Metaplanet achieves 20,000 BTC milestone amid shareholder-approved $2.8B treasury development plan

Metaplanet acquired 1,009 Bitcoin (BTC) for about $112 million, bringing the Japanese agency’s whole holdings to twenty,000 BTC amid shareholder approval for an formidable plan so as to add $2.8 billion price of Bitcoin to its treasury via 2027.

The Tokyo-listed firm introduced the acquisition on Sept. 1, paying a mean value of 16.3 million yen ($110,720) per Bitcoin. The capital growth technique was voted on throughout Metaplanet’s Extraordinary Basic Assembly.

The acquisition pushes Metaplanet’s Bitcoin treasury worth to over $2.1 billion, cementing its place as Asia’s largest company Bitcoin holder. As well as, it makes the corporate the sixth-largest BTC holder globally, surpassing Riot Platforms.

EGM approves multi-billion greenback technique

In the course of the shareholder assembly, CEO Simon Gerovich outlined the corporate’s plan to accumulate 210,000 BTC by 2027, representing roughly 1% of Bitcoin’s whole provide.

The technique includes issuing as much as 555 million most popular shares, which might increase ¥555 billion ($3.8 billion), particularly for Bitcoin purchases.

Eric Trump attended the assembly as a strategic advisor to Metaplanet, collaborating in a fireplace chat with Gerovich. Trump praised the CEO’s management, stating that Gerovich represents “one of the trustworthy individuals I’ve ever met in my whole life” and calling the mixture of robust management and Bitcoin “a successful mixture.”

Gerovich then requested the over 3,000 attendees whether or not they would approve amending the corporate’s articles of incorporation to allow the issuance of most popular shares, to which they consented.

Two courses of shares

The authorized most popular shares plan consists of two courses of perpetual fairness choices. Class A shares will present a 5% yield, designed to compete with conventional fixed-income merchandise.

In the meantime, Class B shares carry the next threat however embody conversion choices into widespread inventory.

Gerovich highlighted Japan’s distinctive place for Bitcoin-backed financing, noting that the nation’s lowest rates of interest amongst G7 nations characterize “our hidden superpower.”

The popular shares are capped at 25% of the agency’s Bitcoin internet asset worth.

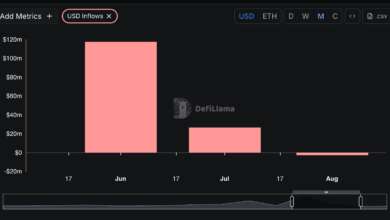

The acquisition comes as Metaplanet reported income for the second quarter reaching 11.1 billion yen ($75.1 million), representing a 41% quarter-on-quarter enhance.

The corporate’s Bitcoin revenue technology enterprise, primarily via the sale of put choices, contributed 1.9 billion yen ($12.9 million) in gross sales income in the course of the quarter.

Metaplanet was just lately upgraded to mid-cap standing in FTSE Russell’s September evaluate, incomes inclusion in each the FTSE Japan Index and FTSE All-World Index.

The plan to succeed in 210,000 BTC in its treasury would place Metaplanet alongside Technique on the listing of firms holding not less than 1% of Bitcoin’s provide.