer Andrew Tate is as soon as once more again to cryptocurrency buying and selling, after a monetary loss on Kanye West’s YZY token.

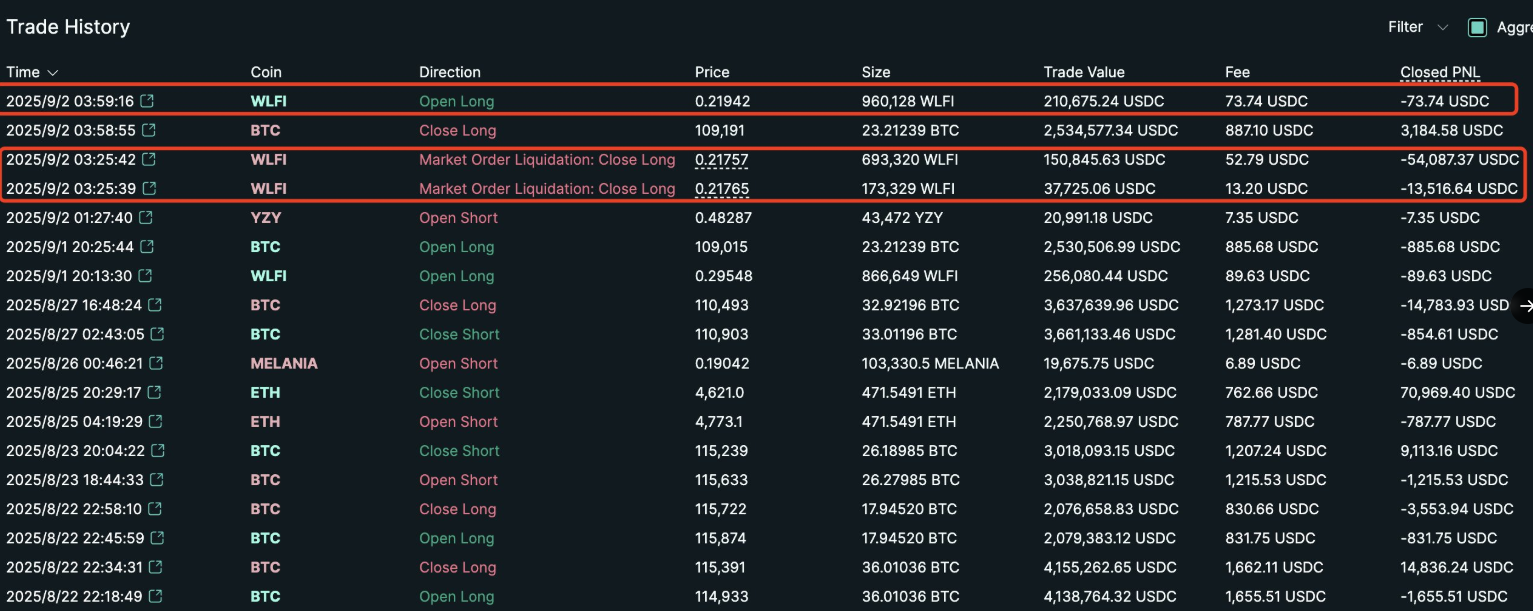

Andrew Tate’s lengthy place on the Trump family-linked World Liberty Monetary (WLFI) token was liquidated for a complete lack of $67,500 earlier Tuesday on decentralized change Hyperliquid.

Regardless of the Loss, Tate continued betting on the WLFI token’s worth appreciation, “instantly” opening one other lengthy place, based on blockchain knowledge platform Lookonchain in a Tuesday X publish.

The liquidation occurred lower than two weeks after Tate opened a 3x leveraged brief place on the Kanye West-linked YZY token, as his cumulative losses neared $700,000 on a single Hyperliquid account.

Tate’s loss got here a day after the Trump family-tied decentralized finance mission World Liberty Monetary’s WLFI token began buying and selling on exchanges on Monday.

WLFI fell about 36% after itemizing, from a peak of $0.331 to a low of $0.210, earlier than recovering barely to commerce above $0.2420 as of 8:42 am UTC. The WLFI token is down over 21% since launch, CoinMarketCap knowledge exhibits.

