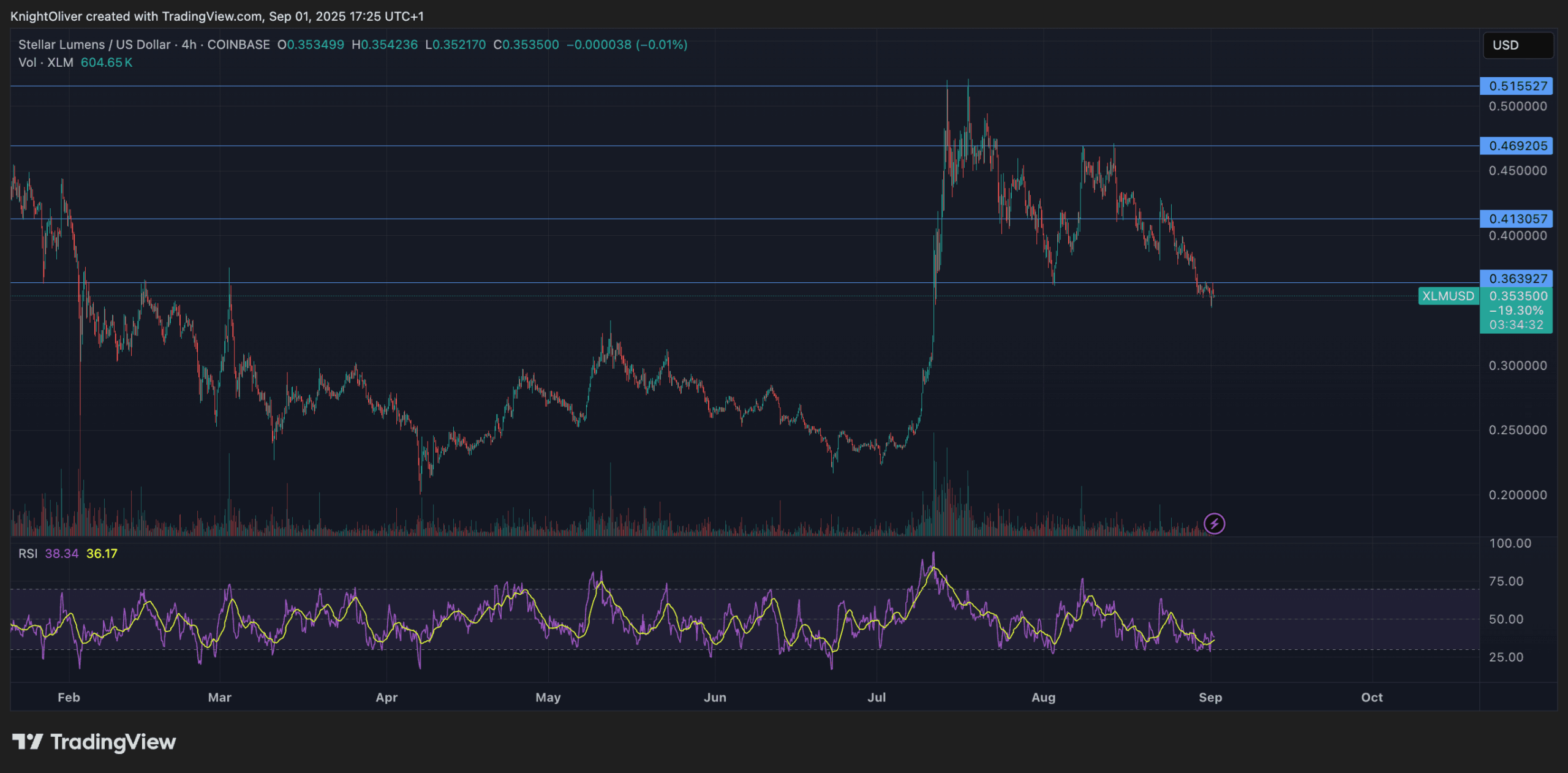

Stellar’s native token XLM endured heavy promoting strain over the previous 24 hours, buying and selling in a decent however punishing 5% vary between $0.34 and $0.36. The session started with relative stability earlier than a late-evening selloff knocked the token from its $0.36 peak to $0.34.

Buying and selling quantity surged previous 57 million models at midnight because the market examined help across the $0.34–$0.35 zone. Consumers stepped again in early the subsequent morning, briefly lifting XLM again to $0.36 on the again of what gave the impression to be institutional accumulation, with volumes swelling to 70 million models.

Regardless of the restoration, value motion stalled round $0.36, making a range-bound construction that technical merchants say typically precedes a directional breakout. The ultimate hour of buying and selling on Sept. 1 confirmed bearish momentum regaining management, with XLM slipping 1% because the consolidation sample broke down.

Intraday knowledge highlighted an acceleration of promoting strain between 13:45 and 13:46, when greater than 1.28 million tokens modified fingers on the day’s low. Makes an attempt at restoration fizzled earlier than the shut, and an absence of exercise within the ultimate minute urged buying and selling had successfully floor to a halt.

The token’s fundamentals had been additionally examined by exchange- and network-related developments. South Korea’s Bithumb introduced it should droop XLM deposits on Sept. 3 whereas Stellar implements community upgrades, a brief disruption that underscores the blockchain’s transition right into a vital improve section this month.

On the identical time, Ripple’s completion of pilot exams with banks has bolstered broader confidence in blockchain-based cost options, placing added strain on Stellar to ship aggressive enhancements.

Quantity Spikes Sign Institutional Exercise

- $0.02 buying and selling vary represents 5% unfold between $0.34 help and $0.36 resistance throughout session.

- Midnight selloff generates 57 million quantity spike indicating heavy institutional promoting.

- Morning restoration surge hits $0.36 on 70 million quantity suggesting accumulation section.

- Resistance confirmed at $0.36 with help zone established round $0.34-$0.35.

- Last hour restoration makes an attempt fail as bearish momentum accelerates.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.