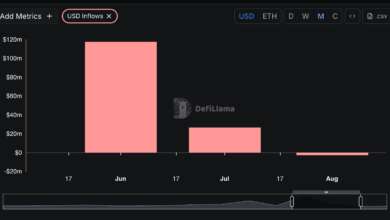

World crypto funding merchandise swung again into constructive territory final week, recording $2.48 billion in web inflows after a interval of withdrawals, in keeping with CoinShares‘ weekly report.

The renewed momentum lifted August’s complete web inflows to $4.37 billion, pushing year-to-date commitments to $35.5 billion.

James Butterfill, head of analysis at CoinShares, famous that inflows remained sturdy till late within the week. In keeping with him, sentiment shifted on Friday after the discharge of Core PCE inflation information, which did not reinforce expectations for a September fee reduce by the Federal Reserve.

That disappointment, mixed with declining worth momentum, weighed on the broader market and drove complete property beneath administration down 10% to $219 billion.

Ethereum outpaces Bitcoin

Ethereum continued to attract the majority of allocations in the course of the reporting interval as traders appeared enamored with the second-largest digital asset by market capitalization.

In keeping with CoinShares, ETH-focused funds attracted $1.4 billion in new capital final week, almost double the determine posted by Bitcoin at $748 million.

Month-to-date flows spotlight the hole much more as Ethereum gained $3.95 billion in contemporary flows final month, whereas Bitcoin registered $301 million in web outflows.

CoinShares advised that the determine indicators a tactical reallocation as traders shift publicity away from Bitcoin into different main property.

In the meantime, different altcoins additionally seem like benefiting from this reallocation.

In keeping with CoinShares, Solana merchandise took in $177 million, whereas XRP captured $134 million, buoyed by rising anticipation of spot ETF approvals. Mixed, these two property have added nearly $700 million in August inflows.

Alternatively, Cardano and Chainlink drew smaller allocations of $5.2 million and $3.6 million, whereas Sui noticed outflows of $5.8 million.

Throughout areas, US-based crypto funding merchandise proceed to drive the majority of investments.

Information from CoinShares confirmed that the US funds noticed $2.29 billion of final week’s flows, whereas traders in Switzerland, Germany, and Canada adopted at $109.4 million, $69.9 million, and $41.1 million, respectively.

Contemplating this, CoinShares posited that the broad distribution of inflows signifies Friday’s dip was possible short-term profit-taking reasonably than the beginning of a deeper retracement.