Chinese language Traders Borrow Document Quantity o Purchase Native Shares, Signaling Threat-On Momentum

Chinese language buyers have borrowed a report quantity to purchase native shares, providing risk-on cues to international markets, together with cryptocurrencies. Nevertheless, crypto merchants nonetheless look like extra cautious.

In response to Bloomberg, margin trades excellent in China’s onshore fairness market surged to 2.28 trillion yuan ($320 billion) on Monday, surpassing the earlier 2015 peak of two.27 trillion yuan.

Margin buying and selling, which includes borrowing cash from brokers to buy securities, represents a type of leverage that displays buyers’ threat urge for food and confidence out there.

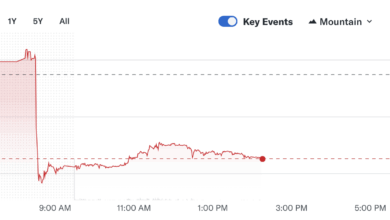

This report surge in margin trades underscores a powerful risk-on sentiment amid the continuing inventory rally. The Shanghai Composite Index has climbed 15% this 12 months, outpacing the S&P 500’s roughly 10% achieve, whereas the broader CSI 300 Index has superior 14%.

Nevertheless, as MacroMicro factors out, this new excessive is happening towards a backdrop of slowing financial development, not like 2015 when China’s GDP was comparatively stronger.

“CSI 300 at decade highs. Borrowed cash chasing shares in a shrinking economic system,” information monitoring agency MacroMicro famous on X, including that the present rally seems extra measured than 2015’s, with broader sector participation past AI and chips, and a bigger deposit base offering some assist.

“But deflationary pressures proceed to erode company pricing energy—ahead earnings are down 2.5%—making debt-funded positions riskier when firms can not elevate costs,” the agency famous.

The potential unwinding of the report excessive margin debt in Chinese language shares may set off important volatility, with potential spillover results throughout international markets.

Average risk-on in crypto

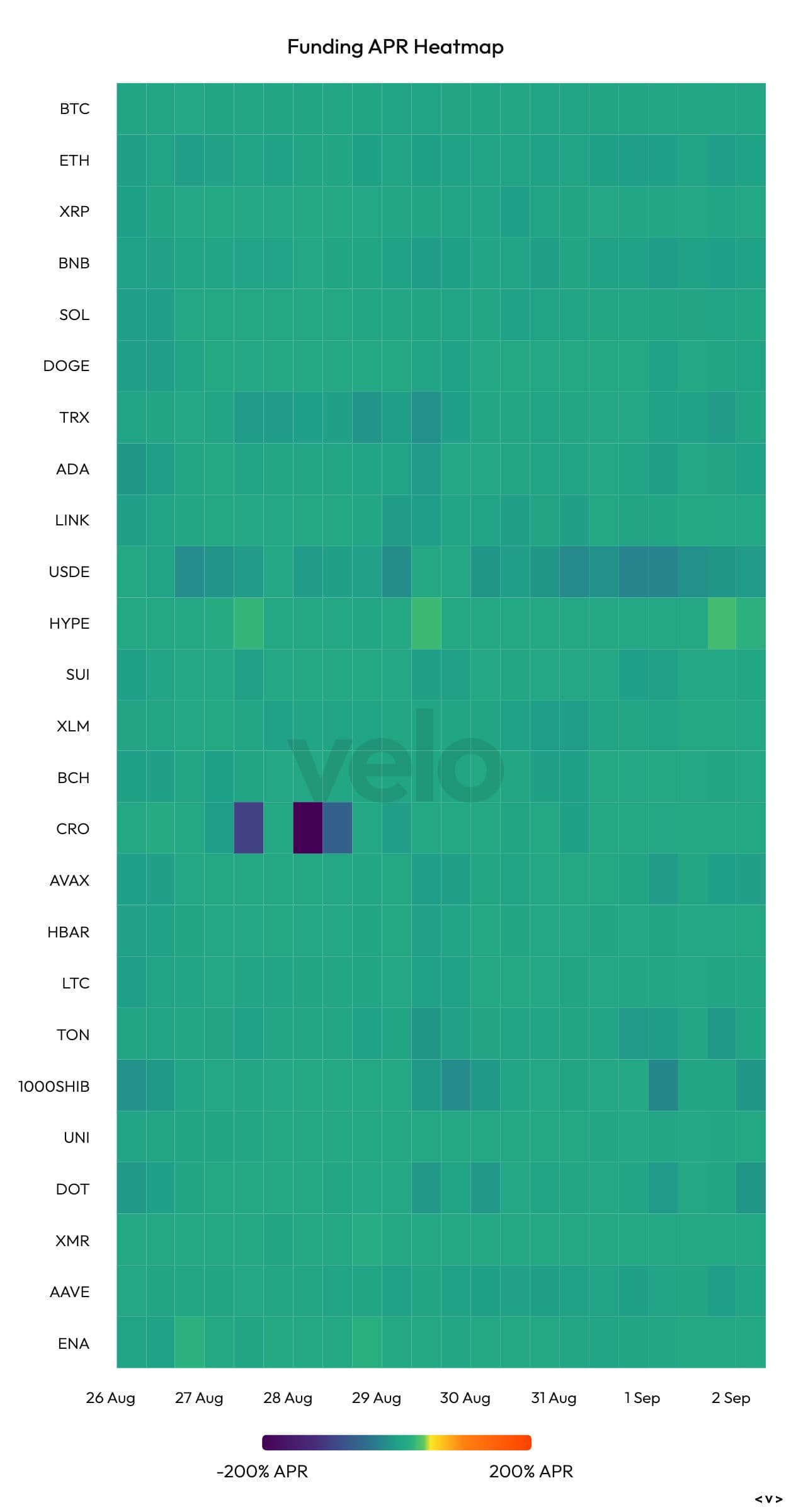

Whereas there isn’t any standardized metric to measure margin debt throughout your entire crypto business, merchants typically use perpetual funding charges as a proxy to gauge general demand for leverage. These charges point out the price of holding leveraged positions and mirror market sentiment towards threat.

Presently, funding charges for the highest 25 cryptocurrencies are hovering between 5% and 10%, signaling a reasonable degree of bullish leverage amongst merchants. This means that whereas there may be demand for leveraged lengthy positions, market contributors stay cautious, putting a steadiness between optimism and threat administration.

Learn extra: Bitcoin Floats Round $110K as Merchants Look In the direction of Friday Information for Upside