Key factors:

-

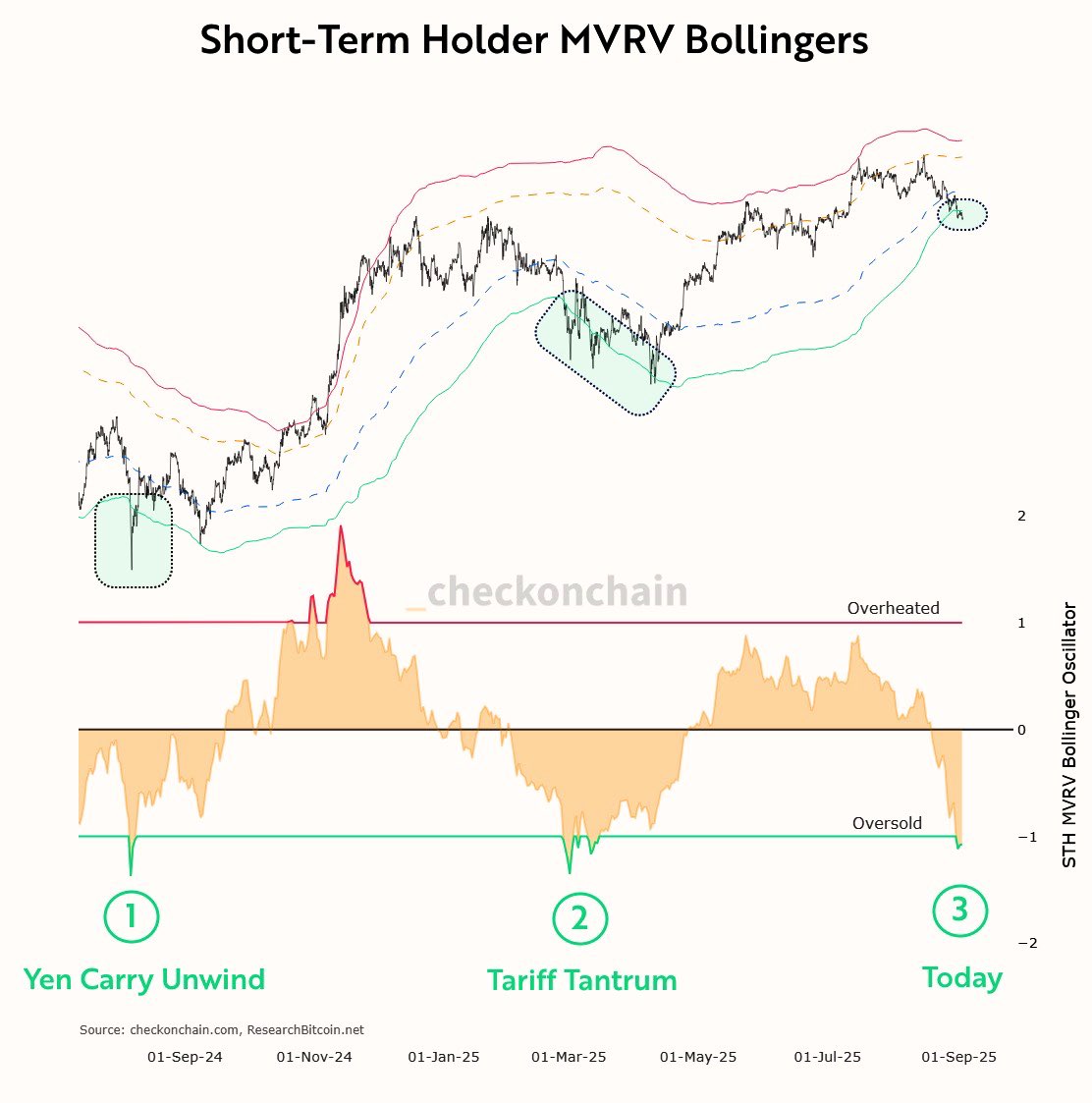

Bitcoin short-term holders are on the heart of an “oversold” sign seen solely twice up to now 12 months.

-

Each events marked long-term BTC value bottoms inside the present bull market.

-

Bitcoin RSI indicators on low timeframes proceed to trace at a bullish market reversal.

Bitcoin (BTC) has printed a brand new sign that has solely appeared throughout native bull market bottoms.

New findings uploaded to X on Sept. 1 by Frank Fetter, a quant analyst at funding agency Vibes Capital Administration, present a key hodler capitulation occasion.

Bitcoin bulls achieve key “oversold” print

Bitcoin speculators have reached a key revenue threshold as BTC/USD falls to its lowest ranges for the reason that begin of July.

