Federal Reserve U.S. Curiosity-Charge Reduce Might Spark a Revival in BTC’s Foundation Commerce

The massive query for bitcoin is whether or not the idea commerce, an try to revenue from the distinction between the spot worth and the futures market, will return if the Federal Reserve cuts rates of interest on Sept. 17.

There is a 90% probability the Federal Open Markets Committee will reduce the federal funds goal charge by 25 foundation factors from its present 4.25%-4.50% vary, in line with the CME FedWatch instrument. A shift towards simpler coverage may spark renewed demand for leverage, pushing futures premiums increased and respiratory life again right into a commerce that has remained subdued all through 2025.

The premise commerce entails shopping for bitcoin within the spot market or via an exchange-traded fund (ETF) whereas promoting futures (or vice versa) to revenue from the value distinction. The purpose is to seize the unfold because it narrows towards expiry, whereas limiting publicity to bitcoin’s worth volatility.

With fed funds nonetheless simply above 4%, an 8% foundation — the annualized return on the idea commerce — could not look enticing till charge cuts start to speed up. Buyers are more likely to need decrease charges to incentivize them to enter the idea commerce relatively than simply holding money.

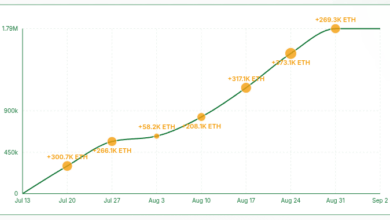

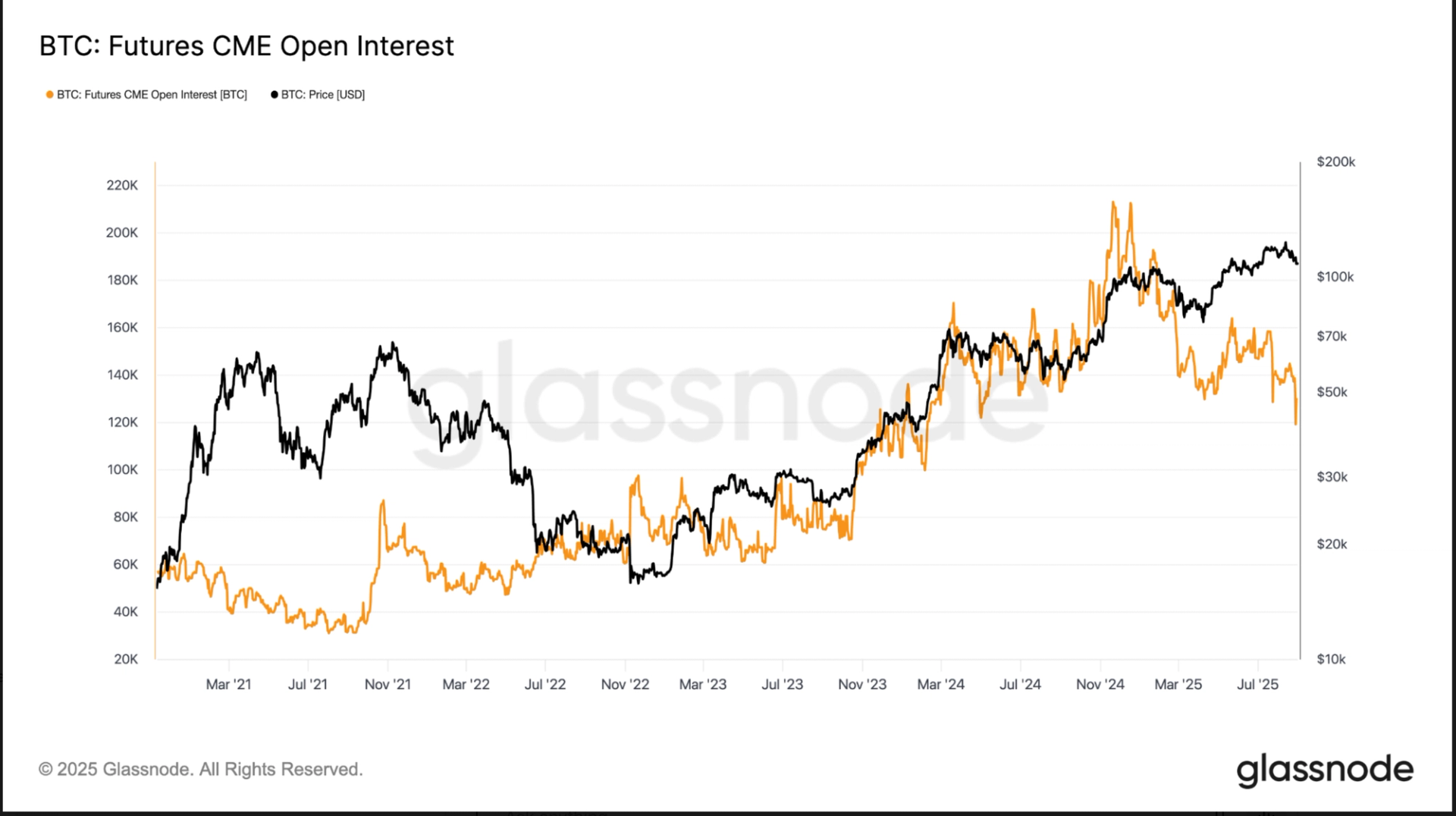

On CME, bitcoin futures open curiosity has slumped from greater than 212,000 BTC initially of the 12 months to round 130,000 BTC, in line with Glassnode information. That is roughly the extent seen when spot bitcoin ETFs launched in January 2024.

The annualized foundation has stayed under 10% all 12 months, in line with Velo information, a hanging distinction with the 20% seen towards the top of final 12 months. The weak point displays each market and macro forces: tighter funding circumstances, ETF inflows slowing after 2024’s growth and a rotation of danger urge for food out of bitcoin.

Bitcoin’s compressed buying and selling vary has bolstered the development. Implied volatility, a gauge of anticipated worth swings, is at simply 40 after hitting a report low of 35 final week, Glassnode information reveals. With volatility suppressed and institutional leverage mild, futures premiums have remained capped.

If the Fed cuts charges, liquidity circumstances may ease, boosting demand for danger property. That in flip could raise CME futures open curiosity and revive the idea commerce after a 12 months of stagnation.