Key takeaways:

-

Bitcoin whales rotating billions of {dollars} into Ether spotlight weakening conviction in Bitcoin’s $108,000 help amongst main gamers.

-

Bitcoin derivatives present rising liquidation dangers with $390 million in leveraged longs at peril beneath $107,000.

Bitcoin (BTC) has traded inside a slim 2.3% vary because the sharp decline from $112,500 on Friday. The absence of momentum can partly be attributed to regulated markets being closed for the US Labor Day vacation, however Bitcoin derivatives markets point out a rising insecurity within the $108,000 help degree.

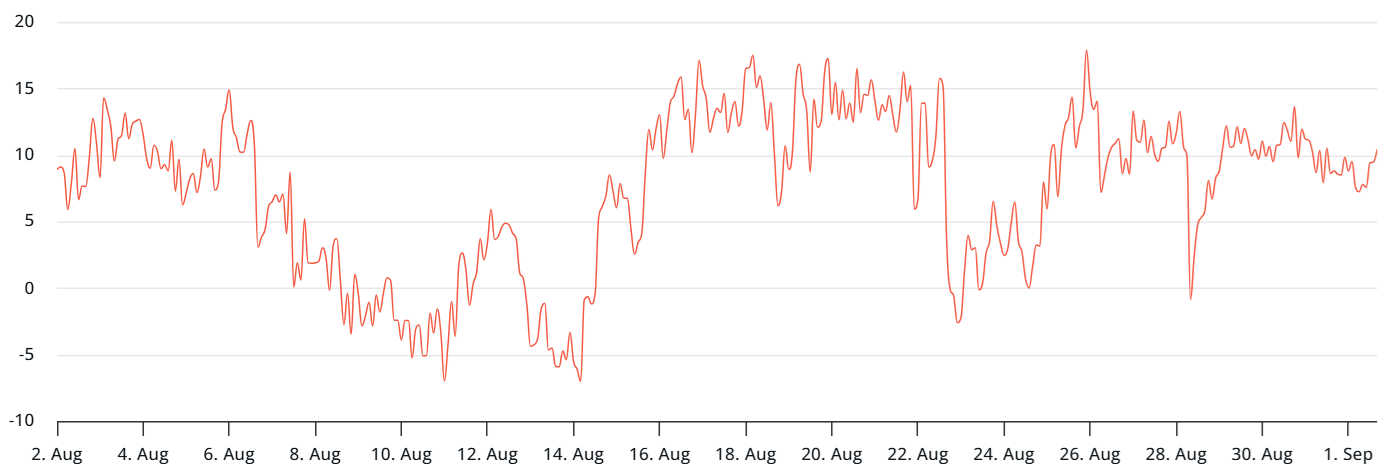

The Bitcoin month-to-month futures annualized premium presently sits at 7%, which is firmly inside the impartial 5% to 10% vary and flat in comparison with the earlier week. The indicator final confirmed indicators of bullishness on Aug. 24, following the rally to $117,000 after US Federal Reserve Chair Jerome Powell’s speech raised hopes for a much less restrictive financial coverage.

Bitcoin value decouples from gold amid whale promoting strain

The value of gold has gained 2.1% since Friday, worsening Bitcoin merchants’ sentiment because the cryptocurrency posted a 12.5% decline from the Aug. 14 all-time excessive. Traders are questioning whether or not the current downturn displays broader danger aversion or components distinctive to Bitcoin, notably after some long-time holders determined to liquidate a part of their positions.

A Bitcoin whale who had beforehand held for greater than 5 years started rotating funds into Ether (ETH) on Aug. 21, promoting $4 billion value of Bitcoin by means of the decentralized alternate Hyperliquid. The motion highlights a “rotation” as altcoins seem to profit from increasing company accumulation, in response to Nicolai Sondergaard, analysis analyst at crypto intelligence platform Nansen.

Bitcoin put (promote) choices are buying and selling at a 7% premium in comparison with name (purchase) devices, in response to the Deribit skew metric. This sort of imbalance is widespread in bearish markets, and the indicator has remained above the impartial 6% threshold for the previous week. Whales and market makers present little confidence that the $108,000 help degree will maintain.

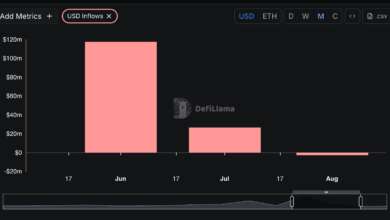

The $127 million web outflows from US spot Bitcoin exchange-traded funds on Friday present one other signal of discomfort amongst holders. Whether or not the sell-off stems from broader macroeconomic uncertainty or Bitcoin-specific weak point, merchants are more and more involved, as mirrored in BTC derivatives. In the meantime, yields on United Kingdom 20-year authorities bonds surged to their highest ranges since 1998.

Associated: Is Warren Buffett’s rising money pile a nasty signal for shares and Bitcoin?

Traders are demanding larger returns to carry authorities bonds, signaling expectations of both stronger inflation or depreciation of home currencies. In both case, rising long-term yields improve financing prices for future debt rollovers and new issuance. Even hypothesis round such dangers may additional pressure nationwide funds and probably spill over into the eurozone attributable to ongoing fiscal considerations.

$390 million in bullish leveraged positions face liquidation if Bitcoin’s value falls beneath $107,000, in response to CoinGlass estimates. Nonetheless, the near-term outlook for Bitcoin doubtless hinges on US job market knowledge due Friday. A possible uptick in unemployment may act as a constructive catalyst for risk-on belongings, as it might improve strain on the Federal Reserve to speed up rate of interest cuts.

This text is for normal info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don’t essentially replicate or symbolize the views and opinions of Cointelegraph.