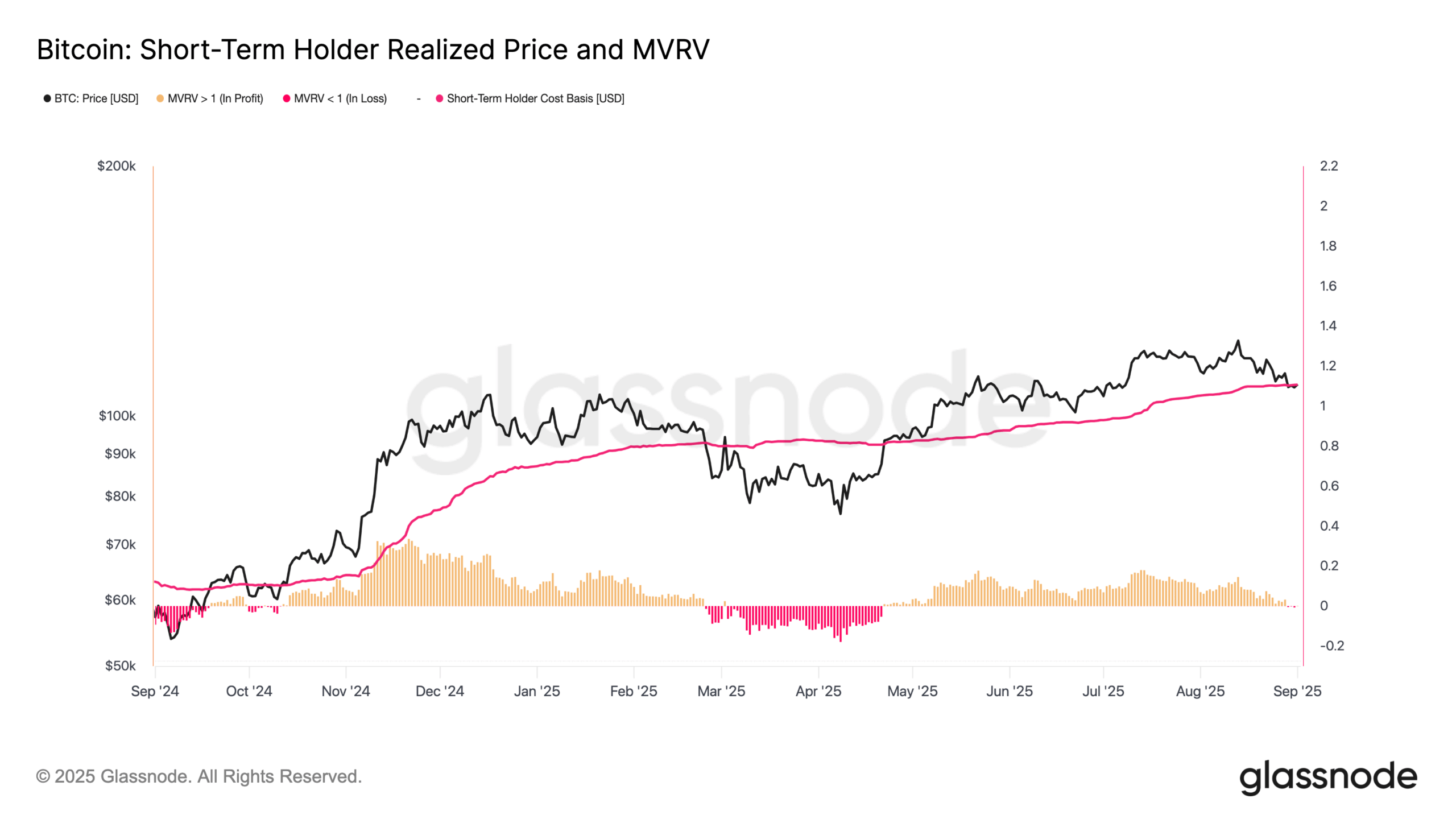

The combination value foundation or realized value of the short-term holder (STH) cohort — entities hodling for as much as six months — now corresponds to the spot value.

That degree tends to behave as help throughout Bitcoin bull market corrections, however shedding it conversely results in prolonged durations of BTC value weak spot.

A number one indicator, Market Worth to Realized Worth (MVRV), measures the worth of hodled cash to the worth at which they final moved onchain.

At present costs, MVRV for the STH cohort is at breakeven. As Fetter notes, nevertheless, including the Bollinger Bands volatility indicator to the combo delivers a key “oversold” sign.

“Formally bought the Oversold print on the short-term holder MVRV bollinger bands,” he confirmed.

The Bands, themselves a number one value indicator, supply commonplace deviation ranges that permit observers to gauge how uncommon given ranges are — on this case, STH-MVRV values.

Fetter notes that draw back deviation on STH-MVRV has solely occurred twice up to now 12 months.

In August 2024, when the Japanese yen carry commerce unwound, STH-MVRV fell beneath the decrease Bollinger Band commonplace deviation line. The identical factor occurred in April this 12 months, when US commerce tariffs induced BTC/USD to drop beneath $75,000.

Bitcoin RSI bullish divergences are nonetheless in play

Bitcoin value motion itself is now teasing a rebound after “strolling down” the underside Bollinger Band via late August.

Associated: BTC vs. ‘very bearish’ gold breakout: 5 issues to know in Bitcoin this week

As Cointelegraph reported, indicators that the newest correction might be coming to an finish first appeared in low-timeframe relative energy index (RSI) readings.

4-hour RSI started to print a bullish divergence with value over the weekend, a sample which continues to play out, information from Cointelegraph Markets Professional and TradingView confirms.

On Monday, in the meantime, MVRV delivered a “dying cross” on the every day chart, suggesting that draw back stress was not but over.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.