It is a each day evaluation by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

XRP: Prints spinning backside

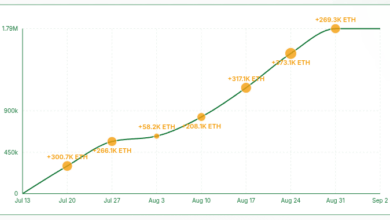

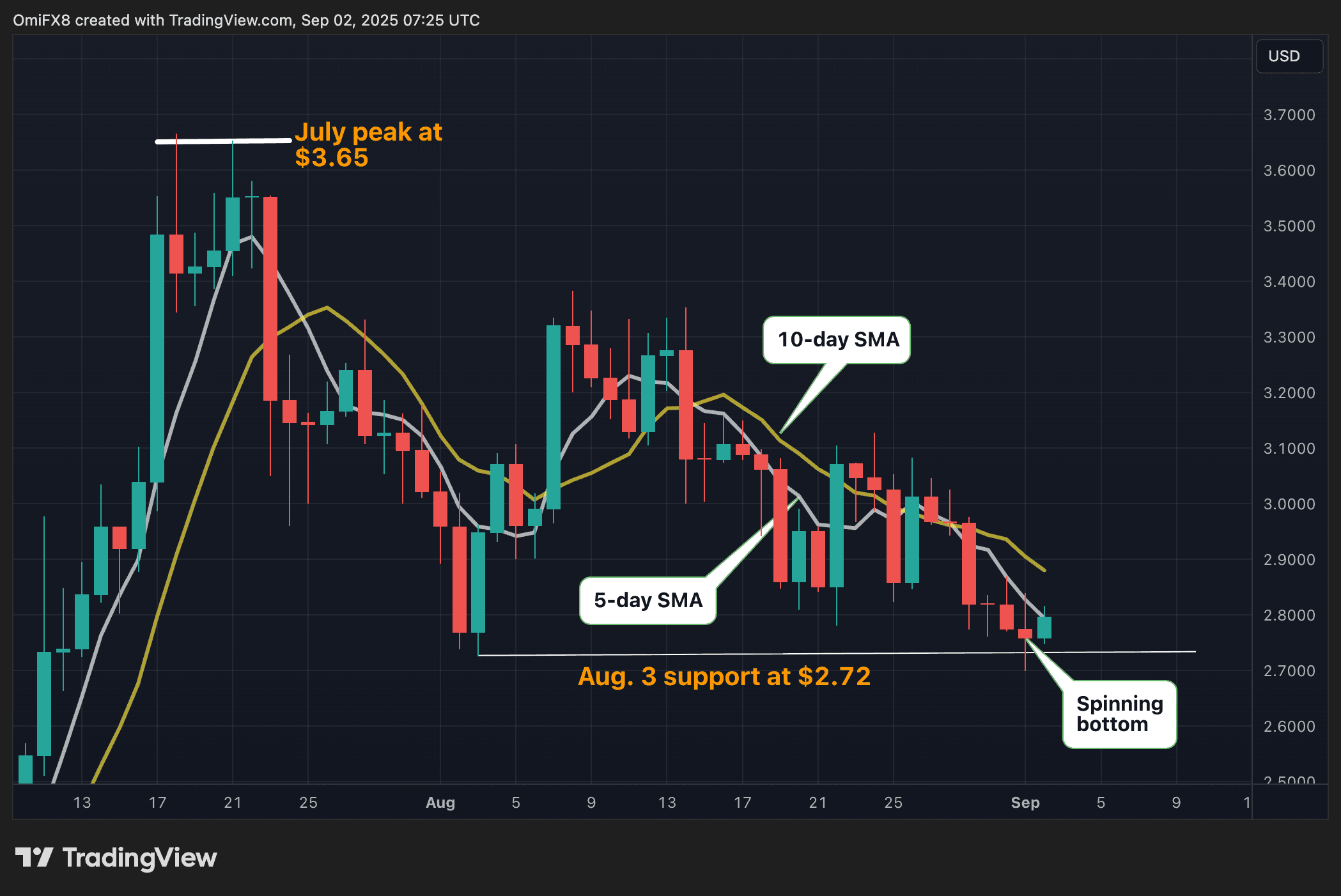

XRP chalked out a “spinning backside” candlestick sample on Monday, which happens when costs swing backwards and forwards in a broad vary, however finish the day close to the opening value. The shadows representing the intraday excessive and low point out that each patrons and sellers had been energetic, however neither aspect might acquire a dominant place.

When the sample seems after a notable value drop and at key help, as in XRP’s case, it alerts that the promoting strain could also be waning and patrons are stepping in to defend the worth.

As seen on the each day chart, XRP’s spinning backside has appeared following a 25% pullback from the July peak of $3.65 and at a key help stage close to the August 3 low, a degree the place the market beforehand rebounded sharply.

XRP’s spinning backside doesn’t assure an instantaneous bullish transfer, but it surely acts as an early warning of a possible bullish pattern reversal. Technical analysts and merchants sometimes search for affirmation from subsequent value motion—reminiscent of a bullish candle closing above the spinning backside’s excessive.

