Lee Eok-won, the nominee to go South Korea’s Monetary Providers Fee, drew heavy criticism this week after dismissing crypto as missing any actual worth in his written testimony forward of affirmation hearings, native media reported on Sept. 1.

Lee stated digital belongings don’t possess intrinsic value in the identical method as equities or financial institution deposits, and argued that their value swings undermine their potential to behave as cash. He additional acknowledged that the intense volatility skilled by digital belongings makes them unsuitable as a retailer of worth or as a medium of trade.

Lee’s place is in line with the federal government’s view that digital belongings are neither authorized tender nor monetary merchandise beneath the monetary regulatory regime.

The FSC chair nominee warned in opposition to permitting retirement and pension funds to spend money on the sector however expressed openness to regulating stablecoins, noting that they could possibly be managed with safeguards whereas leaving room for innovation.

Business pushback

The nation’s blockchain sector rejected the remarks, with many within the business arguing that the assertion ignores the income and adoption being generated throughout the business.

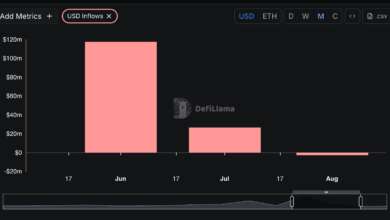

Since 2022, crypto adoption in South Korea has surged from about 9.7 million traders to greater than 16 million by early 2025, representing over 30% of the inhabitants and rising greater than 60% in simply over two years.

Buying and selling exercise on native exchanges has at instances exceeded inventory market volumes, and complete holdings have climbed above 102 trillion KRW ($70 billion), highlighting how digital belongings have quickly change into a mainstream funding selection for South Koreans.

An analyst at Xangle, a neighborhood information agency, accused Lee of counting on outdated arguments as soon as frequent amongst conventional finance leaders.

He pointed to latest token buybacks and income streams from platforms like Hyperliquid, Tron, and Ethena as proof of worth creation similar to company inventory buybacks.

Coverage warning vs. retail demand

South Korean regulators have strengthened restrictions in latest months as retail curiosity continues to climb within the nation.

The Monetary Supervisory Service suggested home asset managers to reduce holdings in crypto-related shares, whereas the FSC ordered exchanges to cease offering lending providers backed by digital belongings or fiat deposits.

Regardless of the tighter stance, retail enthusiasm for crypto continues to climb. Traders bought off lots of of tens of millions of {dollars}’ value of Tesla inventory in August, the biggest disposal since early final 12 months, whereas directing funds into crypto proxies like BitMINE, which just lately turned the most important Ethereum holder.

Information additionally confirmed a steep decline in South Korean purchases of main U.S. tech shares in contrast with earlier this 12 months.

The contrasting positions between regulators and traders go away open questions on how President Lee Jae-myung’s administration will steadiness warning with the general public’s rising urge for food for digital belongings.