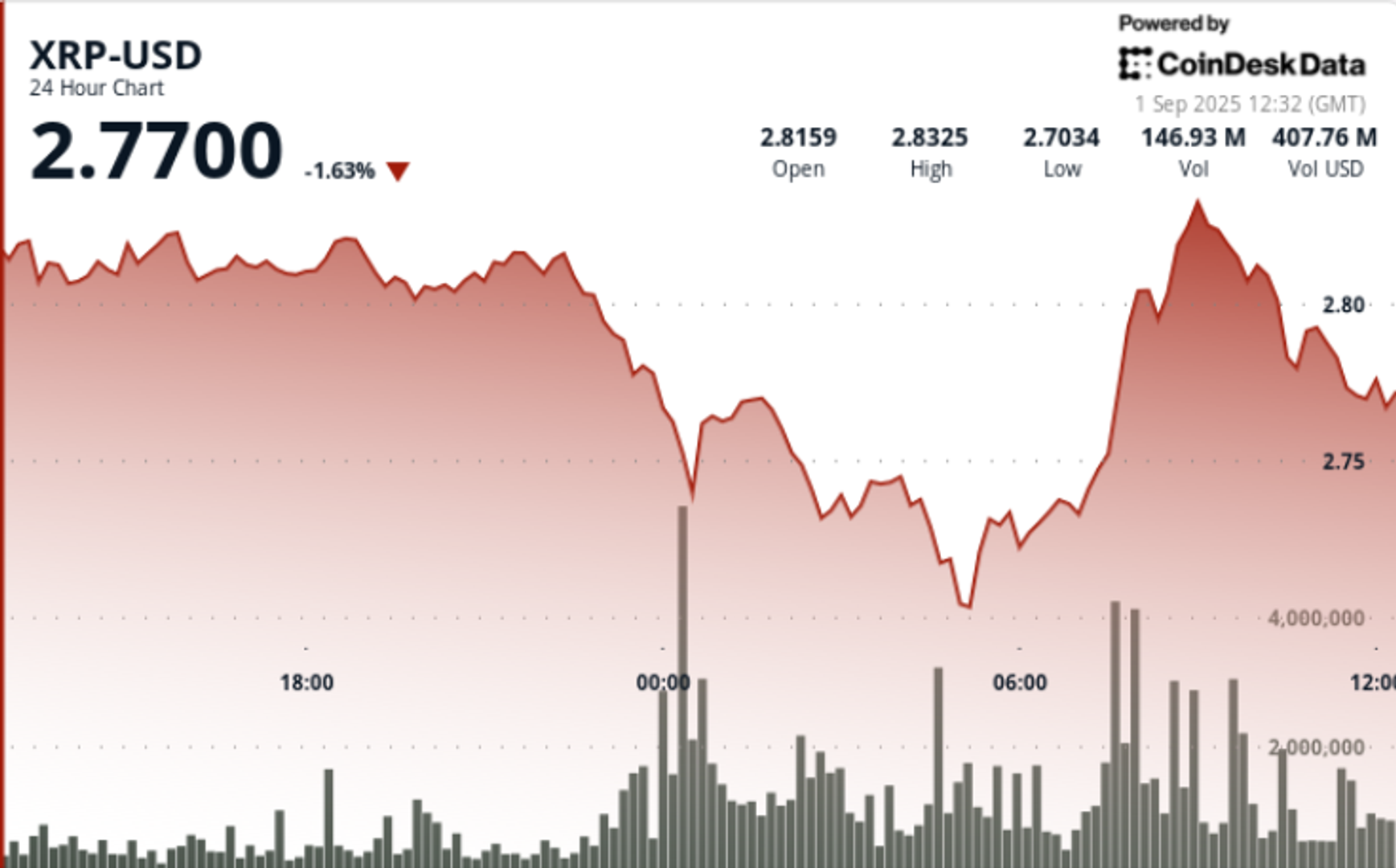

Token trades between $2.70–$2.84 in Aug. 31–Sept. 1 window, with whale accumulation countering heavy resistance at $2.82–$2.84.

Information Background

- XRP fell from $2.80 to $2.70 throughout late Aug. 31–early Sept. 1 earlier than rebounding to $2.82 on heavy volumes.

- Whales accrued 340M XRP over two weeks, a sign of institutional conviction regardless of short-term bearish strain.

- On-chain exercise spiked with 164M tokens traded in the course of the Sept. 1 morning rebound, greater than double session averages.

- September stays a traditionally weak month for crypto, however whale accumulation is seen as a counterbalance to retail liquidation flows.

Worth Motion Abstract

- Buying and selling vary spanned $0.14 (≈4.9%) between $2.70 low and $2.84 excessive.

- The steepest decline got here at 23:00 GMT on Aug. 31, as worth slid from $2.80 to $2.77 on 76.87M quantity, practically 3x day by day averages.

- At 07:00 GMT Sept. 1, bullish flows drove a rebound from $2.73 to $2.82 on 164M quantity, cementing $2.70–$2.73 as near-term help.

- Ultimate hour consolidation (10:20–11:19 GMT) noticed worth slip 0.71% from $2.81 to $2.79, with heavy promoting between 10:31–10:39 on 3.3M quantity per minute, confirming resistance at $2.80–$2.81.

Technical Evaluation

- Help: $2.70–$2.73 ground repeatedly defended, bolstered by whale shopping for.

- Resistance: $2.80–$2.84 stays the rejection zone, with $2.87–$3.02 as the subsequent upside threshold.

- Momentum: RSI close to mid-40s after rebound, displaying neutral-to-bearish bias.

- MACD: Compression section continues; potential crossover if accumulation persists.

- Patterns: Symmetrical triangle forming with volatility compression; breakout path stays open towards $3.30 if resistance clears.

What Merchants Are Watching

- If $2.70–$2.73 holds, short-term merchants will deal with it as a springboard for $2.84 retests.

- A detailed above $2.84 would put $3.00–$3.30 again in play.

- Draw back state of affairs: breach of $2.70 exposes $2.50 as subsequent structural help.

- Whale accumulation vs. institutional promoting — the push-pull dynamic that would dictate September course.