In different phrases, focus is on Monday’s excessive of $2.84, with XRP presently altering arms at $2.80.

Not out of the woods but

The 5- and 10-day easy transferring averages, extensively used to filter out short-term market noise, proceed to pattern downward, signaling ongoing bearish momentum. Moreover, the Guppy a number of transferring common band has just lately turned bearish, with the bearish sign remaining intact as of now.

In different phrases, momentum stays tilted in favor of sellers, and, if Monday’s low of $2.69 is breached, XRP might expertise a sharper decline

Bullish undercurrents?

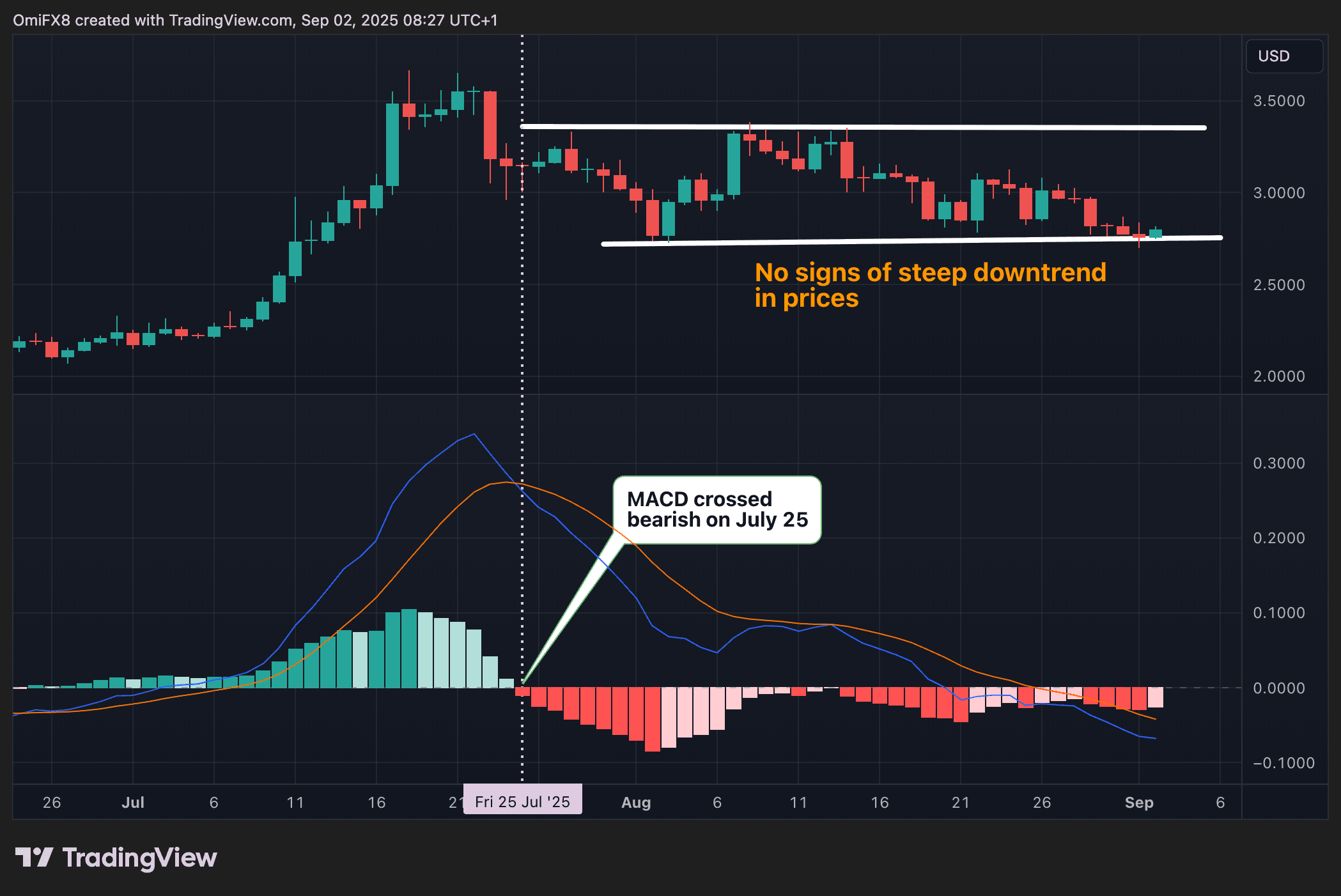

The MACD histogram, an indicator gauging momentum utilizing 12- and 26-week exponential transferring averages, has been persistently detrimental since late July. Nonetheless, XRP’s value has not skilled a steep downtrend, basically buying and selling between $2.70 and $3.00.

The relative resilience of costs means a possible bullish crossover of the MACD might mark the onset of a pointy rally. The BTC market displayed the same dynamic in September final yr when it traded beneath $60,000.

