A Bitcoin whale has been accumulating billions of {dollars}’ price of Ether, surpassing the second-largest company treasury agency, signaling a rising rotation amongst giant traders searching for cryptocurrencies with extra upside potential.

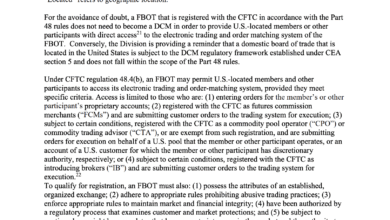

A Bitcoin whale price over $11 billion offered one other $215 million price of Bitcoin (BTC) to purchase $216 million price of spot Ether (ETH) on the decentralized change Hyperliquid.

With the newest acquisition, the whale now holds 886,371 Ether, price over $4 billion, in line with blockchain knowledge platform Lookonchain, in a Monday X submit.

The rising whale demand for Ether is signaling the market’s “pure rotation” into Ether and different altcoins with extra upside potential, whereas Ether’s value can also be benefiting from rising company accumulation, Nicolai Sondergaard, analysis analyst at crypto intelligence platform Nansen, advised Cointelegraph.

The $11 billion Bitcoin whale began rotating his funds into Ether on Aug. 21, when he offered $2.59 billion price of BTC for a $2.2 billion spot Ether and a $577 million Ether perpetual lengthy place, Cointelegraph reported.

Final Monday, the whale closed $450 million price of his perpetual lengthy place at a median Ether value of $4,735, to lock in $33 million price of revenue, earlier than buying one other $108 million price of spot Ether.

The multibillion-dollar rotation impressed different giant traders, together with 9 “huge” whale addresses that acquired a cumulative $456 million price of ETH on Wednesday, Cointelegraph reported.

Associated: Avalanche leads blockchain transaction progress amid US gov’t implementation

$11B Bitcoin whale surpasses SharpLink’s $3.5B Ether holdings

Some cryptocurrency whales are beginning to eclipse the holdings of company cryptocurrency treasury companies.

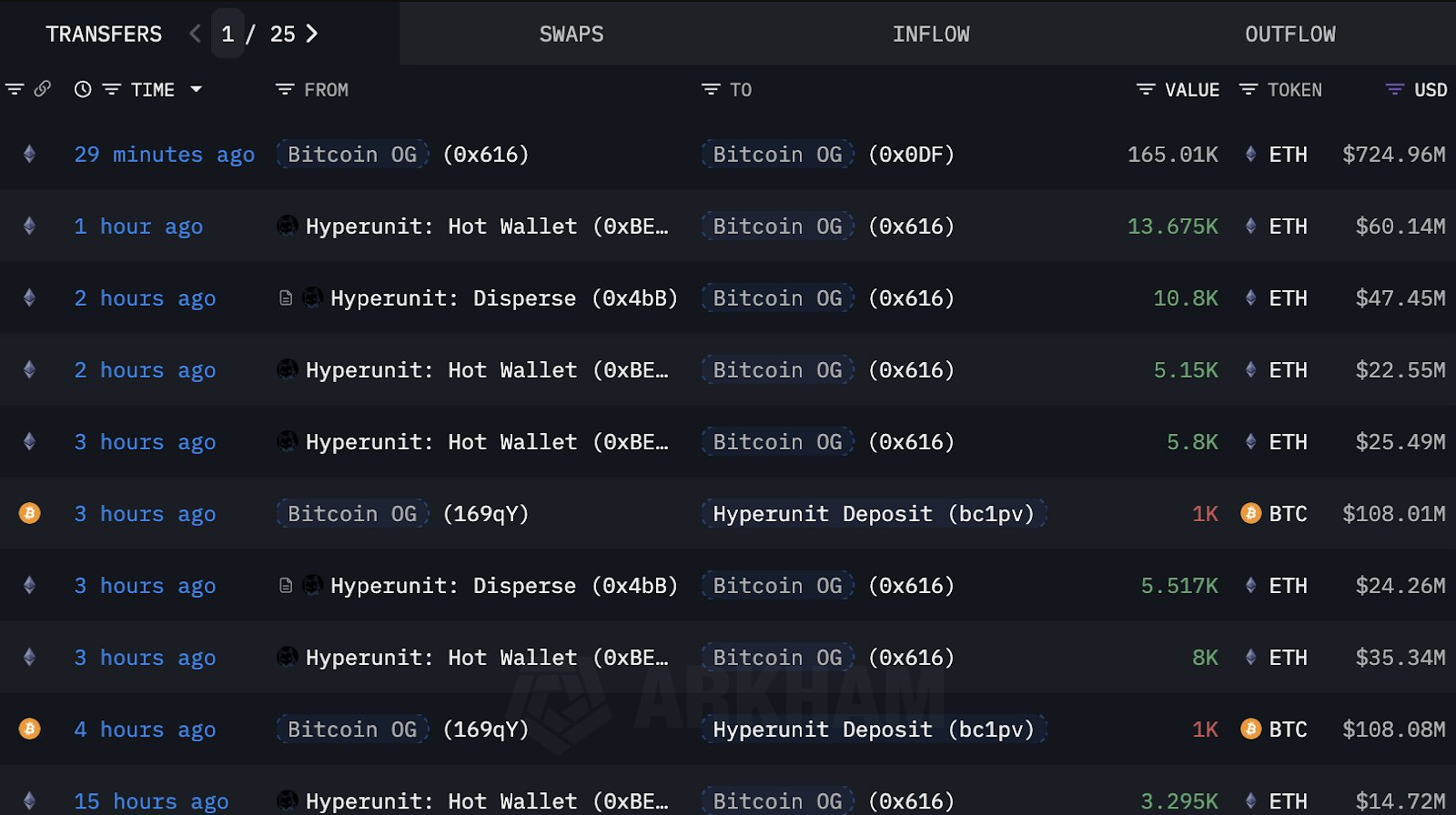

With the newest funding, the mysterious whale’s $4 billion Ether holdings are actually price greater than the portfolio of SharpLink Gaming, the world’s second-largest company Ether holder, which at the moment holds over 797,000 ETH price $3.5 billion.

Nonetheless, the whale’s holdings are nonetheless nearly 50% in comparison with the main company Ether holder, Bitmine Immersion’s 1.8 million Ether tokens price over $8 billion, in line with knowledge from strategicethereserve.xyz.

Associated: Kanye West’s YZY token: 51,000 merchants misplaced $74M, whereas 11 netted $1M

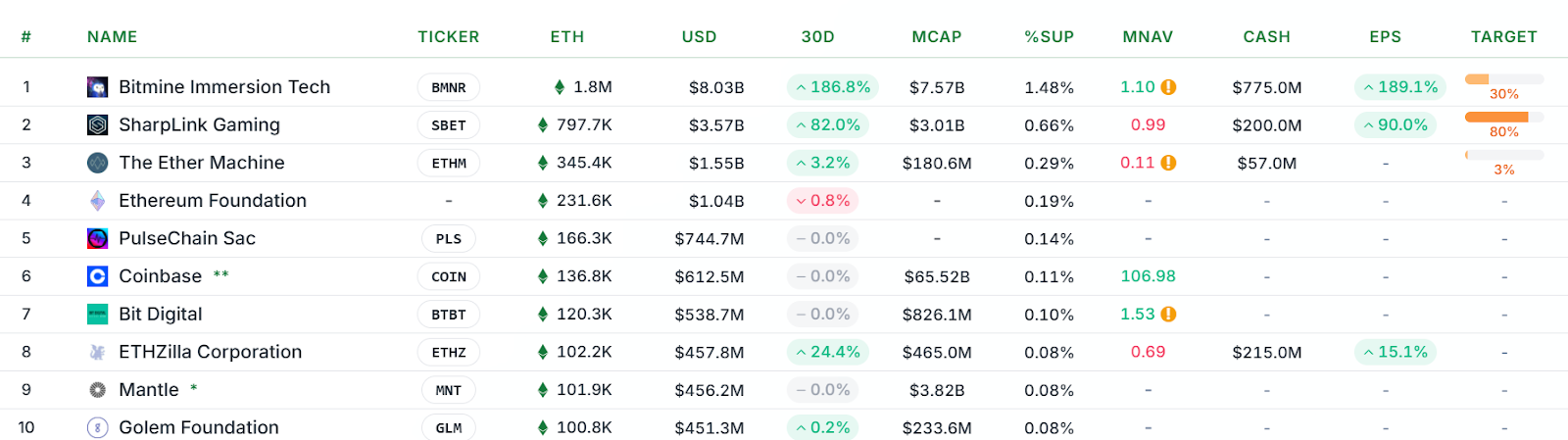

Including to the rising demand, spot Ether exchange-traded funds (ETFs) have additionally acquired over $1.8 billion price of Ether over the previous 5 buying and selling days, knowledge from Farside Buyers reveals.

“Establishments are clearly broadening their scope past Bitcoin,” in line with Iliya Kalchev, dispatch analyst at digital asset platform Nexo.

“For crypto, the sample is obvious: short-term strikes will proceed to hinge on macro releases, however the structural drivers of adoption, institutional inflows, and tokenized finance stay intact,” the analyst advised Cointelegraph.

Journal: Bitcoin is ‘humorous web cash’ throughout a disaster: Tezos co-founder