RAK Properties, one of many largest publicly traded actual property firm within the Ras Al Khaimah emirate of the United Arab Emirates (UAE), will begin accepting cryptocurrency for worldwide property transactions.

In line with a Monday announcement, RAK Properties will start accepting funds in Bitcoin (BTC), Ether (ETH) and Tether’s USDt (USDT), amongst others. The transfer underscores the rising adoption of digital belongings within the UAE, a sector projected to turn into one of many nation’s largest within the coming years.

Crypto transactions shall be dealt with by Hubpay, a world funds platform primarily based within the area. Hubpay will convert digital belongings into the UAE’s native fiat forex earlier than depositing them into RAK’s accounts.

“By enabling and supporting using digital belongings, we’re partaking with a brand new ecosystem of digitally and funding savvy prospects […],” mentioned RAK Properties Chief Monetary Officer Rahul Jogani.

Ras Al Khaimah is the UAE’s fourth-largest emirate by space, with a inhabitants of about 400,000.

RAK Properties, listed on the Abu Dhabi Securities Alternate since 2005, has a market capitalization of 4.7 billion dirhams ($1.3 billion), in line with TradingView.

The developer is increasing in 2025 with 12 new initiatives, although the entire dimension of its portfolio stays unclear. Its web revenue rose 39% year-over-year, climbing to 281 million dirhams in 2024 from 202 million dirhams the 12 months earlier than.

Associated: Dubai and UAE transfer to align crypto frameworks underneath new partnership

Crypto adoption in UAE will increase

Crypto adoption within the United Arab Emirates has been rising steadily. The nation is among the most progressive for the crypto trade and has turn into a sought-after vacation spot for Web3 companies and buyers alike.

In line with Chase Ergen, a board member of digital asset funding firm DeFi Applied sciences, crypto is forecast to turn into the nation’s second-largest sector in 5 years.

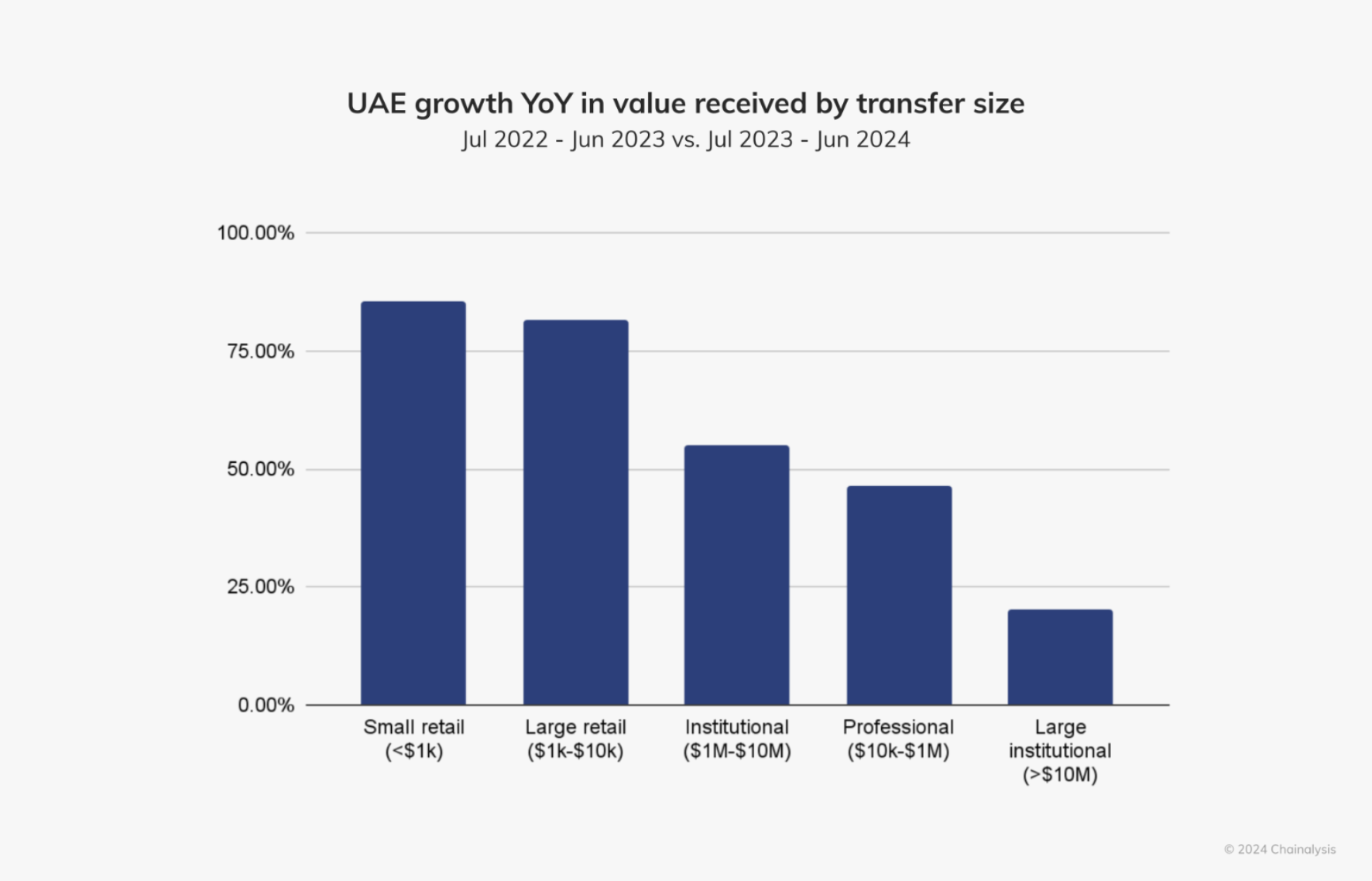

In line with Chainalysis, UAE crypto exercise grew throughout all transaction dimension brackets over the previous few years, with small retail transactions leaping by over 75% year-over-year as of June 2024.

Journal: Bitcoin funds are being undermined by centralized stablecoins