- Help: $2.69 (Monday’s low), $2.65 (the swing excessive from Could), $2.48 (the 200-day SMA)

- Resistance: $2.84 (Monday’s excessive), $3.38 (the August excessive), $3.65 (the July excessive).

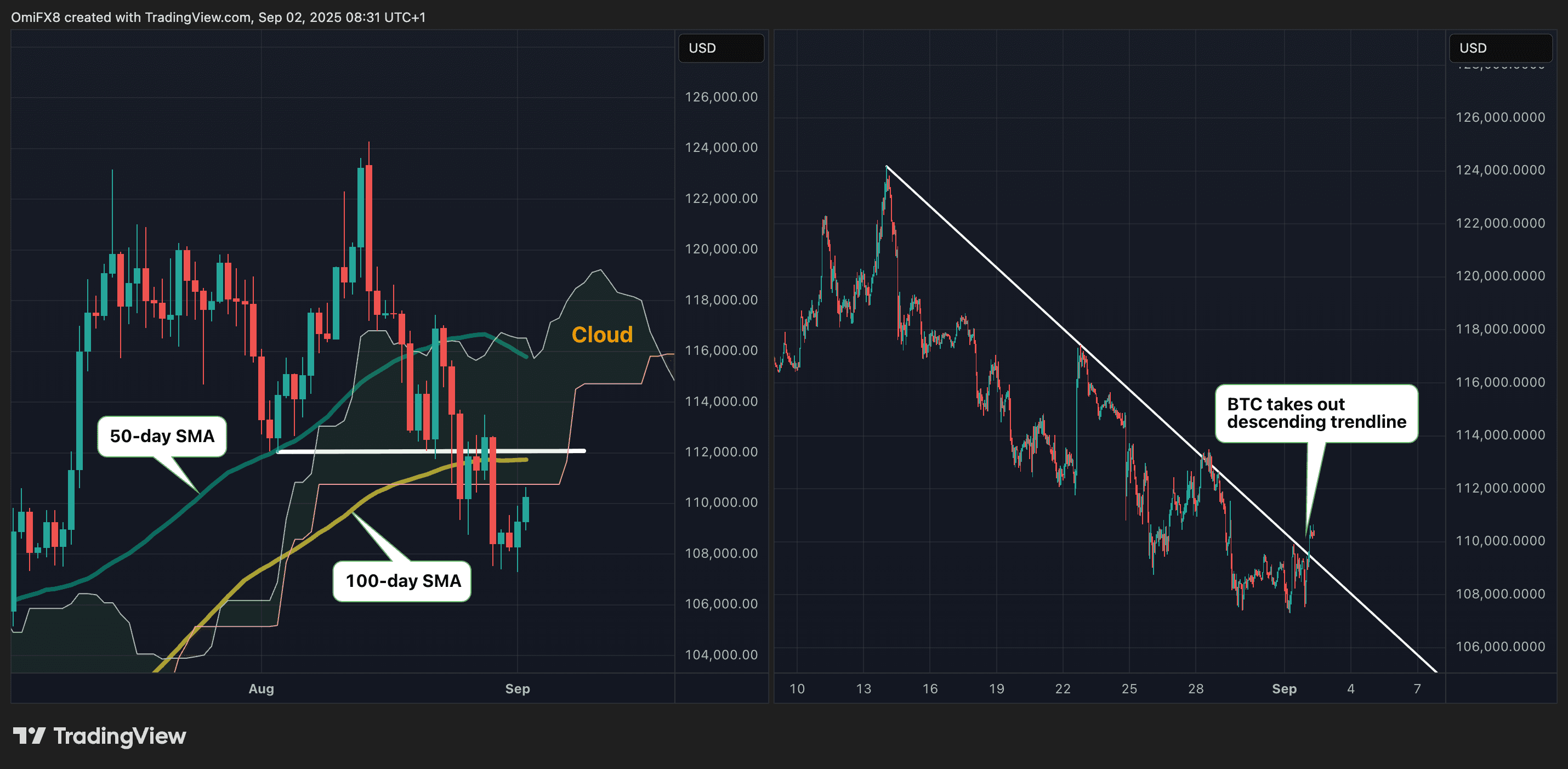

Bitcoin takes out key trendline

BTC has surged previous a descending trendline that marked the pullback from file highs above $124,000. Nonetheless, the instant outlook stays bearish as costs keep beneath key resistance ranges, together with the Ichimoku cloud, the 50- and 100-day easy transferring averages, and the August 3 low. Moreover, a bearish divergence is clear within the RSI on the month-to-month chart.

Taken collectively, these alerts paint a bleak image of the market, the place upward strikes might encounter promoting strain. A transparent negation of this bearish outlook would require BTC to efficiently break and maintain above the Ichimoku cloud, which presently acts as a important resistance zone.

- Help: $107,286 (Monday’s low), $100,000, $98,330 (the swing low from June 22).

- Resistance: $110,756 (the Ichimoku cloud), $111,728 (the 100-day SMA), $115,780 (the 50-day SMA).

Learn extra: Bitcoin Floats Round $110K as Merchants Look Towards Friday Knowledge for Upside