Associated: Crypto in US 401(okay) retirement plans could drive Bitcoin to $200K in 2025

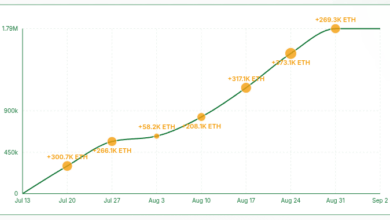

A big token unlock added 24.6 billion tokens to WLFI’s circulating provide on Monday, growing the Trump household’s holdings to $5 billion.

The mission beforehand stated that the WLFI allocations can be initially locked for the founders, together with Donald Trump and his three sons, Donald Trump Jr., Barron Trump and Eric Trump.

Associated: Ether dealer practically worn out after epic run from $125K to $43M

WLFI floats token buyback proposal after 36% dip

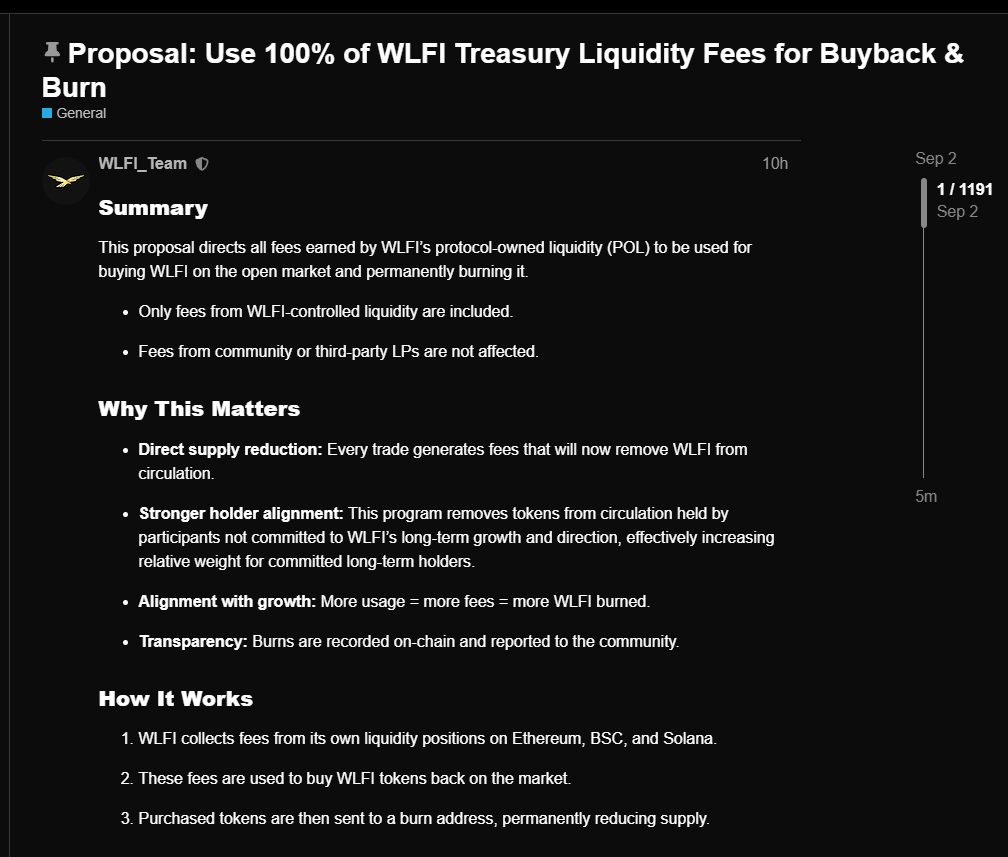

Following the WLFI token’s post-launch dip, the platform issued a brand new governance proposal to implement a token buyback and burn program utilizing protocol-owned liquidity charges.

WLFI proposed utilizing 100% of protocol charges generated from the platform’s personal liquidity positions throughout Ethereum, BNB Chain and Solana to purchase again WLFI tokens from brief sellers on the open market and completely take away them from circulation by way of burning.

Related mechanisms search to cut back the circulating provide of a token and create extra demand by buybacks.

At publication, nearly all of respondents had expressed help for the governance proposal.

Nonetheless, the proposal doesn’t embrace the platform’s generated payment quantities, making it troublesome to estimate the potential market impression the token buybacks can have on WLFI.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder