MicroStrategy, now doing enterprise as Technique (MSTR), has formally certified for potential inclusion within the S&P 500 after posting one of many strongest quarters in its historical past.

Within the second quarter of 2025, the corporate reported $14 billion in working revenue and $10 billion in internet revenue, equal to $32.6 in diluted earnings per share. Quarterly income got here in at $114.5 million, a modest 2.7% improve year-over-year, with subscription providers rising almost 70%.

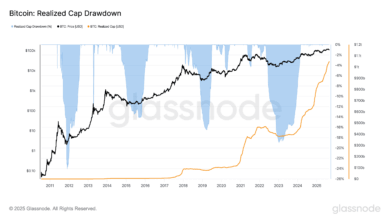

The outcomes mark a dramatic turnaround from prior years, when impairment expenses tied to bitcoin depressed reported earnings. The adoption of latest fair-value accounting requirements in January 2025 allowed Technique to acknowledge unrealized positive factors on its digital asset holdings, instantly boosting profitability. With bitcoin buying and selling above $100,000 through the interval, the corporate booked huge paper positive factors that reworked its steadiness sheet.

As of June 30, Technique held 597,325 bitcoin. The agency highlighted a BTC Yield of 19.7% year-to-date, a key efficiency indicator measuring the proportion change within the ratio between its bitcoin depend and assumed diluted shares excellent.

Administration raised steering for full-year 2025 to $34 billion in working revenue, $24 billion in internet revenue, and $80 in diluted EPS, assuming a year-end bitcoin worth of $150,000.

With constant profitability now established, Technique meets all S&P 500 necessities: U.S. itemizing, market capitalization far above the $8.2 billion threshold, day by day buying and selling volumes exceeding 250,000 shares, greater than 50% public float, and optimistic earnings each within the newest quarter and on a trailing twelve-month foundation.

The subsequent potential window for inclusion is the September 2025 rebalance, with bulletins anticipated Sept. 5 and modifications taking impact Sept. 19. Whereas the S&P Dow Jones Indices committee retains discretion, Technique’s qualification underscores the rising position of bitcoin in mainstream monetary markets.

If admitted, it might be the primary bitcoin-treasury firm to enter the benchmark index, symbolizing a landmark second for the mixing of digital property into U.S. equities.

Learn extra: Bitcoin Hovers Round $107K as Weakest Month for Crypto Begins