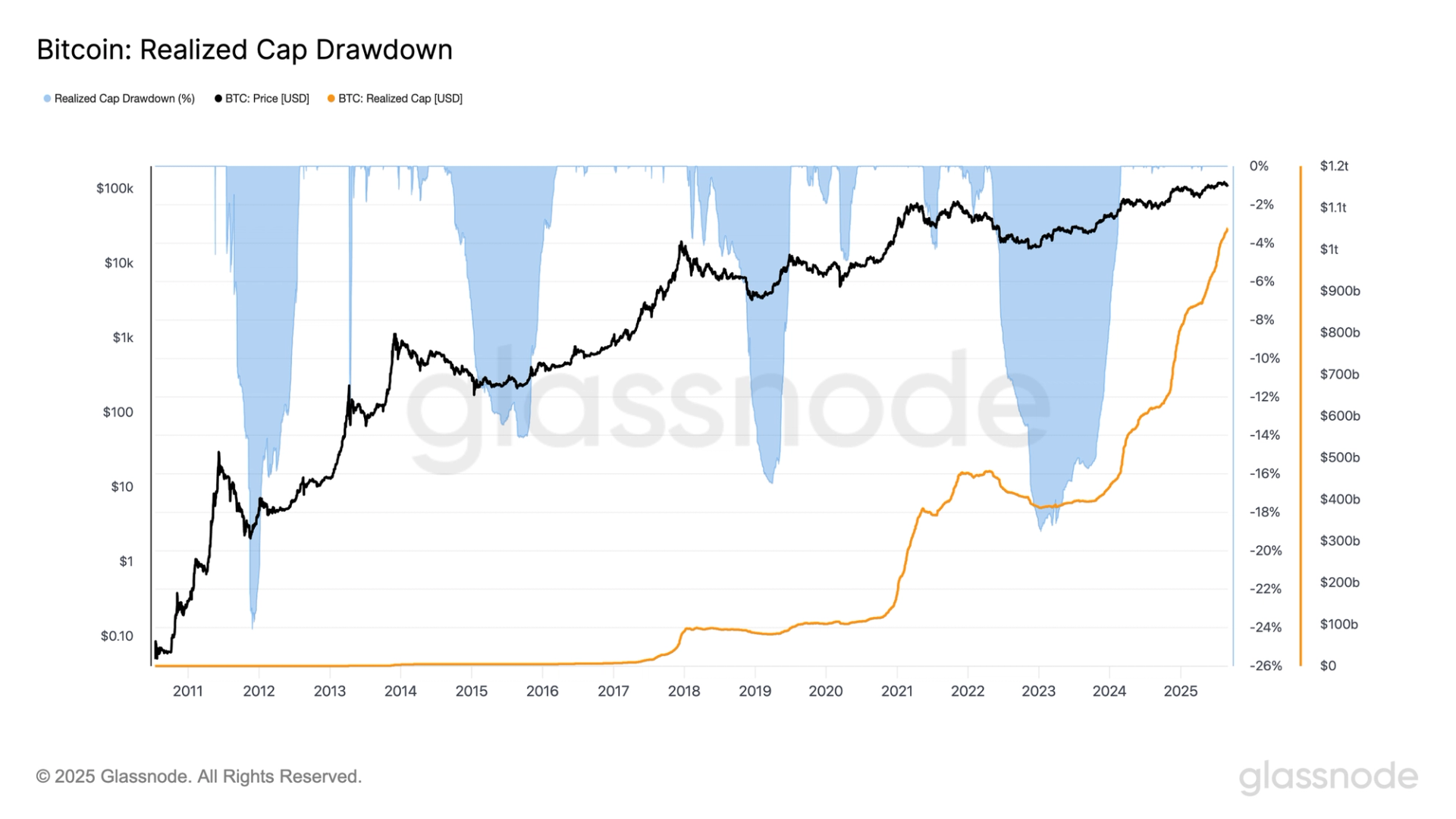

Bitcoin’s (BTC) realized capitalization, an on-chain metric that measures the worth of cash on the value they final transacted, has continued rising even because the spot value drops, signaling investor conviction to the community and a sign the financial spine of the biggest cryptocurrency is strengthening.

After first crossing $1 trillion in July, Glassnode knowledge exhibits that realized cap now sits at a file $1.05 trillion, regardless of the spot value slipping round 12% from its all-time peak close to $124,000. Whereas market capitalization falls because the spot value declines as a result of it costs each coin on the present stage, realized cap adjusts solely when cash are spent and repriced on-chain.

Underneath the realized cap mannequin, dormant holdings, long-term holders and misplaced cash act as stabilizers, stopping massive drawdowns even when short-term value motion turns damaging. The result’s a measure that higher displays true investor conviction and the depth of capital dedicated to the blockchain.

In earlier cycles, realized cap suffered a lot steeper drawdowns. Throughout the 2014–15 and 2018 bear markets, it fell by as a lot as 20% as extended capitulation pressured massive volumes of cash to be repriced decrease. Even in 2022, the metric skilled a drawdown close to 18%, based on Glassnode knowledge.

This time, in distinction, realized cap is gaining regardless of a double-digit value correction. This highlights how the current market is absorbing volatility with a much more resilient underlying base.