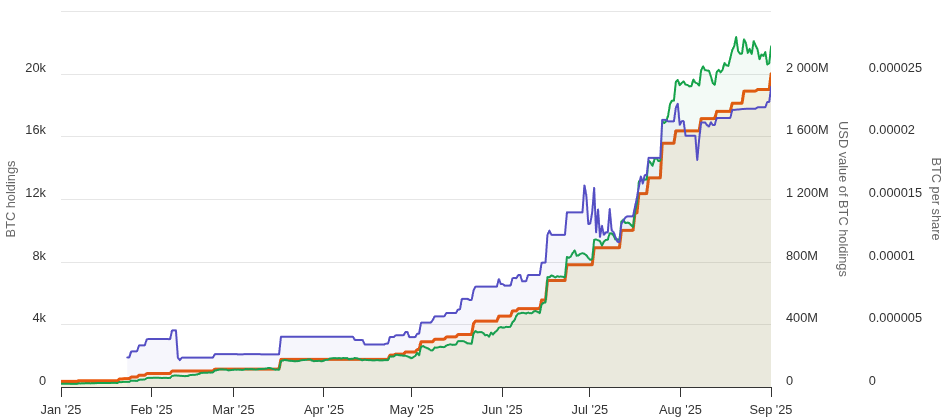

Japan’s high Bitcoin treasury agency, Metaplanet, simply acquired 1,009 BTC, reaching 20,000 BTC of holdings simply because the agency points hundreds of thousands of recent shares.

In line with a Monday Metaplanet announcement, the agency acquired 1,009 BTC and reached 20,000 BTC for 16.479 billion yen (almost $112 million). On the identical day, the agency introduced the issuance of 11.5 million new shares final week, following an investor’s train of warrants to amass inventory.

In line with BitcoinTreasuries.internet information, Metaplanet is at present the sixth greatest and high Japanese Bitcoin treasury. The agency paid a median worth of $102,607 per Bitcoin, which ends up in a 6.75% revenue in comparison with Bitcoin’s worth on the time of writing.

The investor in query, Evo Fund, has acquired 10 million shares at $5.67 and 1.5 million at slightly below $6 for a complete of about $65.73 million. Metaplanet spends these proceeds to finance the early redemption of roughly $20.4 million value of beforehand issued bonds. Evo Fund nonetheless has rights to an extra 34.5 million shares.

Associated: Dutch crypto agency Amdax targets 1% Bitcoin provide with $23M treasury launch

Metaplanet reacts to market stress

The announcement additionally comes as Metaplanet faces mounting stress, with its share worth tumbling, threatening the fundraising mannequin it has used to construct its Bitcoin treasury. The agency’s inventory has dropped 54% since mid-June, regardless of Bitcoin gaining about 2% throughout the identical interval.

Analysts highlighted that falling inventory costs make exercising warrants for Evo Fund much less enticing, squeezing Metaplanet’s liquidity and decreasing its functionality to amass extra Bitcoin. Nonetheless, the agency’s technique seems to be evolving and adapting to this new state of affairs.

Final week, Metaplanet introduced plans to lift roughly 130.3 billion yen ($880 million) by means of a public share providing in abroad markets. At this time, the agency’s shareholders will vote on whether or not to approve the issuance of as much as 555 million most well-liked shares that would elevate as a lot as 555 billion yen ($3.7 billion).

Associated: Bitcoin treasury agency Metaplanet graduates to FTSE Japan and All-World indexes

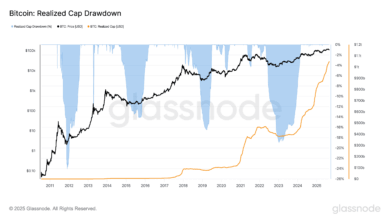

Bitcoin treasuries are protected bets

After Technique — as soon as often known as MicroStrategy — devised the company Bitcoin treasury technique and adopted it with nice success, many corporations determined to observe in its footsteps. Nonetheless, this technique will not be assured to work in the long run.

Actually, a number of Bitcoin treasuries seem like already in serious trouble. Actually, Bitcoin treasuries can fail when Bitcoin’s worth drops and their inventory internet asset worth premiums disappear, shutting down funding alternatives. Loans or margin calls could then flip these corporations into pressured Bitcoin sellers.

Journal: Bitcoin’s invisible tug-of-war between fits and cypherpunks